TLDR

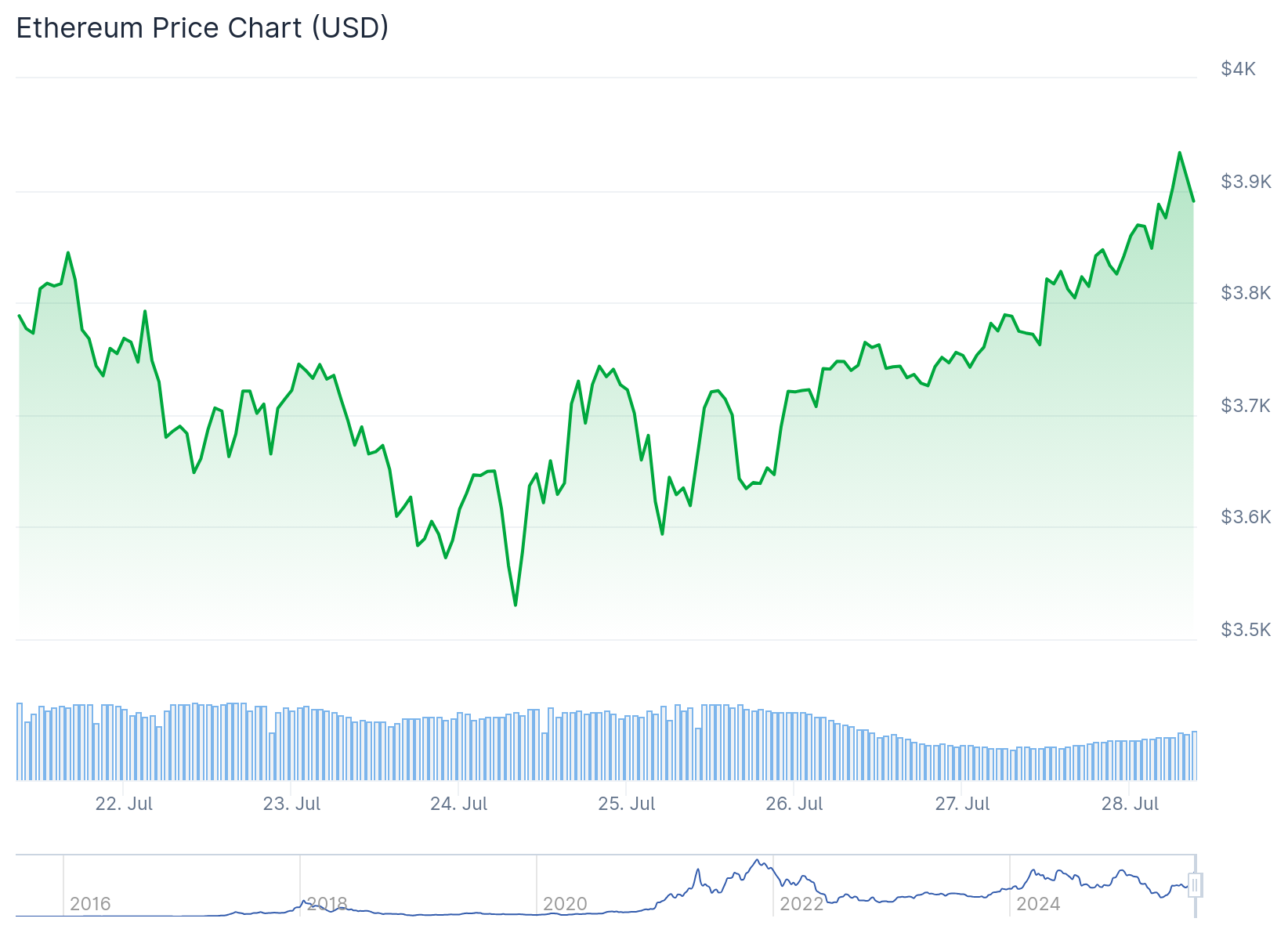

- Ethereum price has recovered above $3,800 after dipping to $3,507 earlier this week, showing renewed bullish momentum

