TLDR

- Ethereum dropped 7% to $4,313 during Tuesday’s crypto market crash before recovering above $4,430

- Tom Lee predicted ETH would bottom out within hours and target $5,100-$5,450 range

- BitMine bought 4,871 ETH worth $21.3 million during the dip, bringing total holdings to 1.72 million ETH

- The company now holds $7.5 billion worth of Ethereum and leads corporate ETH treasuries with 40% market share

- Price predictions for September 2025 range from $4,767 to $5,817 based on technical analysis

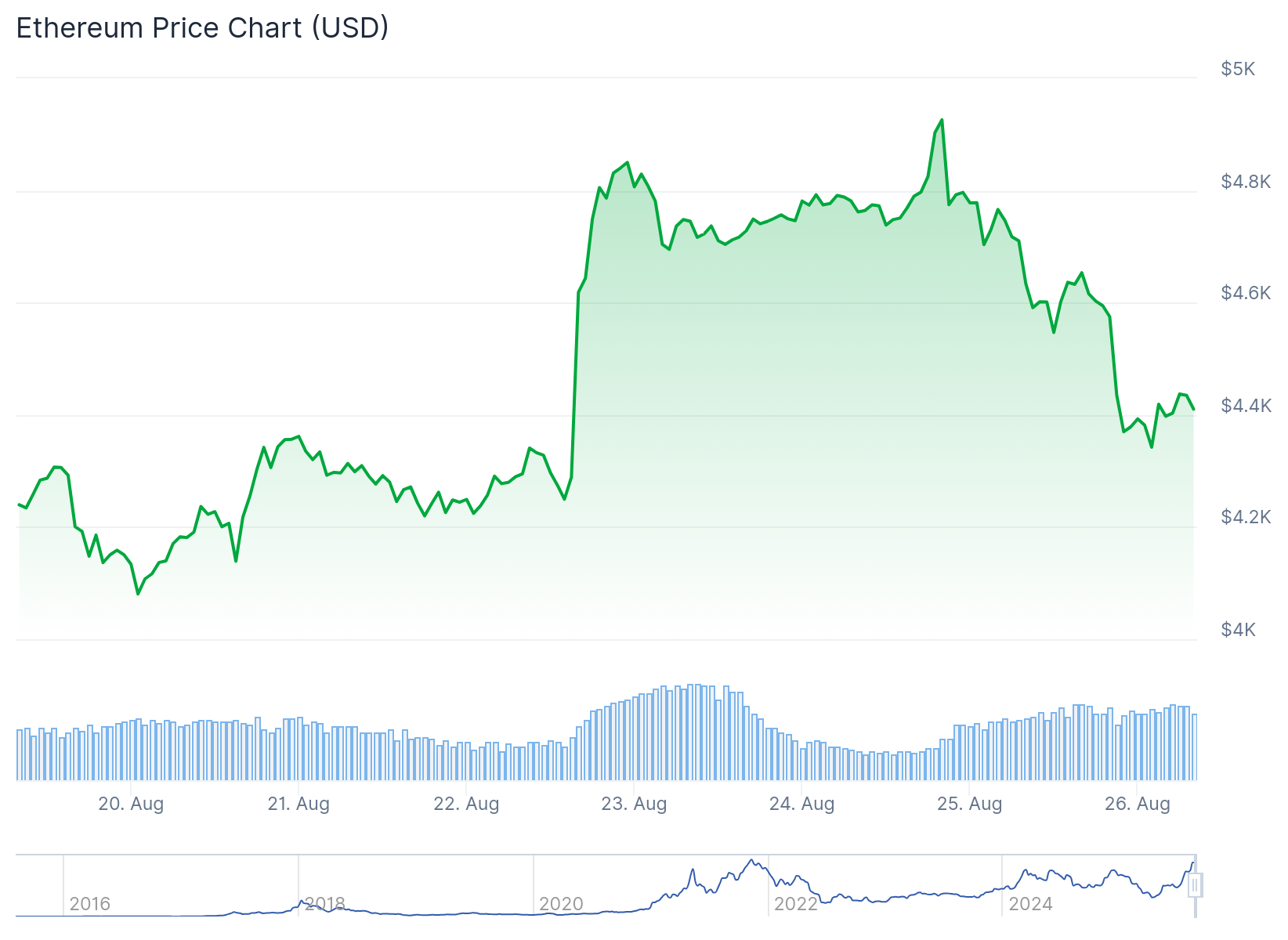

Ethereum experienced a sharp decline on Tuesday as crypto markets faced widespread selling pressure. The second-largest cryptocurrency fell more than 7% to reach a low of $4,313 on Coinbase.

The drop came after Ethereum had recently hit new 2025 highs above $4,950. The decline represents an 11% pullback from its all-time high levels.

Fundstrat Global Advisors managing partner Tom Lee made a bold prediction during the market downturn. He called the bottom for Ethereum on Tuesday at 1 AM UTC via social media.

“Calling ETH bottom to happen in next few hours,” Lee posted as markets showed red across the board. His timing appeared accurate as Ethereum began recovering shortly after his statement.

Mark @MarkNewtonCMT again at it.

➡️Calling ETH bottom to happen in next few hours

Tickers: $BMNR $GRNY pic.twitter.com/038efU7cZH

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) August 26, 2025

Lee’s prediction was supported by technical analysis from Mark Newton at Fundstrat. Newton described Ethereum as presenting “very good risk/reward” at current levels.

The technical analyst expressed skepticism that Ethereum would break below last week’s lows. Newton projected the cryptocurrency should bottom near $4,300 within 12 hours of his analysis.

Corporate Accumulation Continues

BitMine Immersion Technologies used the price decline as a buying opportunity. The company purchased 4,871 ETH worth $21.3 million during Tuesday’s dip.

🚨JUST IN:

BITMINE BOUGHT 190,500 $ETH WORTH OVER $876 MILLION

THEY NOW HOLD 1,713,899 ETH — THAT’S 1.43% OF THE TOTAL SUPPLY!

