TLDR

- Ethereum’s daily internal contract calls have increased from 7 million to 9.5 million, showing strong network growth

- Real-world asset tokenization on Ethereum has reached $11.7 billion, up 680% since January 2024

- Grayscale staked $5.14 billion in ETH, demonstrating institutional confidence in the network

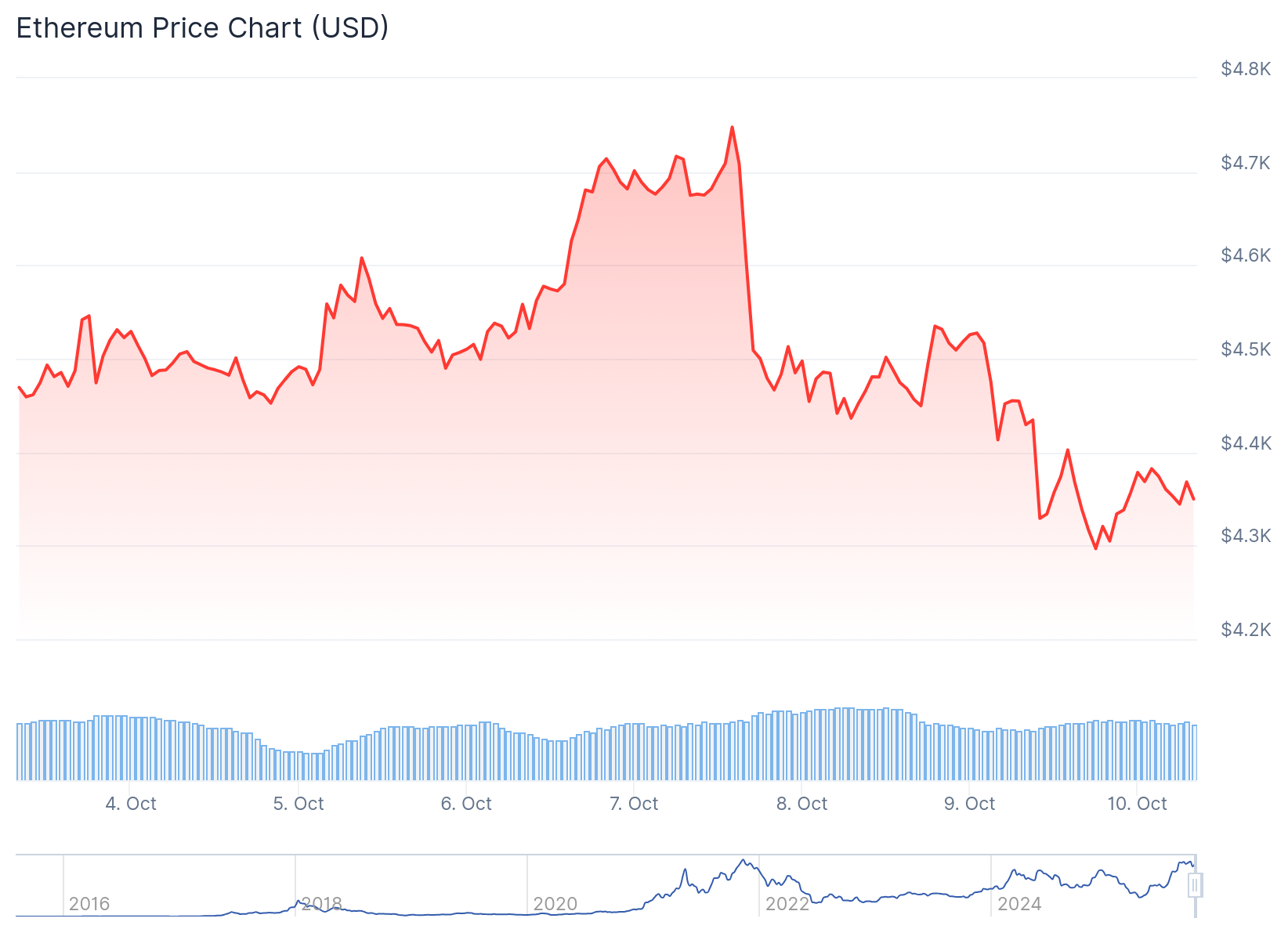

- ETH is currently trading around $4,376 after testing the $4,300 level and rejecting $4,800 resistance for the fourth time

- Analysts see potential support between $4,100 and $4,250, with some predicting a rally to $10,000 later this month

Ethereum is experiencing a disconnect between network fundamentals and price action. While the price has declined 2.58% to $4,376, onchain activity tells a different story about the network’s health.

