TLDR

- Ethereum price bounced 22% from $1,750 low to reclaim $2,100 level after a 43% nine-day crash

- ETH futures premium sits at 3% on Monday, below the 5% neutral threshold, showing continued bearish sentiment

- Open interest dropped to $24.1 billion, the lowest level in nine months, potentially signaling a contrarian buy opportunity

- Tom Lee-backed Bitmine Immersion Technologies acquired another 40,000 ETH for $83.4 million on Monday

- ETH inflation reached 0.8% annually as network activity slowed and the base layer struggled to maintain deflationary status

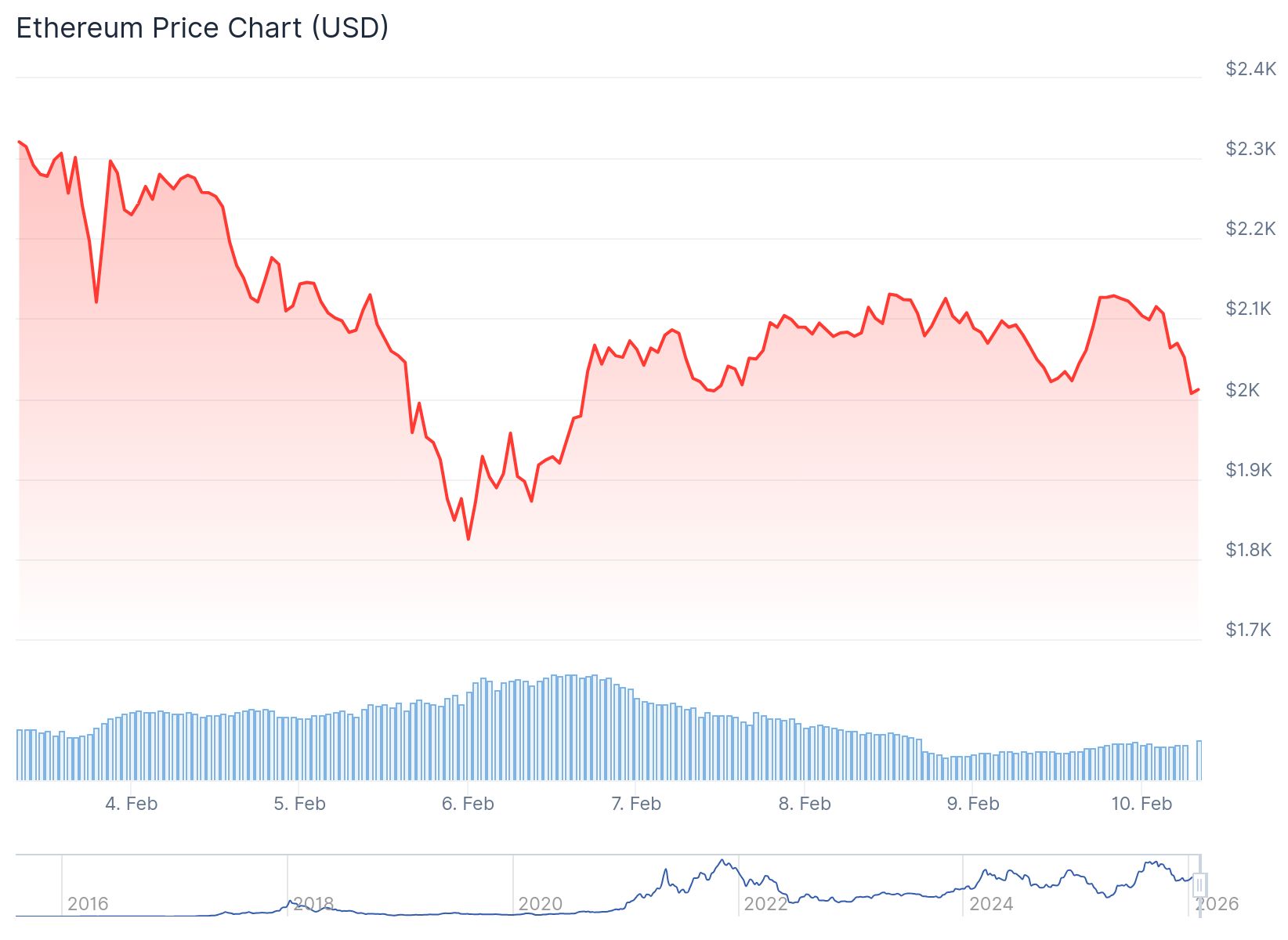

Ethereum price recovered to the $2,100 level on Monday following a sharp decline that saw the cryptocurrency drop 43% over nine days. The altcoin hit a low of $1,750 on Friday before staging a 22% relief bounce.

The recovery comes as Bitcoin and US stock markets also rallied. However, ETH derivatives markets continue to show bearish sentiment among traders.

ETH monthly futures traded at a 3% premium relative to spot markets on Monday. This sits below the 5% threshold that typically indicates neutral market conditions.

The lack of optimism has persisted throughout the past month. Traders showed no signs of increased confidence even as the price approached $1,800.

Open interest in Ethereum futures currently stands at $24.1 billion according to CoinGlass data. This marks the lowest level since May 2025.

The last time open interest reached similar depths, Ethereum was trading around $1,400. Three months later in August 2025, the price had climbed to $4,000.

Institutional Buying Continues

Bitmine Immersion Technologies reportedly purchased another 40,000 ETH on Monday for approximately $83.4 million. The acquisition follows an earlier disclosure that the company had already added 40,000 ETH over the previous week.

It seems that Tom Lee(@fundstrat)'s #Bitmine bought another 20,000 $ETH($42.3M) from BitGo 7 hours ago.

Today alone, it has bought 40,000 $ETH($83.4M).https://t.co/cY4jpzYpQu pic.twitter.com/YNTMDgdo3h

— Lookonchain (@lookonchain) February 10, 2026

Executive chairman Tom Lee maintains a bullish outlook for Ethereum in 2026. He expects the cryptocurrency to stage a V-shaped recovery similar to previous major drawdowns.

“ETH sees V-shaped recoveries from major lows,” Lee said in a statement Monday. “This happened in each of the 8 prior declines of 50% or more.”

Network Activity and Supply Concerns

Ethereum has underperformed the broader cryptocurrency market by 9% in 2026. The network still maintains dominance in total value locked metrics.

Deposits on the Ethereum base layer account for 58% of the entire blockchain industry. When including layer-2 solutions like Base, Arbitrum and Optimism, that figure exceeds 65%.

The Ethereum base layer generated $19 million in fees over the past 30 days. Layer-2 networks contributed an additional $14.6 million.

ETH supply growth has become a concern for investors. The annualized growth of total ETH issued reached 0.8% over the last 30 days.

This represents a shift from one year ago when inflation was near 0%. The change stems from reduced network activity affecting the built-in burn mechanism.

Vitalik Buterin commented Tuesday that Ethereum should prioritize base layer scalability. The co-founder noted that the layer-2 path to decentralization proved more difficult than expected.

Current layer-2 solutions rely on multisig-controlled bridges. These do not meet the security standards required by Ethereum’s original vision according to Buterin.

The Fear and Greed Index hit a record low of 5, indicating extreme panic conditions. Trading volumes for ETH remain high at nearly 9% of the token’s circulating market cap despite retreating 36% in the past 24 hours.

On Monday night, Ethereum held above the $2,000 mark with a 1.8% decline over 24 hours.