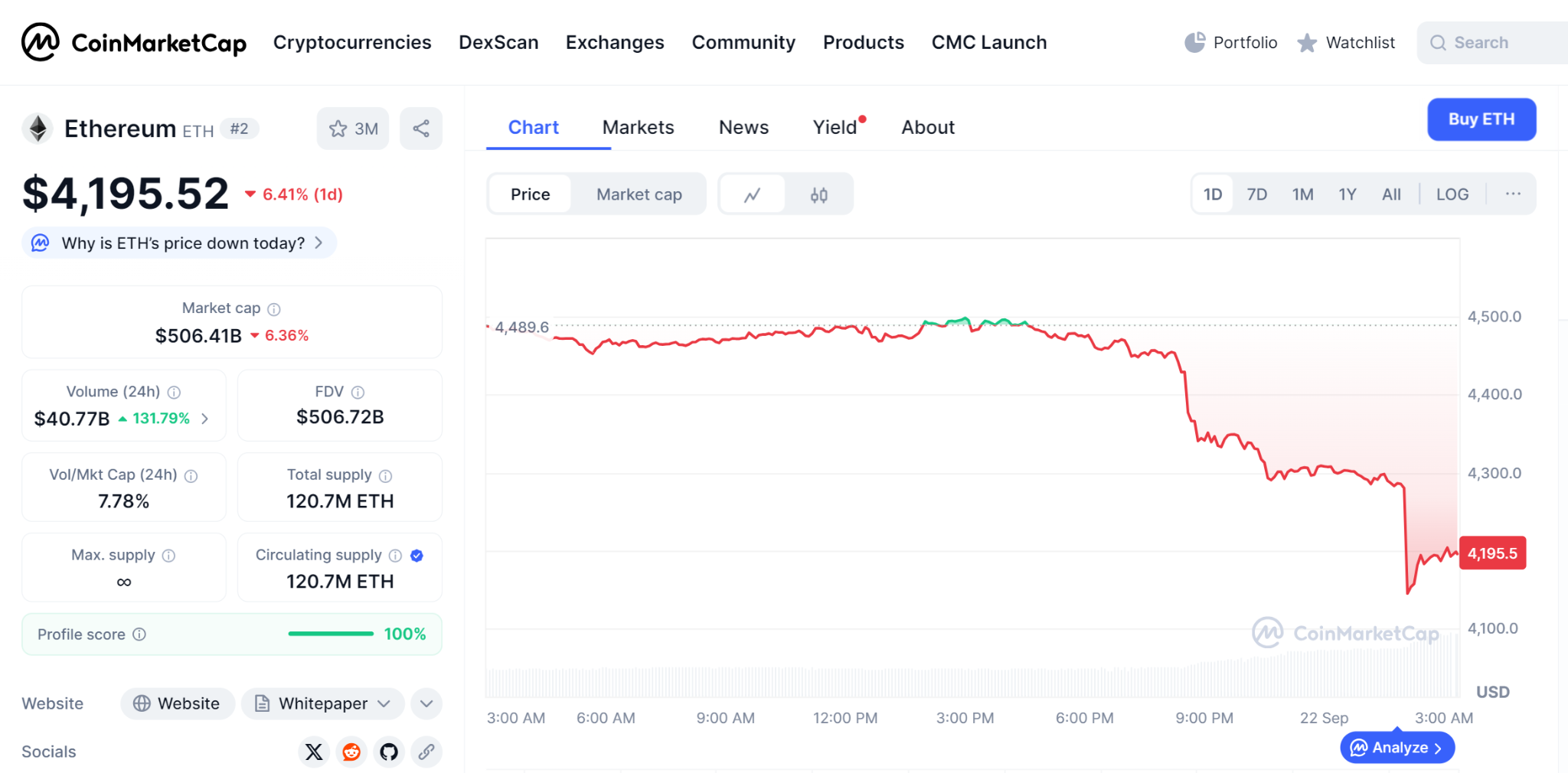

The cryptocurrency market is abuzz with a new wave of institutional interest, and all eyes are on the Ethereum price movements. Analysis shows that a surge in Ethereum ETF inflows has reached a staggering $556 million, a clear signal of growing confidence from major players. Experts forecast this momentum to propel the ETH price by 20%, potentially pushing it past the $5,000 mark.

But this isn’t just a positive sign for Ethereum holders; it’s a critical vote of confidence in the underlying technology and, by extension, the entire decentralized finance (DeFi) ecosystem. The bullish sentiment surrounding ETH is now drawing attention to projects with real-world utility and a clear vision for the future of finance.

