TLDR

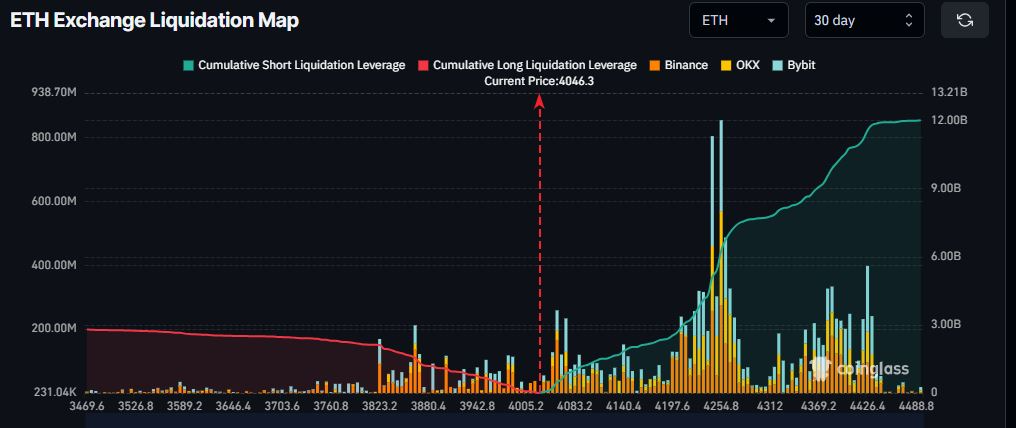

- Over $11 billion worth of Ethereum shorts face liquidation if price moves above $4,200

- ETH is currently trading around $4,054, approaching the liquidation zone that could trigger a short squeeze

- About 25,790 ETH worth of leveraged shorts on Hyperliquid risk liquidation at $4,058