Data from CryptoQuant shows Ethereum’s internal contract calls have jumped to over 9.5 million per day. This represents a 35% increase from the previous average of 7 million daily calls. These calls track complex network interactions including DeFi activity and real-world asset tokenization.

The increase began in mid-July and has remained steady. This suggests the growth is structural rather than temporary. Analysts point to three main drivers: regulatory clarity around stablecoins in the US, record inflows into spot Ether ETFs, and corporations adding ETH to their balance sheets.

Real-world asset tokenization on Ethereum has grown from $1.5 billion on January 1, 2024 to $11.71 billion currently. This represents a 680% increase in less than two years.

Ethereum controls 56.27% of the tokenized RWA market. This is nearly five times larger than the second-place network, ZKsync Era, which holds 11.83% market share.

BlackRock’s BUIDL fund is the largest tokenized RWA product. It accounts for approximately $2.4 billion on Ethereum alone.

Institutional Confidence Grows Despite Price Weakness

Grayscale made waves this week by staking over $5.14 billion in ETH. This move signals strong institutional confidence in Ethereum’s long-term value and staking rewards.

Grayscale has staked $5,145,888,000 in $ETH this week.

Retail is becoming exit liquidity on BNB Chain memes, while smart money is positioning in Ethereum.

No wonder why most people have lost money this cycle. pic.twitter.com/wpH6DnJdRw

— Ted (@TedPillows) October 9, 2025

The contrast between institutional and retail behavior is stark. While large investors accumulate ETH for its stability and yield, retail traders are chasing volatile memecoins on BNB Chain. This pattern often appears during market cycles where institutions buy during weakness while retail investors chase momentum.

ETH’s market capitalization stands at $528.26 billion. Trading volume has dropped 23.11% to $44.16 billion over the past 24 hours, reflecting cautious sentiment among traders.

Technical Picture Shows Mixed Signals

Ethereum has now rejected the $4,800 level four times in less than ten weeks. This resistance has proven difficult to break, with liquidity concentrated at higher levels.

$ETH is now at a key support level.

A failure to hold this level means Ethereum will dump towards $4,250.

If bulls are able to hold this support level, a bounceback could happen. pic.twitter.com/OQhimF9hRv

— Ted (@TedPillows) October 9, 2025

The price fell sharply to $4,300 on Thursday before attempting to stabilize around $4,400. ETH is now trading between established support and resistance zones as traders wait for a clearer direction.

Technical analysts are watching the $4,100 to $4,250 range closely. This zone aligns with daily and four-hour order blocks where significant buying activity previously occurred.

The relative strength index on the four-hour chart is approaching oversold territory. This could signal a short-term bottom is forming.

Trader Crypto Caesar noted that while a dip below $4,000 remains possible, it could serve as a final shakeout. He maintains a target of $10,000 for later this month.

Another analyst, Jelle, pointed to Ethereum’s breakout from a megaphone pattern. This technical formation often precedes upside moves. Jelle stated that ETH “broke out from the bullish megaphone, retested it, shook a bunch of people out again — and now looks ready for continuation.”

The weekly chart shows ETH trading just below the 9-week simple moving average at $4,449. Bollinger Bands are wide, indicating ongoing volatility with support near $3,665 and resistance near $5,406.

The RSI sits at 61.22, still in bullish territory but down from 66. This shows weakening momentum in the short term. The MACD is also showing convergence, suggesting a potential bearish crossover could occur.

Ethereum’s longer-term trend remains positive. However, the network faces short-term correction risk unless it can reclaim the $4,450 to $4,500 range. If bulls can defend the current support zone, a move toward $4,956 becomes possible. If support fails, the next target is $4,250.

Grayscale’s $5.14 billion stake represents one of the largest institutional commitments to Ethereum staking to date.