TLDR

- Ethereum shows bull flag pattern on charts with potential breakout above $5,500 target

- BlackRock sold $254 million worth of ETH but technical structure remains intact

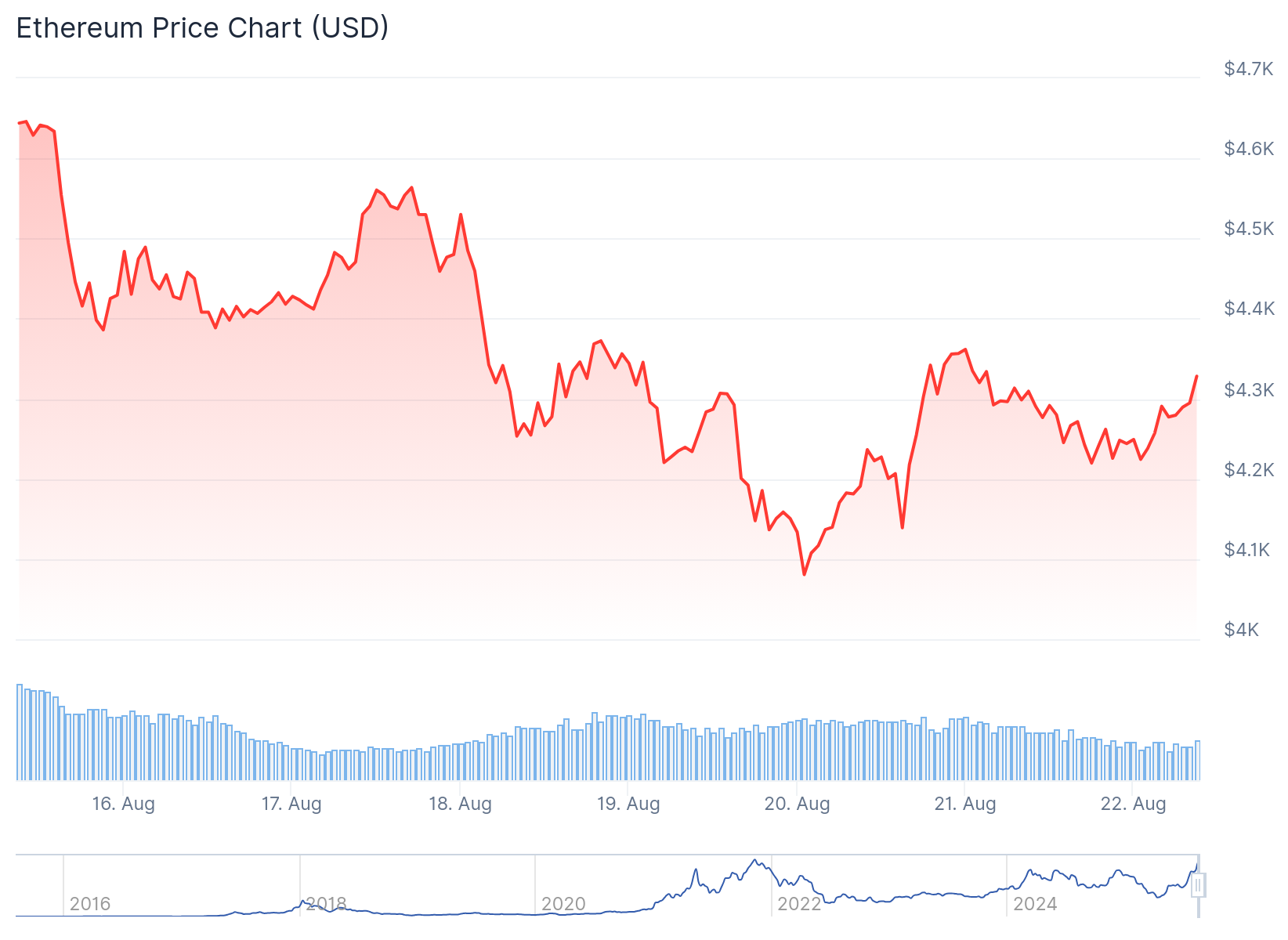

- Current price around $4,268 with key resistance at $4,800 and support at $4,100

- Jerome Powell’s Jackson Hole speech could trigger move toward $5,000 level

- Higher lows and strong chart performance keep bullish outlook alive despite institutional selling

Ethereum price continues to display resilience as analysts identify bullish technical patterns despite recent institutional selling pressure. The second-largest cryptocurrency by market cap is trading near $4,268 while maintaining a constructive chart structure.

Crypto analyst Javon Marks points to a bull flag formation on Ethereum’s daily chart. This technical pattern typically signals consolidation before a continuation move higher.

The pullback from recent highs has occurred within a defined channel. Price action shows orderly correction rather than panicked selling.

Ethereum has maintained higher lows during the recent correction. This behavior demonstrates underlying strength even as selling pressure persists across the market.

Bull Flag Setup Points to $5,500 Target

The bull flag pattern suggests potential for upside continuation. A confirmed breakout could push Ethereum toward the $5,500 level according to technical analysis.

$ETH (Ethereum) looks to be bull flagging here right under its All Time Highs with its MOMENTUM ON THE RISE!

A BREAKOUT CAN SEND PRICES ABOVE $5,500+ ⚡️… pic.twitter.com/xPdtbc0znl

— JAVON⚡️MARKS (@JavonTM1) August 20, 2025

The measured move from the bull flag structure supports this price target. Breaking above current resistance would put Ethereum within reach of its all-time highs.

Short-term resistance sits around $4,800 based on chart analysis. A move above this level would likely trigger additional buying interest.

The $4,200 level serves as near-term support for the bullish case. Failure to hold above this area could lead to deeper retracement.

Ethereum Price Prediction

BlackRock sold approximately 59.6 million ETH worth $254 million recently. The move from the world’s largest asset manager naturally raised questions about institutional demand.

#ARKHAM BLACKROCK JUST SOLD $254 MILLION IN ETHEREUM AND $214 MILLION IN BITCOIN pic.twitter.com/aJzFvb0bfE

— Crypto Stock Lounge (@stockndcypto) August 21, 2025

Some market participants view the sale as profit-taking following Ethereum’s recent rally. Others interpret it as a signal of weakening institutional appetite.

The selling pressure has not disrupted the overall technical formation. Ethereum’s chart structure remains intact despite the institutional outflow.

Market analysts note that single institutional moves rarely determine long-term price direction. Technical patterns and retail conviction often carry more weight for sustained trends.

Jerome Powell’s upcoming Jackson Hole speech could provide the catalyst for Ethereum’s next major move. A dovish tone from the Federal Reserve chair might spark risk-on sentiment across crypto markets.

If Powell hints at slowing rate hikes, crypto assets typically benefit from increased risk appetite. Ethereum could be positioned to lead any resulting rally toward the $5,000 psychological level.

A hawkish stance from Powell would likely pressure crypto prices lower. Ethereum would need to defend the $4,100 support level in such a scenario.

The speech represents a make-or-break moment for near-term price direction. Market participants are positioning ahead of the potential volatility.

Ethereum’s network activity continues supporting its fundamental value proposition. DeFi protocols and NFT marketplaces remain active on the network.

The infrastructure built on Ethereum provides underlying support beyond pure speculation. This network effect helps differentiate ETH from purely speculative crypto assets.

Current price action reflects this dual nature of technical momentum and fundamental utility. Both factors contribute to Ethereum’s relative outperformance compared to Bitcoin recently.

The $5,000 level remains achievable if technical patterns play out as expected and macro conditions remain supportive.