TLDR

- Ethereum ETFs saw massive $461 million in single-day inflows, outpacing Bitcoin’s $404 million

- BlackRock led institutional buying with $250 million in ETH purchases, followed by Fidelity ($130 million) and Grayscale ($60 million)

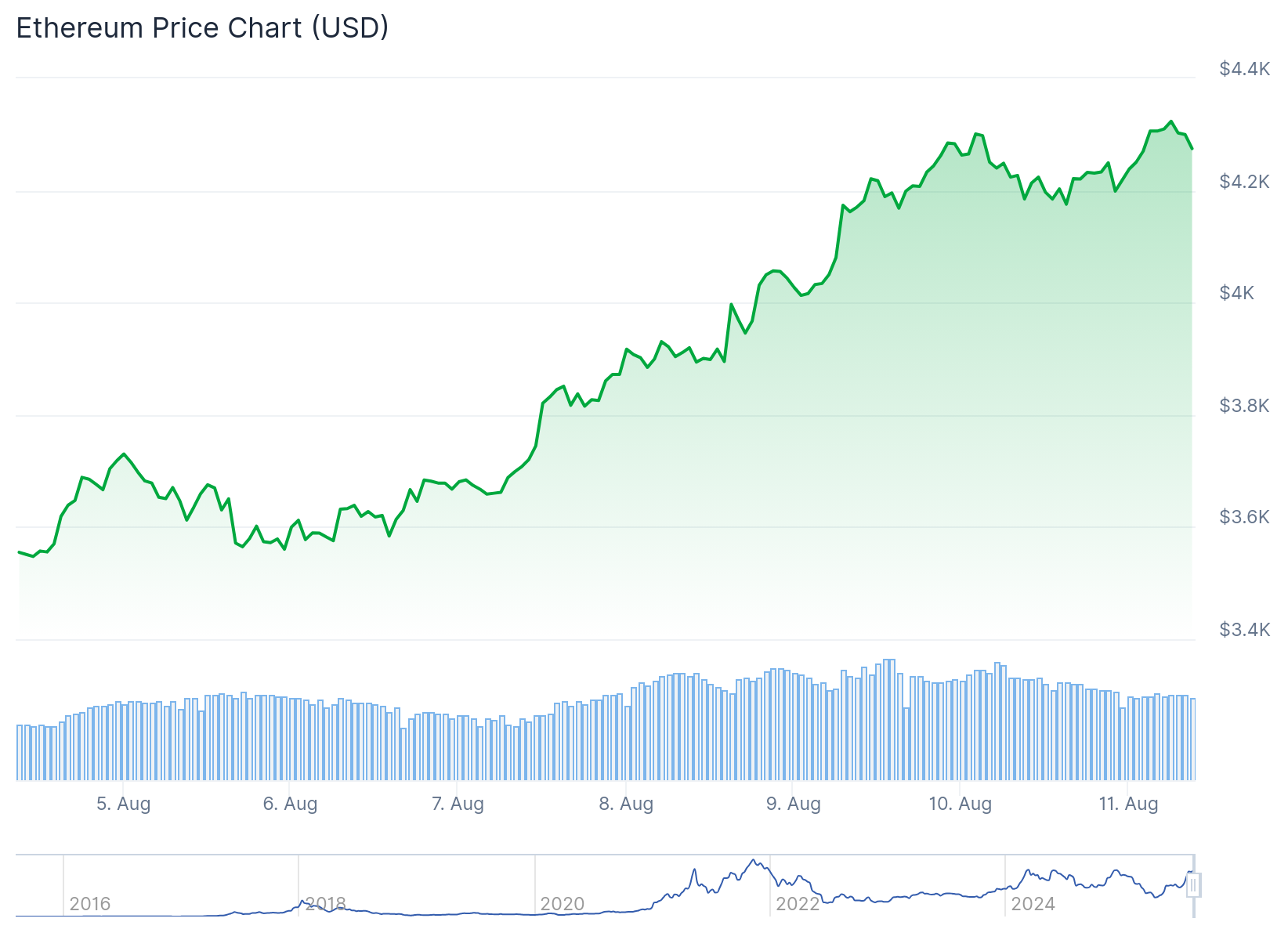

- ETH surged past $4,300, showing 25% weekly gains compared to Bitcoin’s 5.4% rise

- Derivatives market heating up with futures open interest reaching $51.61 billion near yearly highs

- Ethereum sits just $700 away from its $4,891 all-time high as institutional adoption accelerates

Ethereum has captured Wall Street’s attention in a big way. The second-largest cryptocurrency broke past $4,300 as institutional investors poured money into ETH products at unprecedented levels.

ETF inflows tell the story clearly. Ethereum products pulled in $461 million in a single day, beating Bitcoin’s $404 million haul according to Arkham Intelligence data.

ETFS ARE BUYING MORE ETH THAN BITCOIN

ETFs yesterday had total flows of $461M for ETH but only $404M for BTC.

BLACKROCK BOUGHT $250M ETH

FIDELITY BOUGHT $130M ETH

GRAYSCALE BOUGHT $60M ETH pic.twitter.com/C3mSLAnw90— Arkham (@arkham) August 9, 2025

BlackRock led the charge with $250 million in ETH purchases. Fidelity added another $130 million to their holdings. Grayscale rounded out the top three with $60 million in new investments.

This marked one of the strongest institutional buying waves for Ethereum this year. The flow of money shows big players are betting on ETH’s future price potential.

New Buyers Enter the Market

Fresh data from Glassnode reveals more than just institutional interest. First-time buyers and momentum traders are driving new demand higher across the board.

Conviction buyers also grew during this period. These are investors who raise their cost basis despite elevated prices. Their presence signals deeper market commitment beyond short-term trading.

The mix of new money and seasoned holder confidence creates conditions for further price moves. Sustained buying pressure could push ETH toward new territory.

Weekly performance data backs up the bullish sentiment. Ethereum posted 25% gains over the past week while Bitcoin managed just 5.4% despite reaching $119,000.

Derivatives Market Shows Strength

Ethereum’s derivatives market reflects growing trader interest. Futures open interest sits at $51.61 billion, approaching yearly highs according to CoinGlass data.

Technical indicators support the upward move. ETH trades above its 9-day and 21-day exponential moving averages at current levels around $4,190.

The RSI hovers at 69.8, just below overbought territory. MACD readings remain positive, showing continued momentum in the price action.

Open interest climbing alongside price suggests genuine demand rather than speculative bubbles. Traders are putting real money behind their ETH positions.

Fed Vice Chair Michelle Bowman’s weekend comments about rate cuts helped push ETH temporarily above $4,300. Her statement that “three rate cuts are necessary” gave risk assets like crypto a boost.

BlackRock did create some uncertainty with outflows from both Bitcoin and Ethereum ETFs on Monday. The firm withdrew $375 million from its Ethereum ETF, representing a 3% single-day decrease.

However, the outflow stopped after two days. Strategic purchases by US-listed companies helped Ethereum recover faster than other major cryptocurrencies.

Tom Lee called buying Ethereum “the most important trade in the next 10 years.” His comments reflect growing institutional confidence in ETH’s long-term prospects.

Bitmine updated its position as the world’s largest Ethereum-holding public company. The firm now holds over 830,000 ETH tokens on its balance sheet.

Ethereum price currently trades around $4,190, putting it roughly $700 away from its $4,891 all-time high record.