TLDR

- Ethereum price hits $4,000 for the first time in eight months, marking a major milestone.

-

ETH has surged over 50% in the last 30 days, supported by growing Ethereum treasuries.

-

Ethereum’s blockchain activity has surged, leading to increased staking and investor confidence.

-

Ethereum’s market cap dominance continues to rise as it pulls away from Bitcoin.

Ethereum price hit $4,000 on August 8, marking the first time the coin reached this milestone since December 2024. Ethereum’s price increase of 4% over 24 hours was a result of growing investor optimism and a rise in blockchain activity. The price spike happened as Ethereum transactions surged, driven by increased staking and favorable market conditions for crypto assets.

Despite being 18% below its all-time high of $4,878 in 2021, Ethereum has seen a significant rally recently. In the last 30 days, Ethereum has gained more than 50%, with several large institutions accumulating ETH. Ethereum’s performance outpaced Bitcoin’s price, which showed only a small increase during the same period.

Ethereum Treasuries Fuel Price Surge

Ethereum’s recent rise has been partly fueled by the accumulation of ETH by institutional investors. Companies like SharpLink Gaming and BitMine Immersion have added billions of dollars worth of Ethereum to their treasuries.

SharpLink Gaming recently bought $265 million worth of ETH, increasing its holdings to nearly $1.9 billion.

These institutional purchases follow a strategy similar to MicroStrategy’s Bitcoin buying approach, which has seen the company accumulate significant Bitcoin holdings. Ethereum treasuries have grown significantly over the past few months, further boosting Ethereum’s price as investor confidence increases.

Rising Blockchain Activity Drives Ethereum’s Price

Ethereum’s blockchain has seen an uptick in activity, with more users engaging in staking and other decentralized finance (DeFi) applications.

The growth in staking is a sign that investors are increasingly confident in Ethereum’s future potential, with the network’s upgrades and regulatory environment contributing to the positive sentiment.

According to a Myriad Linea Markets table, 76% of participants believe Ethereum transactions will exceed 12 million for the week ending August 10. This growing activity supports Ethereum’s price momentum and reflects the increasing usage of the network.

Ethereum’s Market Dominance Over Bitcoin

As Ethereum’s price climbs, its market dominance has been steadily increasing. Bitcoin’s dominance has recently fallen below 60.7%, while Ethereum continues to take a larger share of the total crypto market cap. Analysts are noting a shift in investor preference, with many choosing Ethereum over Bitcoin as their preferred asset.

Rekt Capital, a popular trader and analyst, pointed out that Ethereum’s dominance is well into its macro uptrend, which could further erode Bitcoin’s market cap share.

Ethereum’s increasing market cap dominance suggests that the altcoin season is in full swing, with Ethereum leading the way. This trend reflects broader market shifts as Ethereum continues to gain traction with both institutional and retail investors.

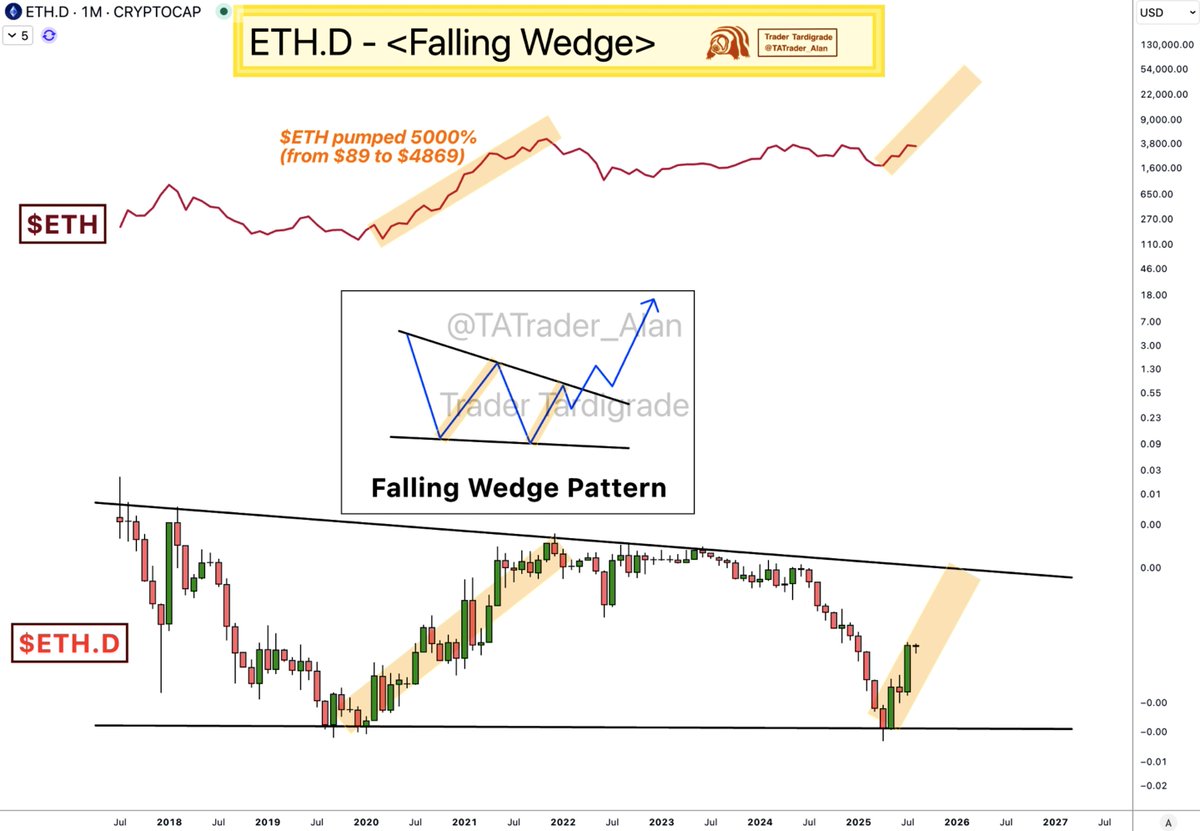

Moreover, according to Trader Tardigrade, Ethereum’s dominance (ETH.D/monthly) has been showing a positive uptrend. Currently, ETH dominance is forming a falling wedge pattern, which typically signals a breakout to the upside. This pattern has led to significant price increases in the past, with the most recent run resulting in a 5000% surge.