TLDR

- Bit Digital plans to raise $100 million through convertible notes to buy more Ether and currently holds over 120,000 ETH tokens.

- BitMine expanded its holdings to 2.65 million Ether worth over $11 billion, making it the largest Ether treasury company tracked by StrategicEtherReserve.

- Exchange reserves for Ethereum are falling according to CryptoQuant data, suggesting investors are moving coins into long-term storage rather than selling.

- Analyst Ted Pillows predicts ETH could rise above $10,000 after a short-term correction, following a 250% rally from its recent bottom.

- SWIFT began testing Ethereum’s Linea Layer-2 network with major banks including BNP Paribas and BNY Mellon for on-chain messaging and settlement.

Bit Digital announced plans to raise $100 million through a convertible senior note offering on Monday. The company will use the proceeds to purchase more Ether tokens.

The offering includes an option for an additional $15 million in notes. All net proceeds will go toward ETH purchases and general corporate purposes.

Bit Digital currently holds more than 120,000 Ether tokens. The company ranks as the seventh-largest Ether treasury company according to StrategicEtherReserve.

Bit Digital Announces Proposed Offering of $100 Million Convertible Notes@BitDigital_BTBT today announced a proposed registered underwritten public offering by the Company of $100,000,000 aggregate principal amount of its convertible senior notes due 2030, subject to market and…

— Bit Digital, Inc. NASDAQ:BTBT (@BitDigital_BTBT) September 29, 2025

If the fundraise succeeds, Bit Digital could purchase another 23,714 tokens. This would move the company up to sixth place, ahead of crypto exchange Coinbase.

BitMine Immersion Technologies expanded its holdings to 2.65 million Ether on Monday. The tokens are worth over $11 billion at current prices.

BitMine now holds the largest Ether treasury among tracked companies. The second-largest company, SharpLink Gaming, holds over 838,000 Ether.

StrategicEtherReserve lists September 26 as BitMine’s latest purchase date. The company acquired 234,000 tokens as part of its goal to hold 5% of total supply.

