Ethereum has always been a pioneer for multiple aspects of the crypto space ranging from DeFi to NFTs, as well as high gas fees and innovations to solve its scalability concerns. As the chain’s scope grew, so did its limitation for scalability.

The following article explores how layer-2 solutions are evolving in the current bear market.

Optimism Brings Its Cavalry

Also known as L2 solutions, these are basically chains built to reduce the load on the mainnet of a blockchain by processing transactions and other operations off-chain and eventually linking it back to the mainnet for finality.

In particular, to Ethereum, these L2 are used in scaling the DeFi applications by processing their transactions off the Ethereum mainnet while still upholding the security and decentralization standards followed on the mainnet.

However, with time as Ethereum’s use and demand are growing, these L2 need to grow as well. They are doing so based on the most recent developments in two of the topmost L2 solutions.

Optimism, an Optimistic rollup-based L2, recently airdropped its token OP to users, but the response was not as expected. With a TVL of $908 million, Optimism’s OP was expected to launch to widespread hype.

If it wasn’t clear by now, this isn't your average token launch.

The Optimism Collective is so much more: a grand experiment in decentralized governance that will evolve over time. OP and the Token House are just the first step.

OP Drop #1 🪂 is live NOW. But first, a recap:

— Optimism (@Optimism) May 31, 2022

However, due to technical issues during the launch, some users were able to claim their tokens before the official airdrop began.

This resulted in users dumping their OP tokens, and consequently, the trading price of the token slipped from $4.5 at launch to $1.38 at the time of writing this report.

This marks an almost 70% decline in price within 72 hours of its launch.

Justifying the bungled launch, Optimism tweeted,

“We significantly underestimated the amount of expected load that this would have on our public RPC endpoint. When website visitors found the claims link, the public RPC started getting slammed.”

They further added that while they were quick to expand the available resources to serve their public RPC, the process took hours of coordination due to the amount of load they observed.

However, the price drop has declined at the moment as OP is not being dumped excessively.

Boba Goes to Fantom and Moonbeam

The second L2 to observe developmental changes was the Boba Network, an L2 with more than $81 million locked on it.

The evolving L2 announced its intentions of becoming a multi-chain by expanding beyond Ethereum.

Integrating with Fantom and Moonbeam, a parachain of Polkadot, Boba Network has accessed other EVM compatible chains for the first time.

This marks a significant milestone for Layer 2 solutions. As Boba expands to other chains, it ensures scalability for DeFi applications on those chains by offering developers access to Hybrid Compute.

This tool can enable Dapps to interact with cloud environments for data unavailable on the chain.

However, this also increases competition for Ethereum as the chains L2 expand to are aimed at higher transaction speeds and lesser gas fees, which stands to be a massive problem for Ethereum currently.

Ethereum and L2s

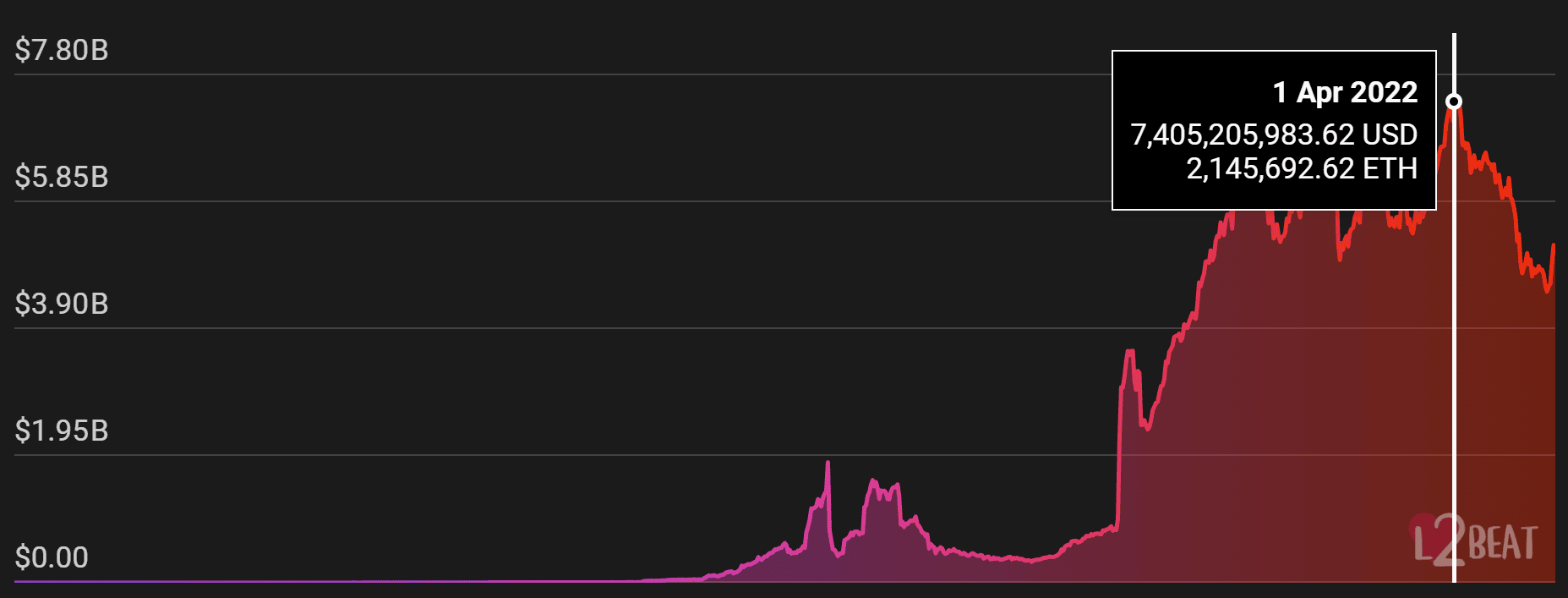

Despite being in existence since 2019, L2 only picked up pace last year in February 2021 and has grown tenfolds since then.