WE GOTTA BE AS CONVINCED AS THESE GUYS pic.twitter.com/8GVIot39bt

— Wimar.X (@DefiWimar) August 25, 2025

This latest purchase brought BitMine’s total Ethereum holdings to 1.72 million ETH. The position is worth approximately $7.5 billion at current market prices.

BitMine disclosed on Monday that its crypto and cash holdings had increased by $2.2 billion to $8.8 billion. The company added over 190,500 tokens during the previous week.

The firm’s crypto plus cash net asset value per share climbed to $39.84. This represents growth from $22.84 recorded in late July.

Market Leadership Position

BitMine maintains clear dominance in corporate Ethereum treasuries. The company holds a 40% share of the total 4.3 million ETH held by corporate entities.

Bitcoin’s market dominance declined to 57% as investor interest shifted toward Ethereum and other altcoins. This trend historically indicates late-stage bull market behavior according to market analysts.

The futures market saw substantial liquidations during the price decline. Ethereum futures liquidations totaled $320.30 million over 24 hours, with $283.21 million from long positions.

Ethereum Price Prediction

Technical analysts maintain bullish projections for Ethereum despite recent volatility. Newton’s analysis suggests the cryptocurrency could push toward new highs above $5,100.

The target range extends to $5,400-$5,450 according to Fundstrat’s technical team. This projection assumes Ethereum successfully holds above the $4,300 support level.

September 2025 price predictions show continued optimism among forecasting services. CoinCodex projects potential gains to $5,817 with trading ranges between $4,825 and $6,978.

Changelly provides more conservative estimates with a mean prediction of $5,097 for September. Their analysis suggests a worst-case scenario floor of $4,767 for the month.

The recovery began shortly after Lee’s bottom call, with Ethereum trading back above $4,430. Market observers are watching whether the cryptocurrency can maintain momentum toward the projected higher targets.