TLDR

- Ethereum price held near $3,850 on Thursday with CME institutional derivatives activity hitting record highs at $9 billion in options open interest

- BlackRock’s ETHA fund saw $110.7 million in inflows on October 22 while Fidelity and Grayscale logged withdrawals, creating mixed spot ETF flows

- Citi set a base target of $4,300 for Ethereum while Standard Chartered raised its year-end target to $7,500 citing stablecoin growth

- A whale purchased 12,000 ETH worth approximately $46 million, signaling renewed confidence from large investors

- Ethereum broke above a long-term descending trendline from 2021, with 82% of traders showing bullish sentiment in community polls

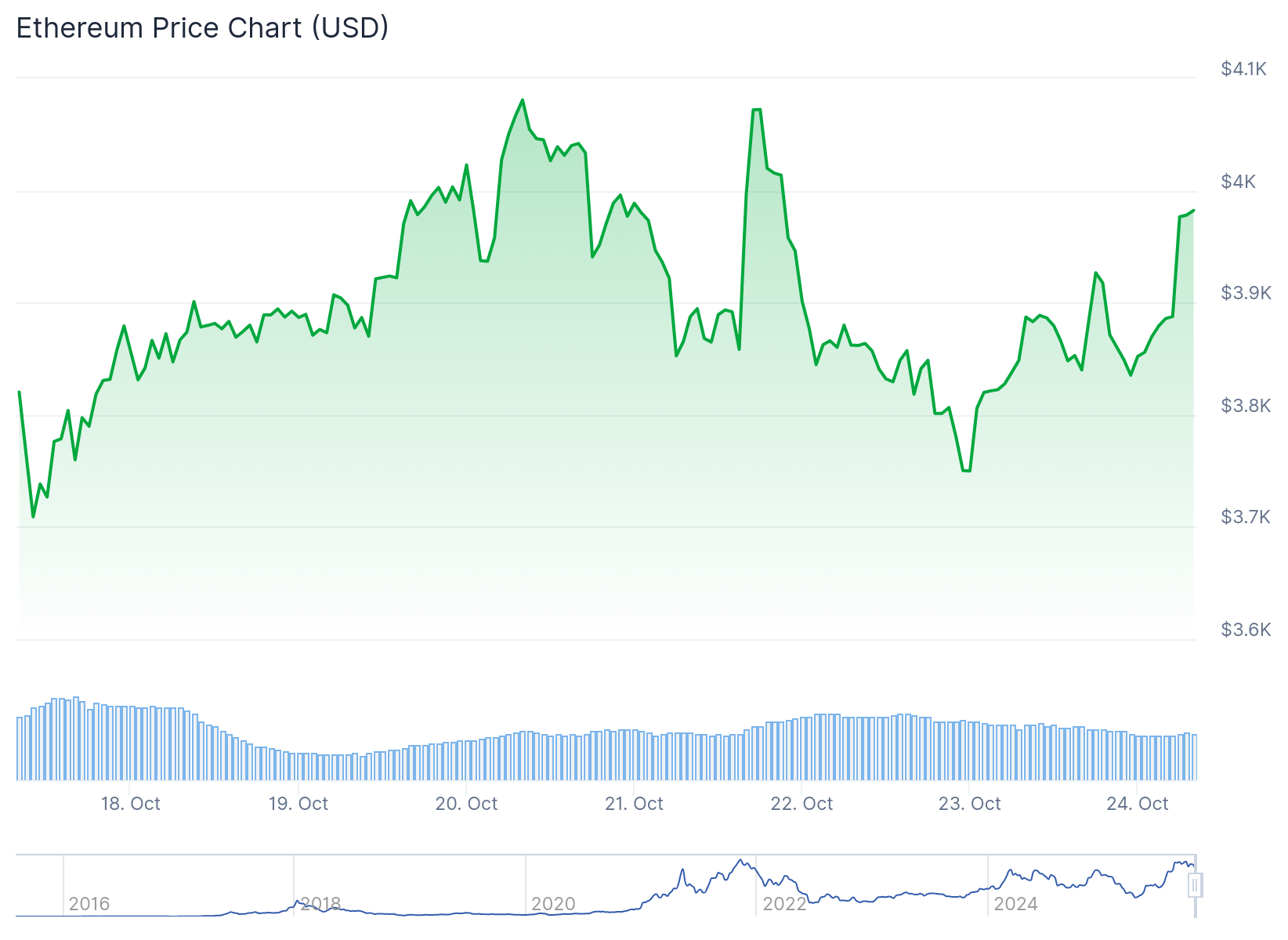

Ethereum traded near $3,836 during late Thursday trading as institutional activity reached new peaks. CME data showed options open interest around $9 billion and futures open interest hitting roughly 48,600 contracts.

The price action came as spot ETF flows showed mixed signals. BlackRock’s ETHA fund recorded about $110.7 million in inflows on October 22 according to Farside Investors. However, Fidelity and Grayscale logged withdrawals that brought the net balance to approximately $38 million.

Leading the shift: Crypto futures and options OI is up 27% since Oct. 10 and Crypto options OI hit a record $9B 👇

🔷 ETH futures: 48.6K OI

🔷 SOL futures: 20.7K OI

🔷 XRP futures: 10.1K OIWe have the regulated tools you need ⬇️ https://t.co/lYJSklEvXH

— CME Group (@CMEGroup) October 23, 2025

The divergence shows institutions building positions through regulated derivatives while spot demand remains measured. Traders continue debating where the asset could finish 2025.

Major banks offered different outlooks for Ethereum’s price path. Citi set a base target of $4,300 according to Reuters, noting that current prices sit above activity estimates. The bank outlined a bullish scenario at $6,400 and a downside case at $2,200.

Standard Chartered took a different view, raising its year-end target to $7,500. Analyst Geoff Kendrick pointed to growing stablecoin use and staking demand as factors that could strengthen Ethereum’s fundamentals.

“We expect the stablecoin sector to grow about eightfold by the end of 2028,” Kendrick said in the Reuters report.

