TLDR

- Ethereum price surged past $4,750, approaching its 2021 all-time high of $4,865

- Polymarket bettors place 64% odds on ETH hitting $5,000 by end of August

- Institutional accumulation continues with BitMine Technologies reportedly holding 1.2 million ETH

- Layer 2 solutions driving network growth and reducing gas fees

- Analysts predict potential targets ranging from $7,500 to $15,000 by year-end

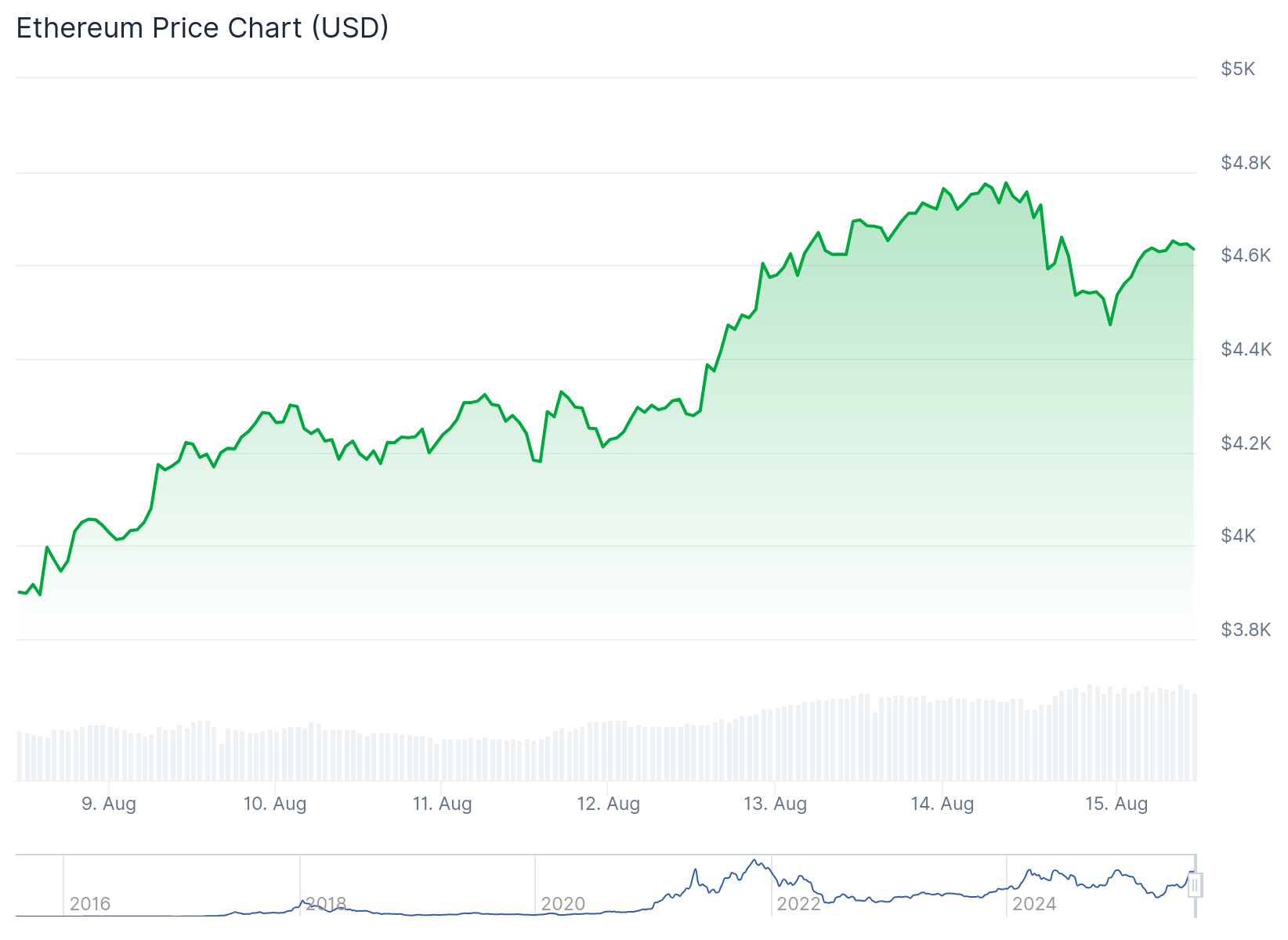

Ethereum has surged over 60% in recent weeks, trading above $4,750 and approaching its 2021 all-time high of $4,865. The second-largest cryptocurrency continues to outperform Bitcoin as traders position for potential breakouts.

