TLDR

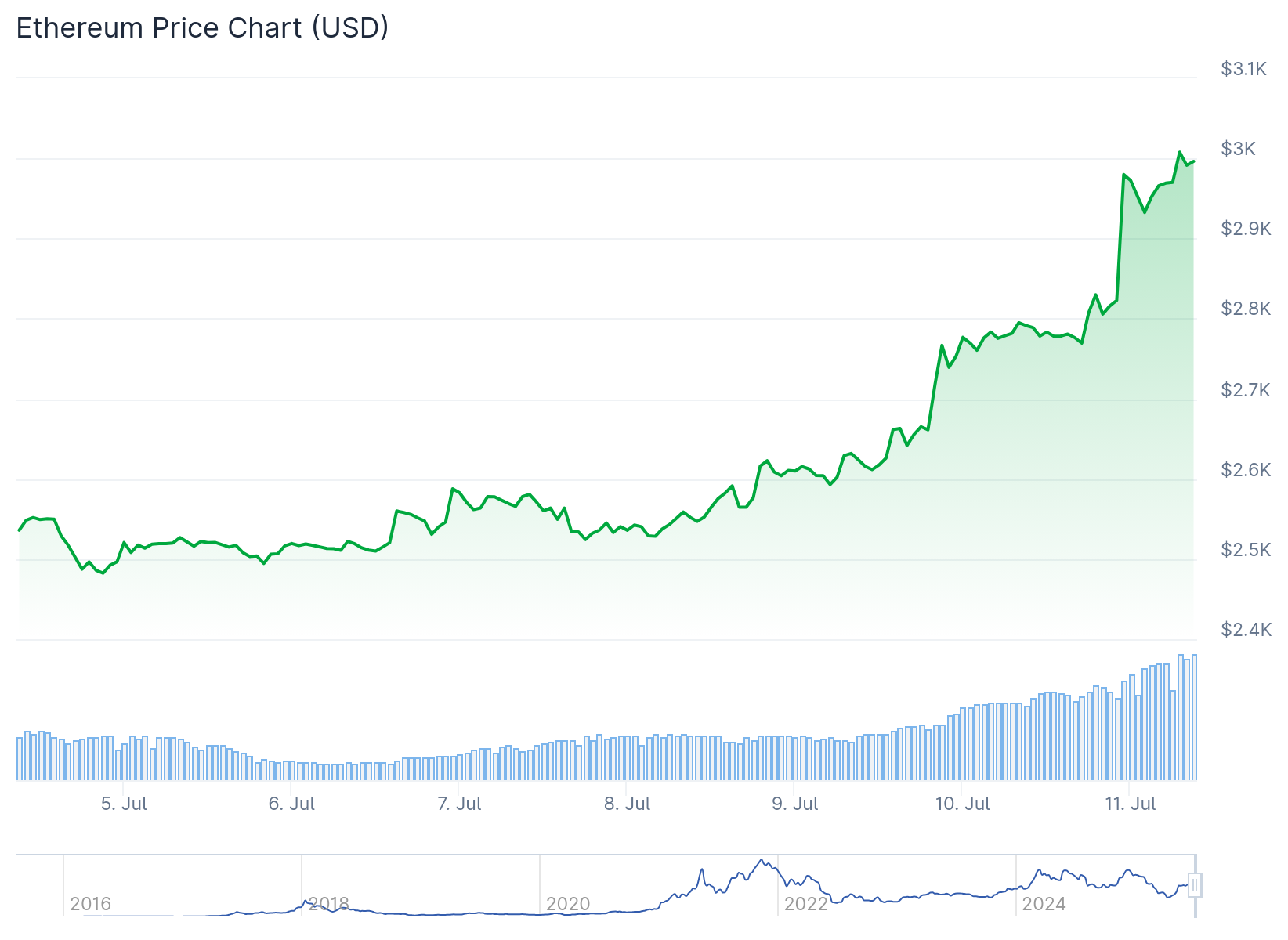

- ETH surged past $3,000 for the first time in over four months, gaining 7% in 24 hours

- Institutional investors purchased $211 million worth of ETH in a single day, the largest buy since June

- CME Open Interest reached $3.27 billion, highest level since February 2025

- ETF inflows totaled over $500 million month-to-date with strong institutional demand

- Technical analysis shows minimal resistance between current price and $4,000 target

Ethereum broke past the $3,000 mark this week for the first time in more than four months. The second-largest cryptocurrency gained 6.7% through the past 24 hours, reaching its strongest price since early 2025.

