TLDR

- Ethereum ETFs recorded their biggest single day with $1.01 billion in net inflows on Monday

- BlackRock’s ETHA fund received $640 million while Fidelity’s FETH took in $277 million

- ETH has gained 45% in the past 30 days, trading near $4,275 and approaching its $4,800 all-time high

- Exchange holdings dropped to a nine-year low of 15.28 million ETH, indicating long-term storage trends

- High leverage ratios at 0.68 could accelerate price movements in either direction

Ethereum exchange-traded funds experienced their largest single-day inflow ever on Monday. The funds collected $1.01 billion across all Ethereum ETFs.

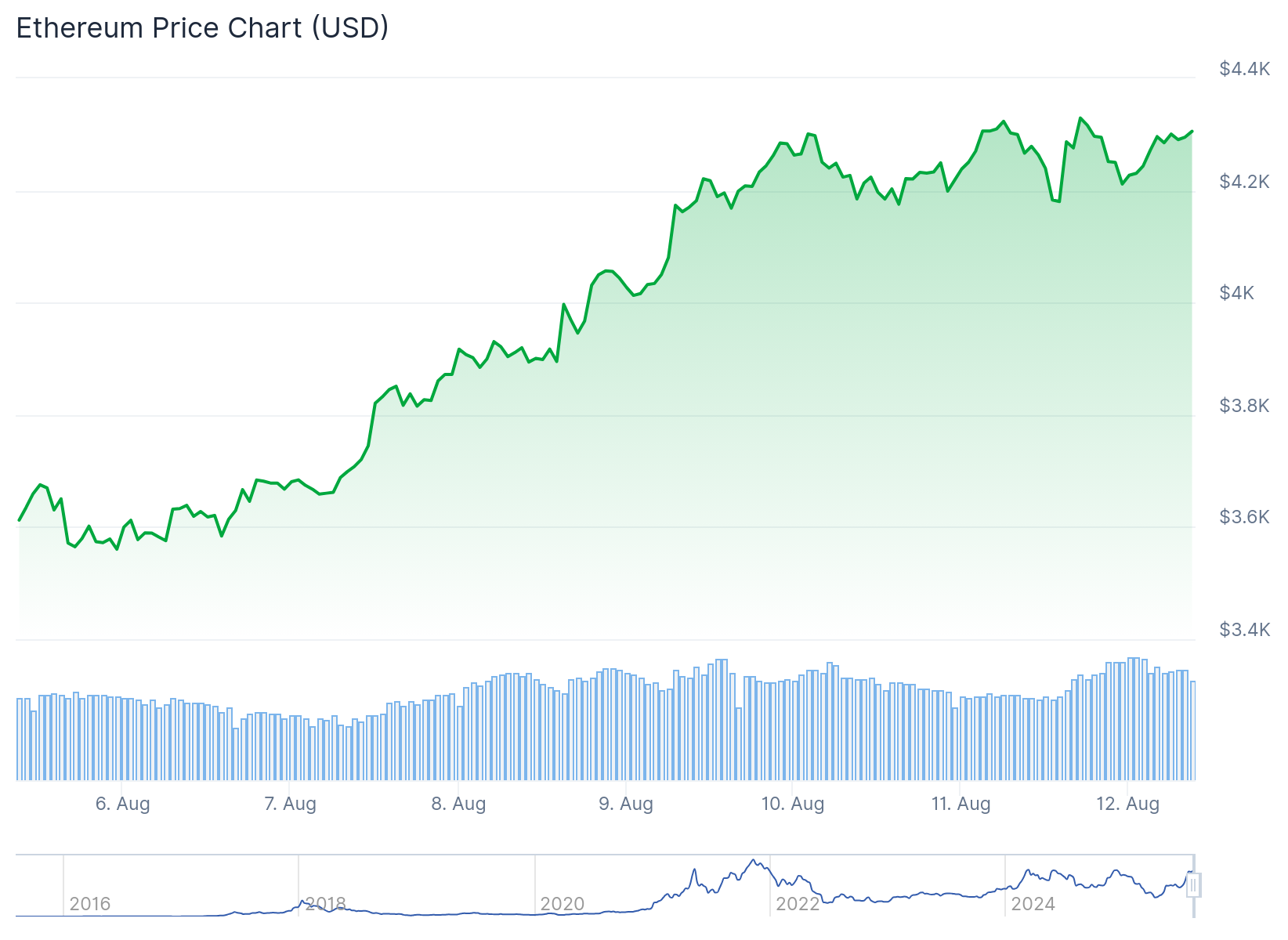

This massive inflow came as ETH rallied 45% over the past month. The cryptocurrency now trades around $4,275, moving closer to its all-time high of $4,800 set four years ago.

BlackRock’s iShares Ethereum Trust ETF led the charge with $640 million in inflows. This marked a record day for the ETHA fund.

The Fidelity Ethereum Fund came second with $277 million in inflows. This also represented the fund’s largest single-day intake.

These Ethereum ETF inflows far exceeded Bitcoin ETF performance on the same day. Bitcoin ETFs only saw $178 million in net inflows on Monday.

NovaDius president Nate Geraci believes institutional investors previously underestimated Ethereum. He stated that traditional finance investors didn’t understand ETH initially.

Now institutional investors view Ethereum as the backbone of future financial markets. This shift in perception has driven increased institutional adoption.

Exchange Holdings Hit Nine-Year Low

Ethereum held on exchanges dropped to 15.28 million ETH on Thursday. This represents the lowest level since November 2016.

When investors move crypto off exchanges, it typically signals long-term holding intentions. This behavior is generally considered bullish for price action.

Token Terminal data shows Ethereum dominates tokenized assets. The blockchain accounts for approximately 58% of all tokenized assets across all networks.

Assets staked on the Ethereum network surpassed $150 billion for the first time. This milestone reflects growing confidence in Ethereum’s proof-of-stake system.

Crypto analyst Anthony Sassano noted that ETF purchases represent over 50% of ETH issued since the Merge. Ethereum has issued 451,000 ETH since switching to proof-of-stake in late 2022.

Total net ETH issuance since The Merge: ~451,079 ETH

Total net inflows into the ETH ETFs today: ~238,200 ETH

In a *single day*, the ETH ETFs bought over 50% all the net issued ETH since The Merge.

ACCELERATE!

— sassal.eth/acc 🦇🔊 (@sassal0x) August 12, 2025

Monday’s ETF inflows alone purchased 238,000 ETH. This single-day purchase represents a massive portion of total ETH supply expansion.

Leverage Concerns Cloud Rally

Despite strong institutional demand, leverage metrics show potential volatility ahead. The all-exchange Estimated Leverage Ratio reached 0.68, near historic highs.

This ratio means open interest in futures contracts equals 68% of spot reserves. While not maximum leverage, this level can accelerate price movements in both directions.

Binance showed a lower leverage ratio at 0.52. This suggests other exchanges carry higher leverage loads.

One unidentified institution purchased 49,533 ETH worth $212 million in a single day. Over the past week, the same buyer accumulated 221,166 ETH valued at $946.6 million.

The Taker Buyer Sell Ratio hit 1.005, entering positive territory. This indicates buyers, particularly institutions, currently control market dynamics.

Corporate holders of Ethereum saw their assets under management reach $13 billion on Monday. The increase came from ETH’s price appreciation.

Ethereum co-founder Vitalik Buterin warned about corporate treasury accumulation trends. He cautioned that corporations buying ETH for treasuries could create an overleveraged situation.

If current accumulation patterns continue, ETH could target $4,501 and then $4,788. However, a leverage-driven squeeze could push prices below $3,980.