Polymarket users are betting heavily on Ethereum’s continued rise. The prediction market shows 64% odds that ETH will hit $5,000 before August 31. Even more optimistic, 87% of bettors expect a new all-time high this month.

The current price action shows ETH trading within a rising channel. Dynamic support sits near $4,723 with immediate resistance at $4,870. Technical indicators remain bullish with RSI at 59.7, showing mild bullishness without being overbought.

Bollinger Bands on the 4-hour chart are expanding. Price is riding the upper band at $4,893. The EMA stack from 20 to 200 periods remains fully bullish, providing layered support below current levels.

Buying $ETH now is like buying $BTC at $19,000 in 2020.

BTC pulled a 3x rally in just 3 months after a new ATH.

Imagine what Ethereum can do with billions in daily inflows. pic.twitter.com/gj33hrcHk2

— Ted (@TedPillows) August 13, 2025

On-chain metrics support the positive outlook. Spot net outflows from exchanges reached approximately $55 million on August 14. This indicates accumulation and reduced selling pressure from holders.

If ETH breaks above the $4,870-$4,875 resistance zone, short-term targets could extend to $4,950. The psychologically important $5,000 level represents the next major milestone.

Institutional Accumulation Drives Demand

Market participants point to robust institutional activity as a key driver. BitMine Immersion Technologies has reportedly accumulated 1.2 million ETH since July. This position is worth around $5.5 billion at current prices.

Record ETF inflows are also supporting price action. BlackRock’s ETHA fund has seen particularly strong activity. This corporate and institutional demand is creating structural support for ETH prices.

Rachael Lucas from BTC Markets commented on the situation. She noted that record ETF inflows combined with corporate allocations create “deep structural demand meeting finite supply.”

Fundstrat Capital’s Thomas Lee called ETH “arguably the biggest macro trade for the next 10 to 15 years.” He pointed to artificial intelligence adoption and Wall Street’s blockchain integration as long-term catalysts.

The convergence of institutional buying and limited supply is creating upward pressure. Corporate treasuries are increasingly viewing ETH as a strategic asset allocation.

Ethereum Price Prediction

Ethereum’s Layer 2 solutions continue expanding rapidly. Arbitrum, Optimism, and zkSync are seeing rising transaction volumes. This growth helps reduce gas fees and enhance network scalability.

The Layer 2 expansion strengthens ETH’s appeal to both retail and institutional users. Lower costs make the network more accessible for everyday transactions.

Agne Linge from WeFi noted positive market sentiment for Ethereum. She said Layer 2 adoption and institutional accumulation are “reinforcing each other, keeping demand high and supply constrained.”

Transaction volumes on Layer 2 networks have increased substantially this year. This growth demonstrates the network’s ability to scale and handle increased demand.

Send $ETH to $8,000 with haste! pic.twitter.com/KEKNM8Ot6n

— CryptoGoos (@crypto_goos) August 13, 2025

The technical outlook remains bullish across multiple timeframes. Support appears at the $4,720-$4,746 VWAP level with deeper support at $4,504.

Analysts are watching key breakout levels closely. Short-term resistance sits between $4,870 and $4,875. A break above this zone could trigger moves toward $4,950 and $5,000.

Looking at medium-term forecasts, some analysts predict ETH could reach $10,000-$15,000 by year-end. Fundstrat’s Sean Farrell bases this on Ethereum’s dominance in tokenized real-world assets and stablecoins.

Fibonacci extensions point to a midpoint target of $7,500. This aligns with other technical analysis suggesting major upside potential.

Popular trader Rekt Capital stressed that ETH “will need to turn $4,631 into new support to confirm upside into price discovery.” He warned that failed reclaim could lead to correction toward $4,000.

The +1 standard deviation Active Realized Price band around $4,700 remains a key technical level to watch based on historical selling patterns.