TLDR

- Ethereum reached a new all-time high above $4,900, peaking at $4,956 before correcting

- Large holders accumulated 350,000 ETH worth approximately $1.67 billion over the past week

- Liveliness metric above 0.70 suggests potential for short-term pullback, similar to early August pattern

- Key support levels identified between $4,592-$4,761 with heavy accumulation clusters

- Price must hold $4,610 support; breakout above $4,948 could target $5,496

Ethereum price reached a fresh all-time high above $4,900 over the weekend. The cryptocurrency peaked at $4,956 before entering a correction phase.

ETH is currently trading around $4,770, up 1.1% in the past 24 hours. The price sits less than 2% below its record high.

The rally extends three-month gains to 85%. One-year returns have climbed over 70%.

Ethereum has outperformed most major altcoins during this period. Traders now debate whether a pullback is coming or if prices will break toward $5,500.

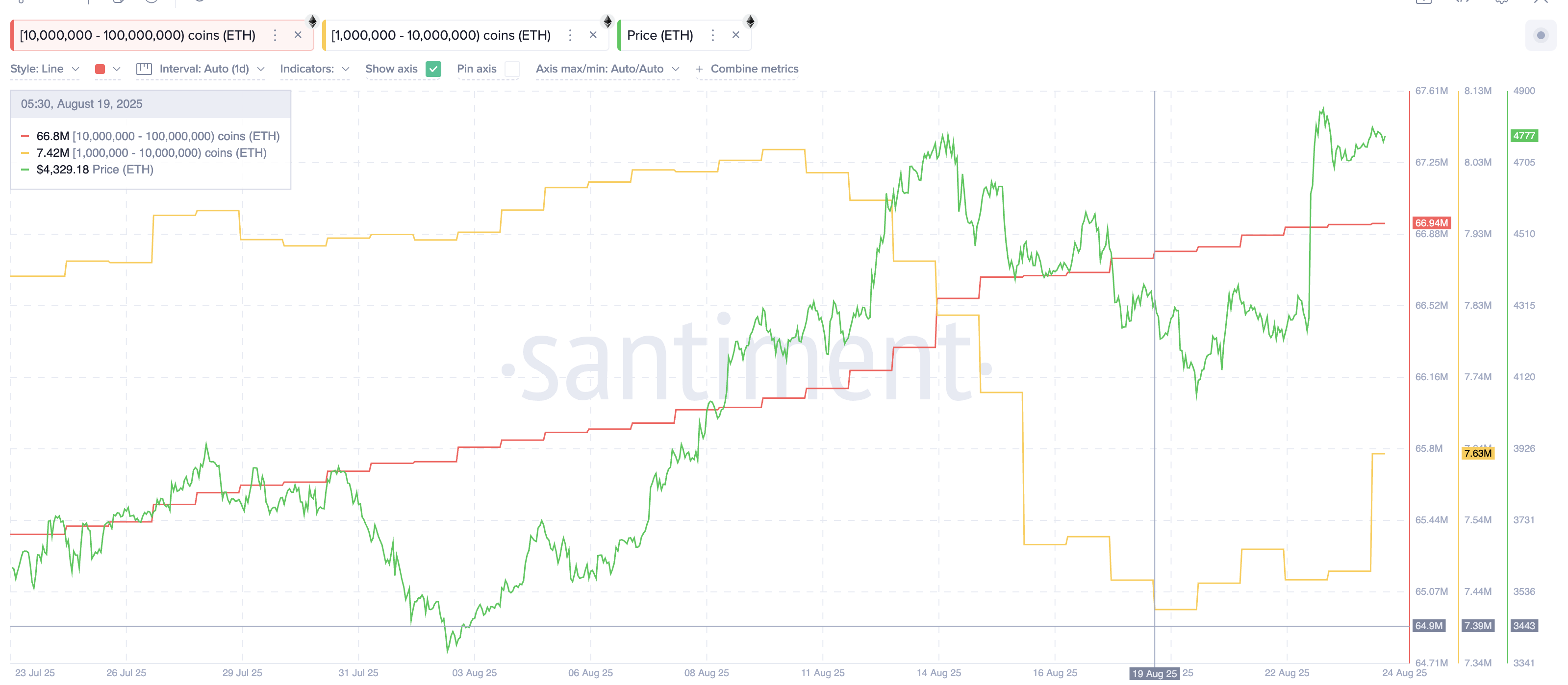

Large institutional holders continue buying despite prices near record levels. Wallets holding between 1 million and 10 million ETH increased their holdings from 7.42 million ETH to 7.63 million ETH since August 19.

This represents an additional 210,000 ETH worth approximately $1.0 billion at current prices. The 10 million to 100 million ETH cohort added another 140,000 ETH valued at $668 million.

Total accumulation by these large holder groups reached 350,000 ETH worth $1.67 billion over the past week.

On-Chain Metrics Point to Mixed Signals

The Ethereum Liveliness metric has climbed above 0.70 for the first time this month. This indicator measures whether coins are being held or spent by long-term holders.

Higher liveliness readings often precede corrections as it indicates profit-taking activity. The last spike above 0.70 occurred in early August when Ethereum dropped from $4,748 to $4,077 within days.

However, strong accumulation zones may limit any potential downside. The Cost Basis Distribution Heatmap reveals three key clusters where heavy buying occurred.

The $4,592-$4,648 zone contains almost 866,000 ETH. The $4,648-$4,704 range holds nearly 700,000 ETH. The $4,704-$4,761 area accounts for approximately 545,000 ETH.

These accumulation layers suggest buyers will likely absorb selling pressure between $4,590 and $4,761. Large holders who accumulated during the rally may continue buying on any dips.

Ethereum Price Prediction

From a technical perspective, Ethereum recently tested the 0.618 Fibonacci extension at $4,948. This level often provides strong resistance during uptrends.

A decisive daily close above $4,948 would open the path toward the 1.0 extension at $5,496. This target aligns closely with the $5,500 psychological level.

On the downside, failure to hold $4,610 support could trigger moves toward $4,400. This support zone aligns with both Fibonacci levels and the cost basis clusters identified on-chain.

The $4,610 level represents a crucial test for bulls. A break below could shift momentum toward bears in the near term.

However, large holder accumulation patterns suggest institutional buyers remain confident. These players typically have longer time horizons and may view any weakness as buying opportunities.

Ethereum started a fresh upward move after forming a base above $4,550. The price gained momentum above $4,650 and $4,720 before reaching the new high at $4,956.