TLDR

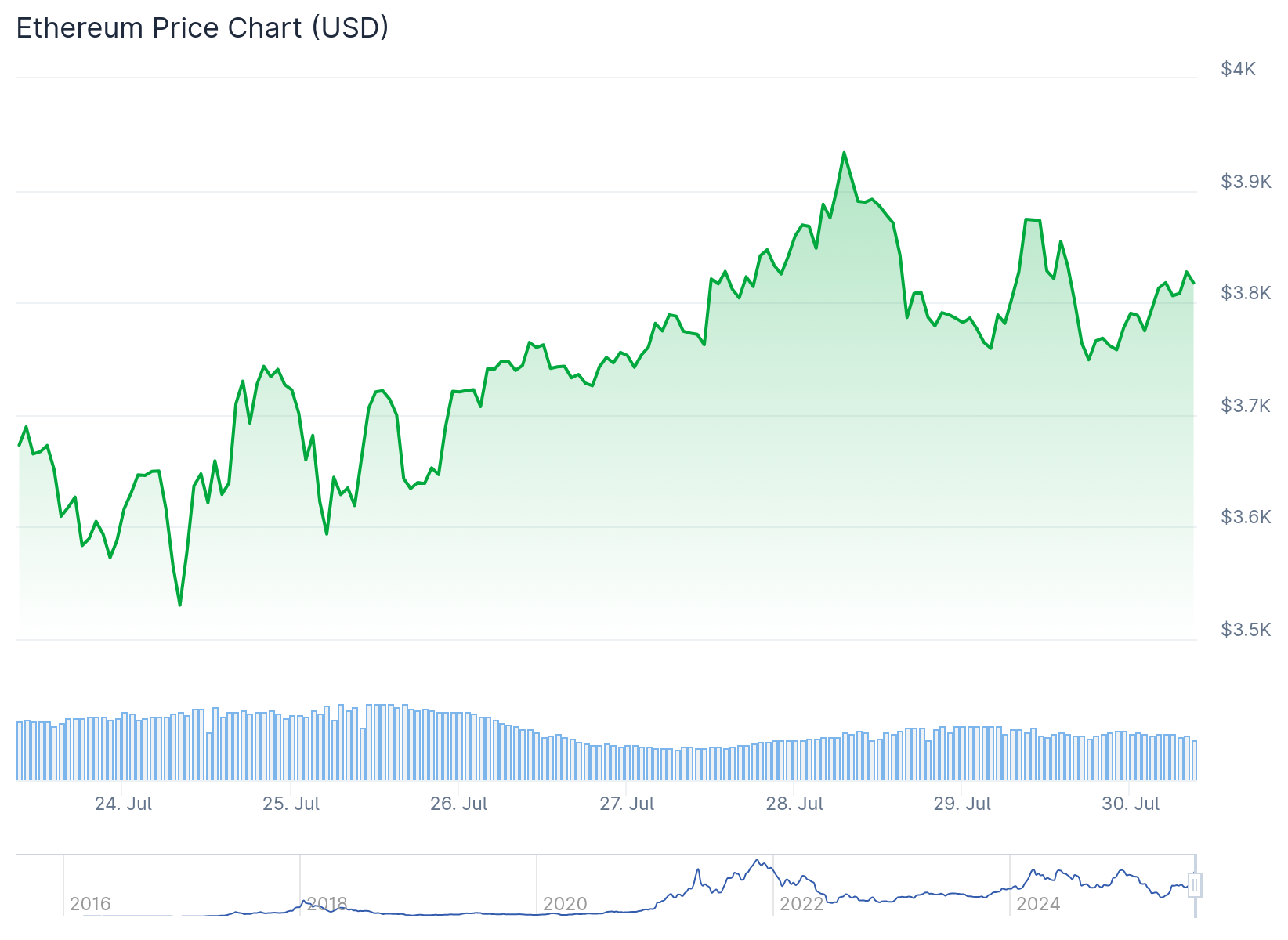

- Ethereum (ETH) price reclaimed $3,800 after briefly dropping to $3,700 in early Asian trading

