TLDR

- Ethereum’s long-term holder indicator shows the market has entered the “belief” phase, historically preceding major price rallies

- Current market value to realized value ratio at 2.08 suggests ETH remains undervalued compared to previous cycle peaks

- Technical analysis points to potential targets between $7,000-$12,130 based on chart patterns and historical cycles

- Onchain metrics indicate room for growth to $5,500 before reaching extreme profit levels

- Multiple analysts predict cycle targets ranging from $10,000 to $20,000 for this bull run

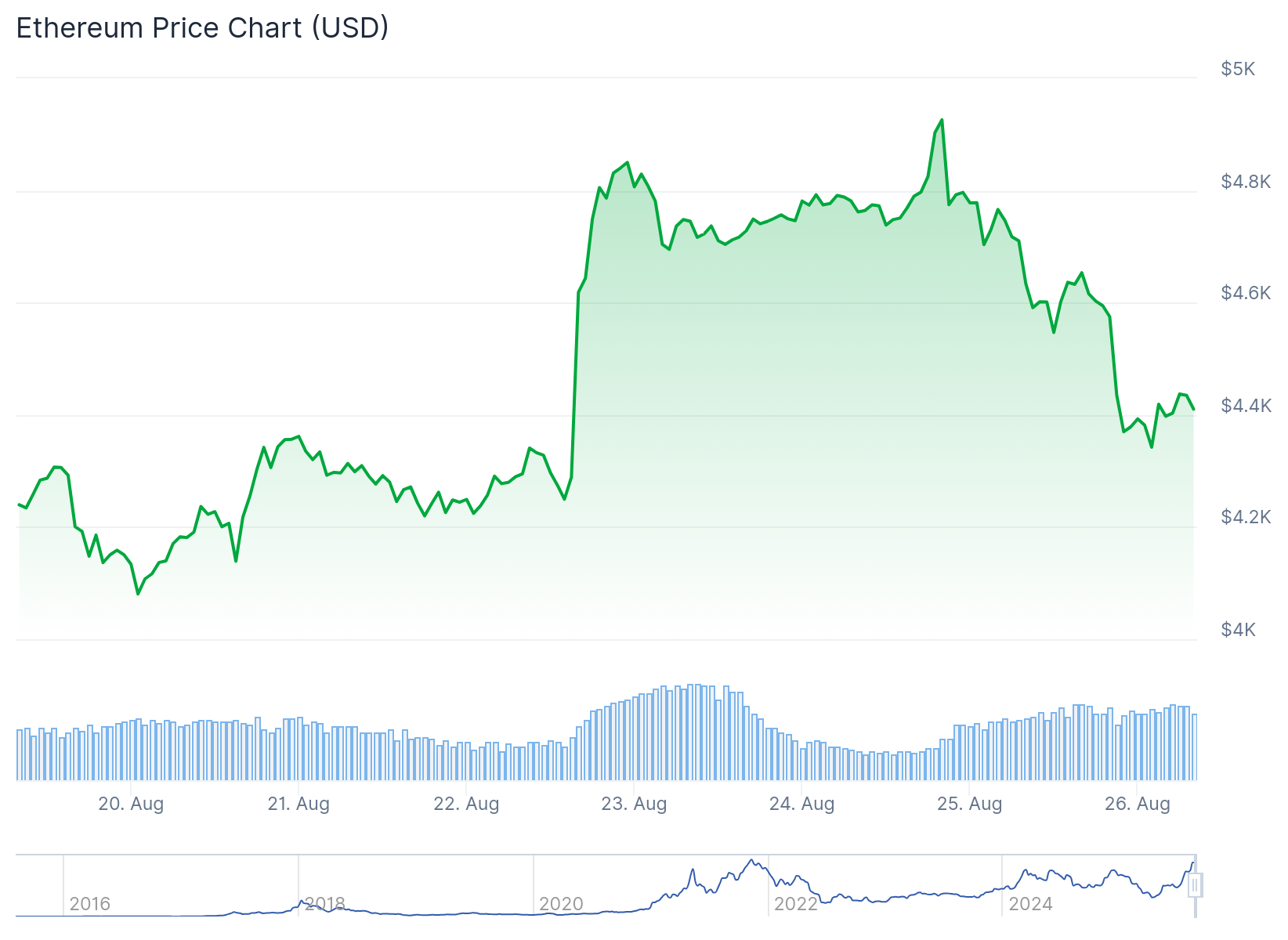

Ethereum has surged more than 240% since April, reaching a new all-time high above $5,000 on Sunday. The rally has pushed investor profitability to levels that mirror previous bull market cycles.

Onchain data reveals that Ethereum’s long-term holder net unrealized profit/loss indicator has entered the “belief-denial” zone. This metric tracks the difference between unrealized profits and losses for investors holding ETH for at least 155 days.

Popular analyst Gert van Lagen notes this positioning historically comes before major price increases. The current phase suggests ETH has not yet reached the euphoric stage typically seen at cycle peaks.

Van Lagen explained that for the transition from belief to euphoria to occur, ETH price needs to climb further. He stated that $10,000 and $20,000 price targets “are not unimaginable” for this cycle.

The Long-Term Holder NUPL shows that $ETH has just entered the Belief zone (green).

Historically, at the peak of a bull market, price spends a measurable period in the Euphoria zone (blue).

For that to occur, price still needs to climb further.

$10k and $20k $ETH are not… pic.twitter.com/Nr28zw23nc

— Gert van Lagen (@GertvanLagen) August 25, 2025

The market value to realized value ratio supports the bullish outlook. At 2.08, this metric sits well below previous cycle peaks of 3.8 in 2021 and 6.49 in 2017.

This lower MVRV reading indicates limited profit-taking activity and suggests potential for continued price appreciation. The data shows investors have not yet reached extreme profit levels that typically trigger major selling pressure.

Technical Analysis Points Higher

Ethereum’s MVRV extreme deviation pricing bands suggest room for expansion to $5,500 before unrealized profits reach extreme levels. This represents the uppermost MVRV band threshold on current metrics.

Crypto analyst Jelle identified a bullish megaphone pattern forming on ETH’s weekly chart since December 2023. This technical formation carries a target of $10,000 according to the analyst’s assessment.

Jelle noted that ETH has “defeated every resistance level standing in its way” and described the path ahead as having “clear skies.”

Cycle Targets Range from $7,000 to $12,000

Analyst Mickybull Crypto confirmed that ETH performed as expected with its run to new highs above $5,000. The analyst’s cycle targets for Ethereum range from $7,000 to $11,000.

$ETH is attempting a strong weekly close above $4,600.

This'll be a major confirmation that it's not a bull trap.

If ETH manages a weekly close above $4.6K, that'll mark the highest weekly close ever.

Also, it'll set the stage for the next leg up towards $5,200-$5,500 by next… pic.twitter.com/cYpCqMBcGx

— BitBull (@AkaBull_) August 24, 2025

The ETH/USD pair broke above a rounded bottom pattern on the daily chart. Price action retested the pattern’s neckline at $4,100 to confirm the breakout.

Bulls are now targeting the technical objective of $12,130 based on this chart pattern. This represents a potential 161% increase from current price levels.

Several other analysts predict Ethereum could reach $12,000 or higher in 2025. They cite potential interest rate cuts, capital inflows through spot Ethereum ETFs, and demand from ETH treasury companies as supporting factors.

The combination of onchain metrics and technical analysis suggests Ethereum’s current rally may have substantial room to continue before reaching typical cycle peak conditions.