At their peak in April 2022, L2 accounted for more than $7.2 billion worth of investments, but following the crash of May 9, the total value locked on them decreased to $5.04 billion.

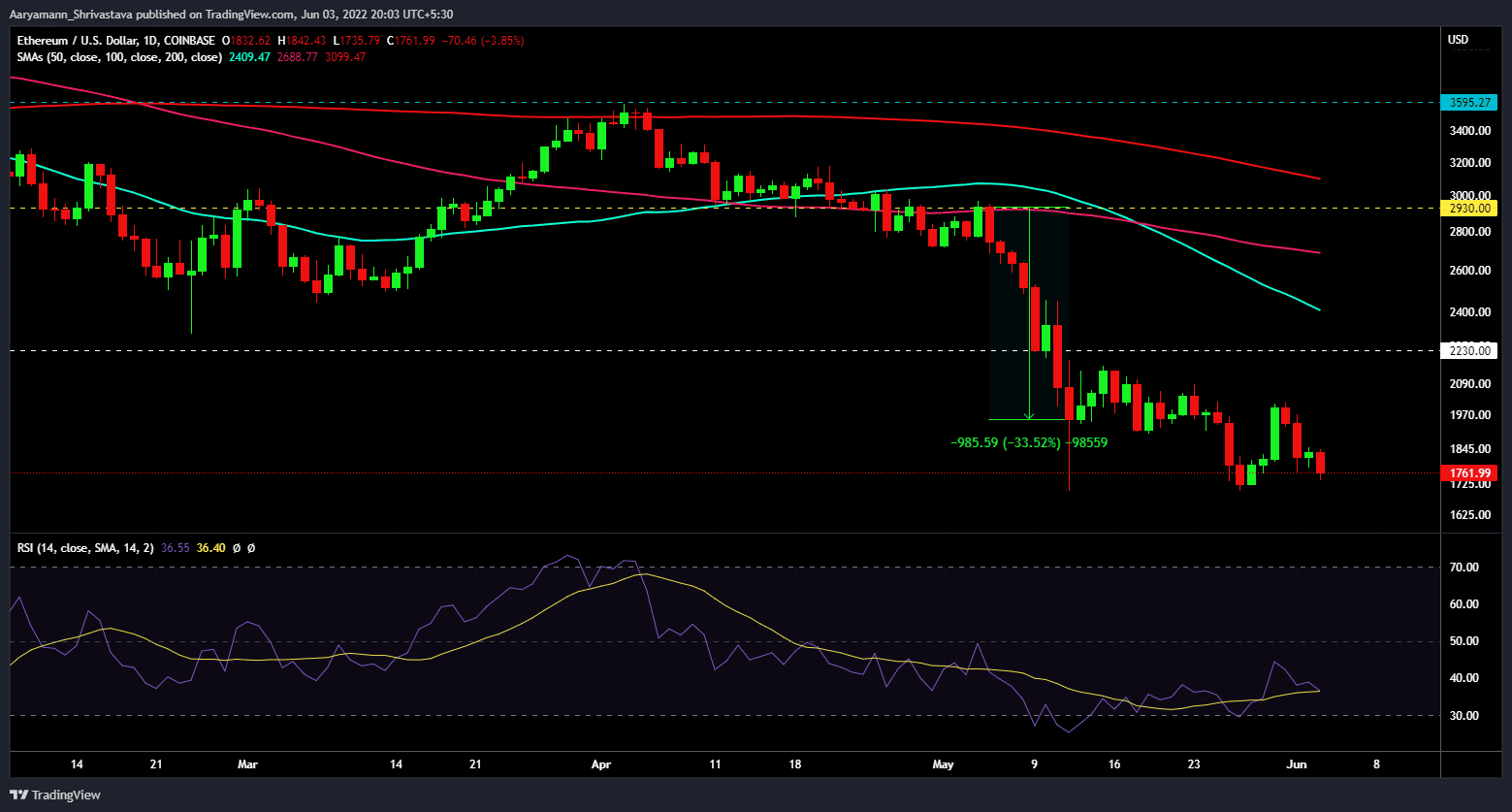

Ethereum also suffered a major setback in its price in the same duration, and the altcoin king plummeted by 33.52% and is currently trading at $1760.

Plus, with the broader market’s bearish pressure persisting, the cryptocurrency is struggling to pull itself out of the bearish zone.

In conclusion, Layer-2 solutions’ recovery is dependent on Ethereum’s recovery into the bullish zone, which would trigger a rise in the TVL, bringing investments back onto the chain.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.