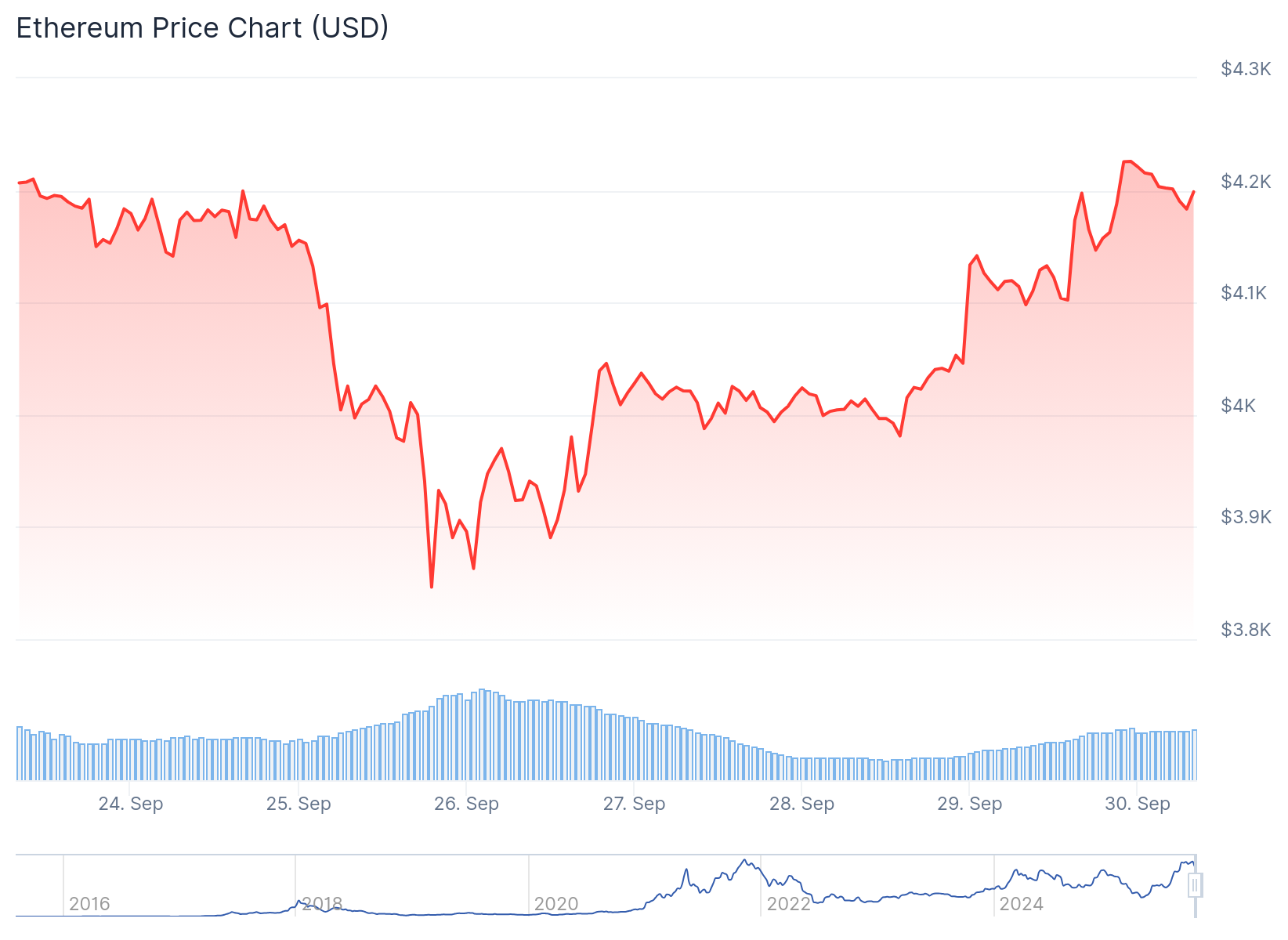

BitMine estimates its average purchase price at $4,141 per Ether. The token currently trades at $4,221 according to CoinGecko.

Falling Exchange Reserves Signal Long-Term Holding

CryptoQuant data shows that ETH reserves on spot exchanges have been dropping in recent weeks. More coins are leaving exchanges and moving into personal wallets or staking platforms.

The firm stated that investors are buying ETH and transferring it for long-term holding. This reduces the amount of ETH available for sale on exchanges.

Lower reserves can set the stage for higher prices if demand increases. Past examples show network congestion and high gas fees were followed by rallies when new demand arrived.

Exchange reserves are falling while the price remains steady. This suggests buyers are active but sellers are still matching them.

CryptoQuant stated that stronger demand is the missing piece. If global conditions improve, such as lower interest rates, ETH could benefit.

Analyst Ted Pillows noted that ETH rallied about 250% from its bottom. He expects a correction to end soon.

I'm not long-term bearish on $ETH.

ETH rallied almost 250% from its bottom, so a correction is expected.

I think the Ethereum correction will be over in a few weeks.

After that, ETH will rally above $10,000. pic.twitter.com/s7eu7tyaKd

— Ted (@TedPillows) September 28, 2025

Pillows believes ETH price could rise above $10,000 once demand returns. The level remains speculative but shows positive sentiment among market watchers.

SWIFT Tests Ethereum Technology with Major Banks

SWIFT started testing Ethereum’s Linea, a Layer-2 network. The global payments messaging network connects more than 11,000 banks and moves over $150 trillion annually.

Major banks including BNP Paribas and BNY Mellon participated in the pilot. The test focused on using Linea for on-chain messaging and settlement.

Banks are exploring Ethereum technology for real-world use. If projects like this expand, it would strengthen Ethereum’s role in the financial system.

BitMine Chairman Tom Lee called ETH’s current price a discount to the future. He cited two cycles forming in late 2025: crypto and artificial intelligence.

Lee stated that both cycles require neutral public blockchains. He believes Ethereum is the premier choice for Wall Street and AI companies moving onto blockchain.

VanEck CEO Jan van Eck made similar comments in August. He predicted financial services will adopt blockchain to handle stablecoin transactions and expects Ethereum to be the platform of choice.

Institutions have been steadily acquiring Ether throughout 2025. The total across treasury companies and ETFs sits at over 11.8 million tokens, representing just under 10% of total supply.