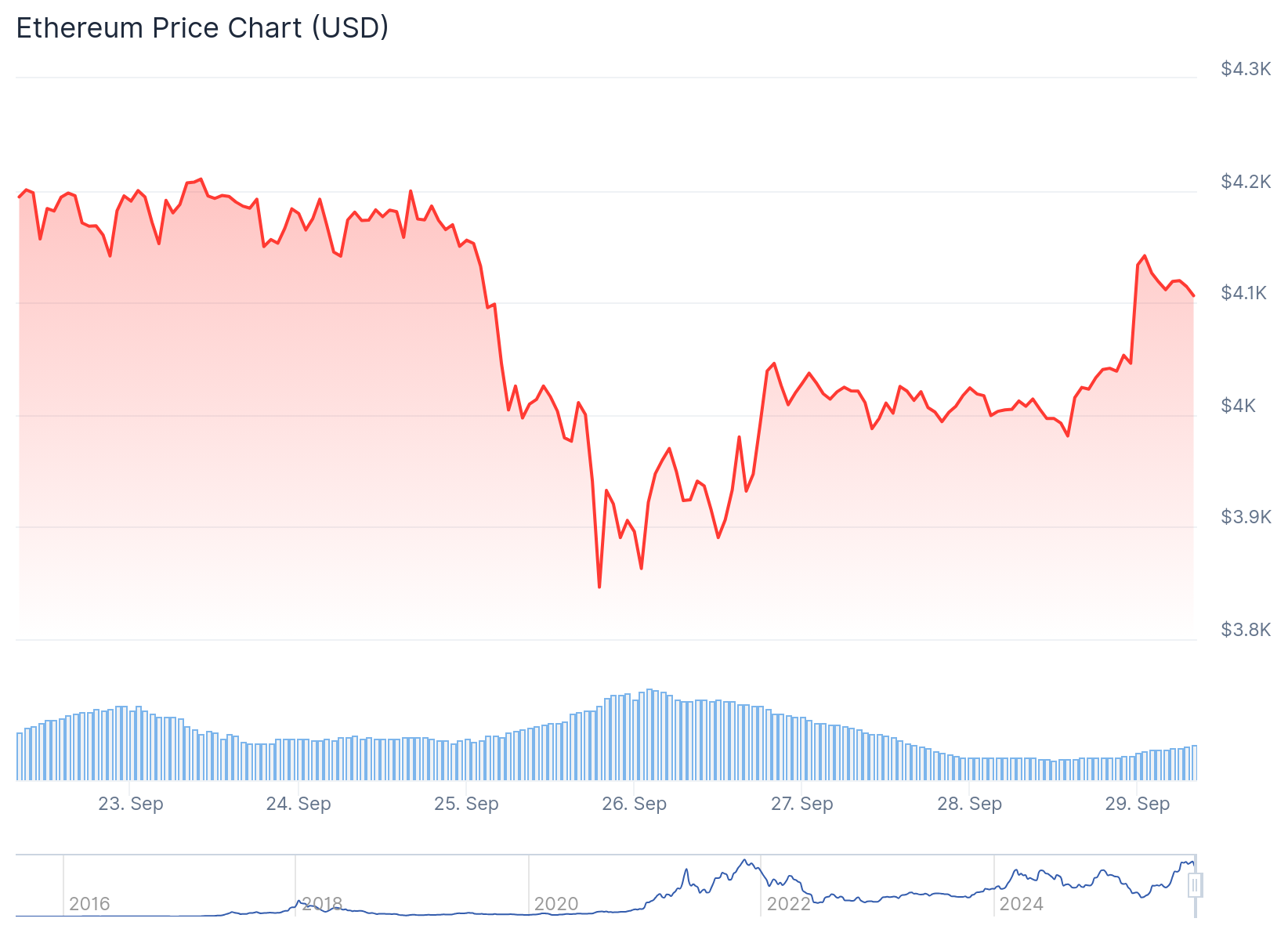

- Ethereum has recovered from last week’s low of $3,812 to above $4,000 levels

- Technical analysis shows a bullish divergence between price action and RSI indicator

Ethereum price has shown recovery signs after last week’s decline. The cryptocurrency is now approaching a critical level that could trigger massive liquidations.

Data from Coinglass reveals over $11 billion worth of short positions face liquidation above the $4,200 price level. This creates potential for a short squeeze event if ETH pushes through this resistance.

Ethereum currently trades at $4,054, putting it close to the liquidation zone. The price has bounced back from last week’s low of $3,812 to above $4,000.

Short liquidations occur when traders betting against price increases are forced to buy back their positions. This buying pressure can fuel further price gains.

Bearish Sentiment Creates Liquidation Setup

The high number of short positions reflects bearish expectations among traders. Many expect Ethereum to continue declining toward the $3,380 support level.

Market sentiment dropped to 28 on the Fear and Greed Index last Friday. This reading approaches extreme fear territory and indicates widespread pessimism.

However, sentiment has improved slightly over the weekend. This improvement coincides with Ethereum’s price recovery above $4,000.

Additional liquidation data shows about 25,790 ETH worth of leveraged shorts on Hyperliquid face liquidation at $4,058. This represents roughly $104.6 million in positions.

Ethereum ETF outflows contributed to last week’s decline. Recovery in ETF demand could support further price gains.

Net spot flows still favor outflows by approximately $10 million. This suggests large holders remain cautious about the recovery.

Technical Analysis Points to Recovery

Technical indicators support the potential for continued gains. Ethereum broke above a key bearish trend line with resistance at $4,000.

The price now trades above the 100-hourly Simple Moving Average. This level provides support for further upward movement.

A bullish divergence has formed between price action and the RSI indicator. Ethereum made a higher low compared to its August bottom while the RSI formed a lower low.

The first major resistance sits at $4,200. A clear break above this level could push prices toward $4,250 and potentially $4,320.

On the downside, initial support lies at $4,050. The major support level remains at $4,000.

If Ethereum fails to hold above $4,000, the price could decline toward $3,920 and then $3,880. A capitulation below these levels would risk over $1 billion in long positions if prices fall to $1,865.

The 76.4% Fibonacci retracement level sits near $4,170. This represents another key resistance level to watch.

Smart money traders may target the liquidation zone above $4,200 to capitalize on forced buying from short covering.

Current price action shows Ethereum trading above both $4,050 and the 100-hourly moving average. The hourly RSI has moved above the 50 level, indicating improving momentum.