The rally comes as bitcoin reached new record highs above $116,000. ETH has lagged behind bitcoin during this cycle but recent momentum suggests the narrative is shifting.

Institutional interest has been a key driver of the price movement. ETH spot Exchange-Traded Funds saw their largest single-day purchase since June 6th, with investors accumulating $211 million worth of ETH from the market.

Month-to-date, U.S.-listed spot ETFs have recorded over $500 million in inflows. This marks a clear pickup in institutional demand for the asset.

Derivatives Activity Shows Growing Interest

Data from Glassnode reveals a spike in Open Interest on the Chicago Mercantile Exchange. The 7-day Simple Moving Average reached $3.27 billion, marking its highest level since February 2nd, 2025.

This increase indicates growing institutional capital flowing into the market. Professional traders are taking larger positions in ETH derivatives contracts.

The corporate crypto treasury strategy has expanded beyond bitcoin to include ETH. Public companies like Sharplink Gaming and Bitmine Immersion Technology have added the asset to their balance sheets.

One crypto investor noted that public companies are buying enough ETH to offset all the tokens created since the merge. ETH has one-ninth the market cap of bitcoin, requiring less capital to move the price.

Technical Picture Shows Clear Path Higher

Analysis of ETH’s price action reveals limited resistance levels ahead. IntoTheBlock’s In/Out of the Money Around Price data shows only two resistance levels visible between the current price and $4,000.

These resistance volumes are relatively low at 3.44 million and 3.42 million ETH. The levels fall between $3,222.13 and $4,816.30, suggesting minimal selling pressure.

The rally occurred in three distinct phases during a 60-minute trading window. ETH jumped 6% from $2,819.07 to $2,996.85 between 20:58 UTC and 21:57 UTC.

Initial consolidation around $2,824 was followed by acceleration through resistance at $2,845, $2,870, and $2,920. The final advance pushed the price to $2,993.

Support levels have been established at $2,756.18 and $2,761.11 throughout the trading session. Strong resistance remains around the $2,993.34 threshold.

Retail Behavior Supports Upward Movement

CryptoQuant data shows retail investors are holding their ETH rather than sending it to exchanges. The number of Depositing Addresses on centralized exchanges dropped to 23,000 and continues trending downward.

This behavior implies fewer funds are being sent to exchanges as investors choose self-custody. Historically, this pattern has been a bullish signal for price action.

However, one metric shows potential caution. Exchange Reserve data indicates the total amount of ETH held on centralized exchanges has increased to 18.9 million over the past day.

Rising exchange balances could signal an incoming demand squeeze where supply exceeds demand. This situation could potentially lead to price drops if the trend continues.

The risk appears minimal for now since depositing addresses are still declining. Increased buying activity from institutional investors remains a major force sustaining ETH’s upward trajectory.

Growing Role in Infrastructure

Market analysts point to ETH’s expanding role in settlement and tokenization infrastructure as a key driver. The token is increasingly seen as foundational for blockchain-based financial services.

This infrastructure narrative has gained traction alongside the price rally. ETH’s utility in decentralized finance applications continues to grow.

The current momentum represents a shift from earlier in the cycle when ETH failed to reach new record levels. Unlike bitcoin or Solana, ETH has underperformed during this market cycle until recently.

CME Open Interest hitting multi-month highs indicates professional traders are positioning for continued upward movement. The $3.27 billion figure represents the highest level of institutional interest since February.