Whale Purchase Signals Confidence

A large investor purchased 12,000 ETH worth approximately $46 million. The transaction drew attention from market watchers as a sign of renewed confidence from institutional players.

BREAKING:

THIS MASSIVE WHALE JUST BOUGHT 12,000 $ETH WORTH $46M.

BULLISH FOR ETHEREUM! pic.twitter.com/tAcIc6N2hF

— Mister Crypto (@misterrcrypto) October 22, 2025

Community sentiment polls showed 82% of traders expecting continued upward movement. Only 18% expressed bearish views, indicating low fear of decline among participants.

Ether traded around $3,875 early Friday after rebounding from support near $3,860. Market analyst Crypto Tony said he was taking a long position while the price stayed above that area.

The price has been testing resistance between $3,900 and $4,100 over recent sessions. Multiple attempts to break through the $4,000 level have not held.

Technical Setup Shows Pattern Shift

The daily chart shows Ethereum breaking above a descending trendline that capped rallies since 2021. This move turned the $3,800 level from resistance into support.

Could. Not. Be. Clearer.

Connect the dots or stay broke. pic.twitter.com/Ep2nEljS8h

— Gordon (@AltcoinGordon) October 23, 2025

The four-hour chart displays higher lows forming after the recent pullback to $3,720. This pattern typically indicates buyers returning to the market.

Momentum indicators point to a neutral-to-slightly bullish setup. Resistance remains tight around $3,900 to $3,920 where earlier rallies lost strength.

Ethereum’s dominance metric rebounded from monthly support but faced resistance soon after. Analysts identified 11.5% and 9.5% as key demand areas that could provide support for the next move.

A strong daily close above $4,000 would confirm the breakout structure. A break of that level could open a path toward the $4,020 zone and potentially higher.

On the downside, losing the $3,860 support could lead to another test of $3,740. Traders are watching whether the price can break through near-term resistance with volume.

Ethereum held at $3,896 at time of publication with 24-hour trading volume at $45.31 billion and market value at $469.49 billion.