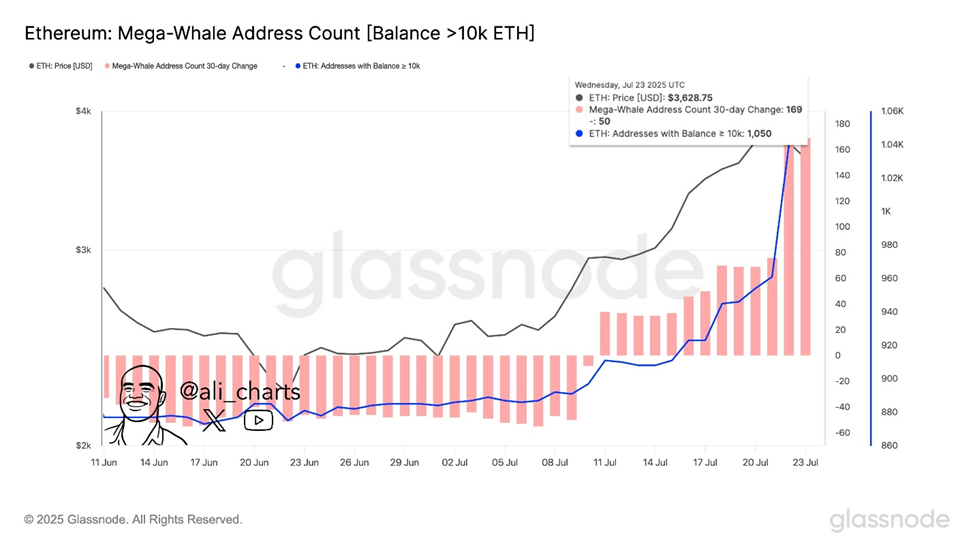

- Whale addresses holding over 10,000 ETH increased by 50 in the last 30 days, reaching about 1,050 addresses total

- Ethereum ETFs recorded over $1.8 billion in sustained inflows, indicating strong institutional demand

- ETH is approaching a potential breakout from a 4-year triangle pattern with key resistance at $3,920-$4,000

- Technical indicators including MACD and RSI are turning bullish as price trades above the 100-hourly moving average

Ethereum price has mounted a fresh recovery above the $3,800 level after testing support near $3,507 earlier this week. The second-largest cryptocurrency is now eyeing a potential move toward the psychologically important $4,000 resistance zone.

The recent price action shows ETH trading above both the $3,820 level and its 100-hourly Simple Moving Average. A key bullish trend line has formed with support established at the $3,800 zone on hourly charts.

Technical analysis reveals that Ethereum has been consolidating above the 23.6% Fibonacci retracement level of its recent upward move. The price tested the $3,900 zone with a high formed at $3,904 before pulling back slightly.

Whale Activity Points to Continued Accumulation

Data from Glassnode shows whale addresses holding over 10,000 ETH have increased dramatically since mid-July. The number of mega whale addresses rose by 50 in the past 30 days to approximately 1,050 addresses.

This accumulation by the top 1% of ETH holders suggests smart money remains confident in Ethereum’s prospects. The whale activity has helped support price levels during recent consolidation periods.

Large holder behavior often serves as a leading indicator for price direction. The continued accumulation despite sideways price movement indicates these sophisticated investors expect higher prices ahead.

Institutional Demand Remains Strong

Ethereum ETFs have recorded sustained inflows totaling over $1.8 billion in recent weeks. This institutional interest has persisted even during periods of sideways price action.

The consistent ETF inflows demonstrate that institutional investors maintain conviction about ETH’s upside potential. These flows have helped provide a floor for the cryptocurrency during recent pullbacks.

Institutions typically take longer-term positions compared to retail traders. Their continued investment suggests expectations for price appreciation over coming months.

Technical Breakout Pattern Developing

Long-term chart analysis shows Ethereum has been trading within a multi-year wedge or triangle pattern. This formation features ascending support and descending resistance lines that are converging.

The pattern suggests a potential breakout is approaching as the price action becomes increasingly compressed. A successful break above resistance could target new all-time highs.

Current price action is testing the upper boundary of this formation near the $3,900-$4,000 zone. Supply and demand dynamics in coming sessions will determine whether a breakout occurs.

Technical indicators are showing bullish signals with the MACD gaining momentum in positive territory. The RSI has moved above the 50 level, indicating upward momentum is building.

If Ethereum price clears the $3,920 resistance level, the next target sits at $3,950. A move above that zone could open the path toward the key $4,000 resistance area.

An upside break above $4,000 might call for further gains toward $4,050 or even $4,200 in the near term. Some analysts speculate ETH could eventually reach $5,000 if broader market conditions remain supportive.

However, failure to clear the $3,920 resistance could trigger a downside correction. Initial support on any pullback sits near $3,820, with major support at the $3,800 zone.

A clear move below $3,800 support might push the price toward $3,750 or potentially $3,700 in the near term. The next key support level is located at $3,640.

The correlation between Ethereum and Bitcoin remains strong, with ETH likely to extend gains if BTC continues higher. One analyst noted that ETH price could push above $4,000 if Bitcoin rallies back above $120,000.

Ethereum price is currently trading above $3,820 with the 100-hourly moving average providing dynamic support for the uptrend.