One that’s particularly eye-catching is PayDax Protocol (PDP), a project that’s depowering centralized banks and empowering the people with a novel model for lending, borrowing, and insuring loans.

Eventual Ethereum Price Rebound and Why It Matters

The anticipated rebound of the Ethereum price to $5,000 is not just a price milestone but also signifies a maturing market. Ethereum’s status as a secure, decentralized settlement layer makes it the foundation upon which DeFi protocols are built.

This heightened trust encourages a greater flow of capital and users into the DeFi space, unlocking new levels of liquidity and innovation. For Ethereum, this represents a potential 20% rise for ETH as inflows jump by $556M. But more interestingly, new DeFi tokens like PDP are attracting short-term projections greater than 1,000% amid institutional interest.

PayDax Protocol (PDP) is a novel project that’s tackling one of modern finance’s biggest challenges: lending. Unsurprisingly, its unique solutions have left investors flocking to the PDP presale, and for tangible reasons.

PayDax Protocol (PDP): 2025’s Most Promising DeFi Project

PayDax Protocol’s vision is to dismantle the old, credit-score-based system and replace it with one that recognizes a person’s true financial value. It’s a decentralized alternative to traditional banks, built on the principle of giving people access to liquidity using their own wealth as collateral, not on an institution’s arbitrary judgment. For instance, a collector with a high-value piece of art or a rare watch can now have it authenticated by Sotheby’s, tokenized on the blockchain as a Real-World Asset (RWA), and used as collateral for an instant stablecoin loan.

This revolutionary approach transforms static, illiquid wealth into dynamic, working capital. And this system is built for the mutual benefit of every participant. A lender can provide liquidity directly to a borrower and earn a significant return on their stablecoins, receiving as much as 15.2% APY. For example, a peer with $100,000 in idle stablecoins can lend it out and, instead of a traditional bank’s meager return, earn over $15,000 in a year.

Furthermore, PayDax is redefining insurance with its Redemption Pool, which allows users to act as decentralized underwriters for loans. By contributing to this pool, these P2P insurers earn a premium, with some receiving up to 20% APY for securing the network (a role once reserved for large, centralized corporations).

Credibility Backed By Infrastructure

Paydax Protocol (PDP) is backed by a robust technical and physical infrastructure that ensures security, compliance, and trust for all users. The platform’s smart contracts are already audited by Assure DeFi to guarantee integrity. Furthermore, PayDax relies on the following network of institutional-grade service providers to bridge the gap between traditional and decentralized finance.

- Sotheby’s & Christie’s: Used for the professional authentication of high-value collectibles like luxury watches and art before they are tokenized on the platform.

- Brinks: Provides secure, physical custody for valuable Real-World Assets like gold and precious metals that are collateralized on-chain.

- Jumio: Handles professional KYC and identity checks to ensure a compliant and secure borrowing environment, preventing fraud and theft.

Leadership That Builds Confidence

The leadership at PayDax Protocol has made transparency a cornerstone of its operations. Especially notable is the full team doxx, and they have emphasized their mission through regular AMAs, podcasts, and video updates. The Chief Executive Officer stated, “We’re not chasing hype, but building a financial system that puts users first.” The Chief Marketing Officer further noted, “Transparency defines us. From doxxed leadership to live community updates, users know who we are and what we’re building.”

PayDax Protocol (PDP) Presale: PDAX Price Projections Attract Investors

The excitement surrounding PayDax Protocol (PDP) isn’t limited to its innovative technology; it’s also driven by the immense opportunity for early investors. The current presale is a chance to acquire the PDP token at its lowest price of $0.015, an entry point that is attracting a wave of new investors. Analysts are increasingly bullish on its trajectory, with many drawing parallels to the early stages of market-defining tokens.

This is the kind of ground-floor opportunity that has historically rewarded early backers of disruptive DeFi projects, such as BNB ICO investors who just saw the token break past $1,000, surging over 10,000x.

Experts agree that acquiring PDP tokens at this presale stage presents the biggest opportunity for growth with one of 2025’s best crypto projects, especially with an 80% bonus when buying with the PD80BONUS code. But the window will gradually close as the next stages come with significant price increases.

Join the PayDax Protocol (PDP) presale and community:

Join PayDax Protocol (PDP) presale | Website | Whitepaper | X (Twitter) | Telegram

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.