Will Ethereum experience a supercycle? Well, recent on-chain data indicates that BitMine, the world’s largest ETH digital asset treasury, acquired 104,336 ETH, valued at approximately $417 million, on October 16. This strategic move occurred as Ethereum’s price experienced a 20% decline from its August peak, suggesting a “buy the dip” strategy.

This substantial purchase has increased BitMine’s treasury to over 2.5% of Ethereum’s total supply, reinforcing confidence in ETH’s long-term price outlook. Despite market crashes, major entities continue to accumulate Ethereum, signaling a robust belief in its future value and ecosystem growth.

But for those seeking opportunities with more explosive gain potential, early-stage presales offer a compelling alternative. DeepSnitch AI, currently in its presale, presents a real chance for 100x gains because it mixes AI with utility tools for traders and investors.

Ethereum corporate adoption surged in Q3 2025

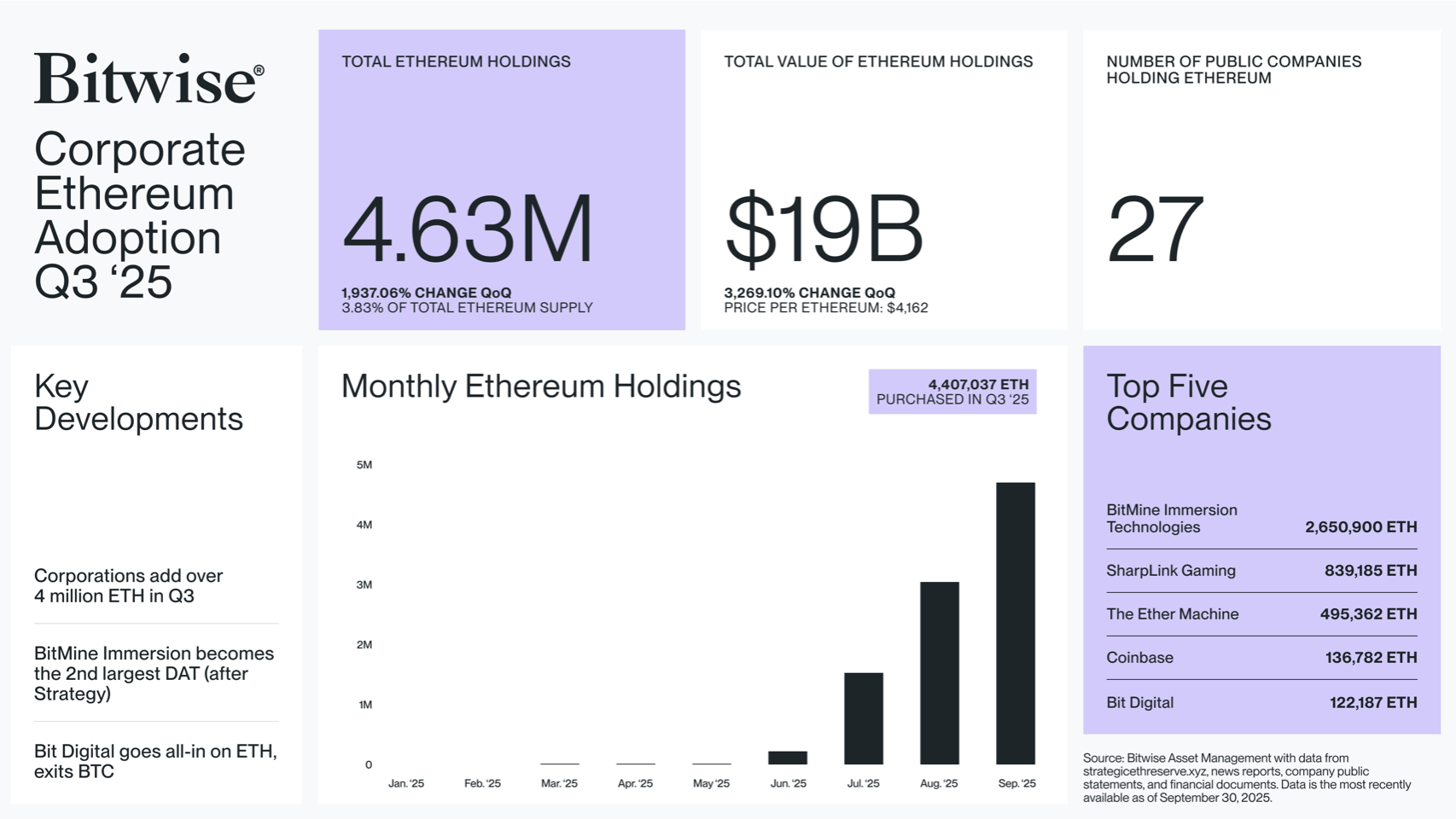

Recent data highlights a significant surge in corporate adoption of Ethereum, with nearly all ETH accumulated by public companies occurring within Q3. This concentrated buying activity saw public treasuries add over 4 million ETH tokens in Q3 alone, signaling strong institutional interest.