- ETH futures open interest hit a record high of $58 billion, more than doubling since June 22

- Network activity shows strength with 7.2% increase in active addresses and 16% rise in monthly transactions

- Stablecoin supply reached all-time high of $132.5 billion, indicating increased liquidity demand

- Whale activity suggests potential manipulation with 100 high-cap holders exiting while maintaining price below $4,000 resistance

Ethereum price bounced back to $3,800 on Tuesday after falling to $3,700 during early Asian trading hours. The recovery comes as multiple onchain metrics show increased network activity and market participation.

ETH futures open interest reached a record high of $58 billion on Tuesday. This represents more than double the level seen on June 22. The metric has increased 10% over the past two days alone.

For comparison, Ethereum’s open interest was $20.75 billion on April 29 when the price traded around $1,800. When ETH reached $4,000 in December 2024, futures open interest was only $31.5 billion.

ETH open interest dominance has climbed to nearly 40%, its highest level in over two years. This marks a shift in speculative focus with capital rotating from Bitcoin to Ethereum at the margin.

#Ethereum open interest dominance has climbed to nearly 40%, its highest level since April 2023. Only 5% of days have seen a higher reading. This marks a clear shift in speculative focus, with capital rotating from $BTC to $ETH at the margin. pic.twitter.com/yNKLe9gJKt

— glassnode (@glassnode) July 29, 2025

Crypto trader Merlijn The Trader noted the open interest milestone. He said this level of leverage stacking creates fuel for vertical price movement rather than a normal breakout pattern.

Network Metrics Show Increased Activity

Ethereum’s onchain activity continues to strengthen across multiple measures. Active addresses increased by 7.2% over the last 30 days according to Nansen data.

Average monthly transaction count rose 16% over the same period to 43.3 million transactions. Weekly DEX volume hit a 4-month high of $22.6 billion according to DefiLlama data.

Weekly app revenue reached a 6-month high of $89.8 million. Stablecoin supply on Ethereum reached an all-time high of $132.5 billion on Tuesday.

Analyst Elja described the network activity as “going through the roof.” He expects these metrics to drive ETH to new all-time highs as a matter of time.

The current Ethereum price trades around $3,800, representing a 6% gain over the past seven days. Breaking the $4,000 level remains key for upside potential toward new all-time highs.

Whale Activity Raises Questions

However, whale behavior suggests a different picture beneath the surface metrics. Whale wallet count holding 1,000+ ETH dropped from 4,897 to 4,797 over the past seven days.

This represents a net loss of 100 high-capacity holders during a period of supposed strength. Weekly funding rates on Binance show -0.21%, indicating net short positioning in perpetual futures.

ETH ETFs have attracted close to $1.9 billion in inflows since July 21. Exchange reserves dropped from 8.9 million to 8.7 million ETH, creating a 200,000 ETH supply squeeze through spot venues.

Despite this supply reduction and ETF demand, Ethereum price remains unable to break the $4,000 resistance level. Over $100 million in Ethereum long positions were liquidated in a 24-hour period.

$ETH Slowly creeping its way up to those cycle highs.

Going to be a very interesting spot when it gets there.

I still think it would be a bit healthier if price consolidates below it for some time before breaking it, as the current rally has been very sharp already.

That way… pic.twitter.com/JjRfxfkIEe

— Daan Crypto Trades (@DaanCrypto) July 29, 2025

Trader Daan Crypto Trades suggests ETH is “slowly creeping” toward cycle highs around $4,000. He notes this resistance level has rejected price multiple times since February 2024.

Market analysts Bitcoinsensus believe ETH is “ready to explode to the upside” above a multi-year trendline. They expect sufficient momentum could lead to much higher prices in the upcoming cycle phase.

ETH sits 3.3% below the $4,000 breakout zone with macro catalysts emerging as the FOMC prepares policy updates. Bitcoin dominance cooled to 61.25% after reaching 62%+ this week, potentially supporting altcoin rotation.