TLDR

- Ethereum’s daily transactions hit a record 1.74 million in August, surpassing 2021 bull run levels

- Corporate ETH holdings jumped 127.7% in July to over 2.7 million ETH through ETF inflows

- ETH price currently trades around $3,621, with analysts targeting $4,000 next and $10,000 long-term

- Whale accumulation exceeded $1.2 billion since ETF approval rumors gained momentum

- August typically shows bearish performance for ETH, but 2025 is breaking historical patterns

Ethereum price action continues gaining momentum in 2025 with record-breaking transaction volumes and institutional inflows reshaping market dynamics. The Ethereum network processed 1.74 million daily transactions on August 5th, marking a new all-time high that surpasses even the 2021 bull market peaks.

This surge in Ethereum network activity comes as ETH price trades at $3,621, down slightly from recent highs but maintaining strength within its current trading range. The current Ethereum price represents a 22% discount from ETH’s all-time high, positioning the cryptocurrency for potential upward movement.

Corporate adoption of Ethereum has accelerated rapidly through July. ETF-related inflows drove corporate Ethereum holdings up 127.7% to over 2.7 million ETH tokens. This institutional Ethereum accumulation now represents nearly half of all ETF-held Ethereum across 24 new firms that added ETH exposure during the month.

July recorded the highest monthly transaction count in Ethereum’s history at 46.67 million transactions. Active Ethereum addresses reached 683,520, reflecting increased DeFi activity and institutional on-chain deployment.

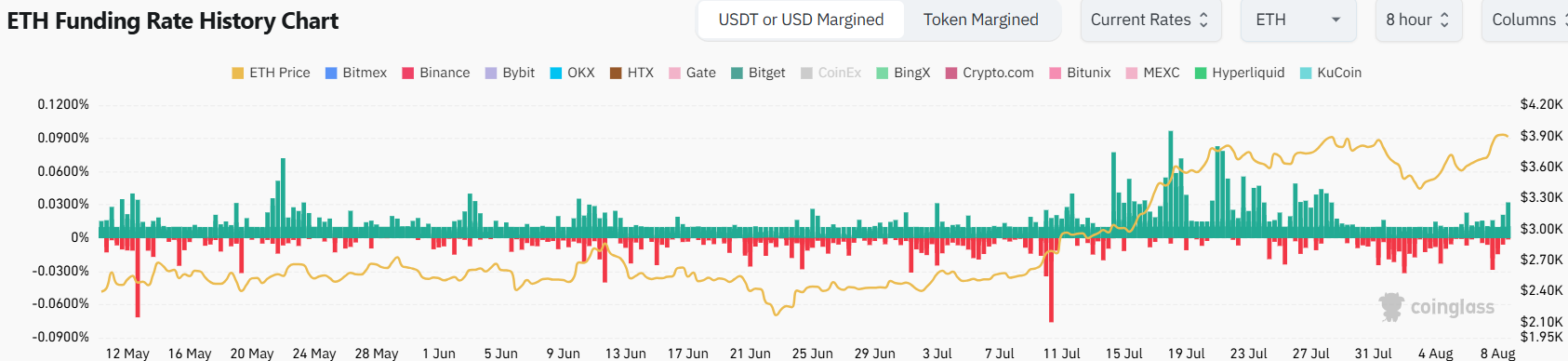

The Ethereum network’s technical indicators show mixed signals with trading volume down 9% over 24 hours. However, ETH funding rates remain positive, indicating continued bullish sentiment among Ethereum traders. Open interest has declined slightly as leverage positions were cleared during recent ETH price movements.

Large Ethereum wallets have maintained aggressive buying patterns. Whale activity intensified alongside institutional purchasing, with major holders adding over $1.2 billion in ETH since ETF approval rumors gained market traction.

Ethereum Price Technical Analysis and Market Patterns

Ethereum typically faces headwinds during August, with 60% of the past decade closing negative for the month. However, 2025 ETH price performance has consistently broken these seasonal patterns.

$ETH trading within top range.

Would like to see momentum into the highs again.

With enough momentum we can send Ethereum to $4,000. 🤝 pic.twitter.com/lGSXHbgIYG

— Ted (@TedPillows) August 6, 2025

July Ethereum performance flipped from its usual bearish trend to deliver a 48% rally. This marked the strongest July ETH performance in years and validated what analysts call a structural shift rather than temporary momentum.

The institutional positioning reinforces this Ethereum trend break. Corporate treasury accumulation in July reached record levels, powering the 50% ETH rally that established Ethereum as a top large-cap performer.

Current Ethereum technical analysis points to $3,817 as the next key resistance level. A break above this ETH price threshold could shift market sentiment and drive momentum toward the $4,000 psychological barrier.

The recent 10% Ethereum pullback triggered a $10 billion open interest flush with over $1 billion in realized profits. This cleared leveraged ETH positions and removed weak holders from the market.

ETH has recovered nearly 8% this week, reclaiming over 80% of the previous week’s decline. The ETH price bounce came after tagging the $3,941 local high, establishing a clear range for near-term trading.

Ethereum Price Prediction and Future Outlook

Analysts now view the path to $10,000 Ethereum as inevitable rather than speculative. The combination of ETF inflows, whale accumulation, and record transaction volumes creates multiple catalysts for sustained upward ETH price pressure.

The ETH funding rate remains positive despite recent consolidation, indicating traders maintain bullish positioning. Daily Ethereum trading patterns suggest accumulation continues at current price levels.

Ethereum network utilization metrics support the bullish technical setup. The record transaction volumes demonstrate real utility driving ETH price action rather than speculative momentum alone.

On-chain activity and Ethereum price performance are synchronizing as institutional adoption accelerates. The combination of record throughput and corporate holdings surge indicates fundamental strength underlying current ETH price levels.

Ethereum’s transaction processing capacity continues expanding alongside price growth. The network handled July’s record monthly activity while maintaining stability and processing efficiency.

ETH price momentum appears positioned for continuation based on multiple technical and fundamental factors. The convergence of record usage, institutional buying, and technical breakout patterns creates a favorable setup for higher Ethereum prices.

Network growth metrics align with Ethereum price projections as adoption expands across corporate and retail segments. The sustained transaction volume increases suggest genuine utility driving long-term ETH value appreciation.