For example, Bitwise Invest reported that 95% of all ETH held by public companies was purchased between July and September, totaling $19.13 billion, or roughly 4% of Ethereum’s total supply. Despite a market-wide sell-off that pushed ETH below the $4,000 level, this corporate accumulation suggests a positive sentiment for Ethereum’s future.

Crypto executives seem optimistic, with some predicting that ETH could increase significantly by the end of 2025. Factors contributing to this positive Ethereum price prediction include continued corporate ETH purchases, increasing ETF accumulation, and a substantial amount of ETH locked in staking contracts, with good ETH staking rewards.

This is an important factor because with this reduced circulating supply, coupled with strong institutional demand and retail FOMO, it sets the stage for a potential price increase in ETH, and perhaps, a supercycle is about to happen.

Analysis: Ethereum looks good, but DeepSnitch AI looks better

DeepSnitch AI: The best AI trading tool of this decade?

In a market where milliseconds can decide millions, DeepSnitch AI is growing out of its place as the first true intelligence layer for traders. It’s not another hype coin. It’s a whole ecosystem that was built to decode the blockchain faster than any human could.

DeepSnitch architecture runs on five AI-agents that operate in sync, scan wallet movements, liquidity migrations, and new token contracts across multiple chains. Also, it helps identify what insiders do before the news breaks. It’s automated, constant, and precise, like having a team of analysts working around the clock for you.

The presale started at $0.01510 and is already up 26%. Right now, DeepSnitch AI is a stage-2 presale sitting at just $0.01915 after raising $420K+ in days, and early buyers will get access to each feature as it rolls out. The price will continue to rise with each new stage, so buying now is taking advantage of the chance to still buy cheaply.

With real-world applications and low market capitalizations, this could be your opportunity to bet on the next 100x crypto!

Ethereum price prediction: Will it rise by the end of 2025?

Ethereum on October 16 fell 2.5% with the token near $3,890.00. ETH is struggling to break above the 20-day EMA at $4,227, showing strong resistance from sellers. If ETH rebounds from the support line and climbs past the EMA, it may continue the descending channel.

A breakout above the channel’s resistance would signal the end of the correction.

This could lead to a retest of the $4,957 all-time high and a potential move toward $5,665.

One of the attractive ways to push the price back up is the opportunity for ETH staking rewards. Currently, average ETH staking rewards range from approximately 2.92% to 6.5% APR, depending on the platform and validator setup. These rewards provide an incentive for traders to hold tokens and to secure the network.

For those considering an ETH long-term price outlook, the combination of network upgrades, corporate interest, and attractive ETH staking rewards paints a positive picture. However, due to its large market capitalization, achieving 100x gains from current levels is almost impossible.

Bitcoin price prediction: Is BTC recovering?

Bitcoin price dictates the direction of the entire crypto market, and the bears are currently in charge.

Bitcoin faced rejection at the 20-day EMA ($115,945) on October 14th, indicating that sellers continue to dominate and are selling into rallies. Bears will aim to push the price down to the crucial $107,000 support level. A close below this level could confirm a double-top pattern, potentially driving BTC down to $100,000 and even $89,526, in a bearish scenario.

However, this bearish scenario could be negated if BTC manages to climb back above the moving averages. In that case, the price may stabilize and move sideways between $107,000 and $126,199 for some time. This would suggest indecision and a possible pause before the next major move.

For investors, Bitcoin offers a relatively secure, albeit less explosive, investment compared to early-stage projects. Its market capitalization makes it unlikely to deliver 100x returns, positioning it as a protection asset rather than a high-growth opportunity.

Conclusion: DeepSnitch AI is the best choice for 100x gains

Ethereum price prediction looks good, but for investors actively seeking the next 100x coin, DeepSnitch AI presents the most promising option. Its presale status provides an early entry point into a project with real utility, leveraging artificial intelligence to deliver market insights.

DeepSnitch AI offers a unique opportunity to capitalize on the intersection of AI and blockchain, promising significant returns for early adopters. It is positioned to deliver the kind of transformative growth that established cryptocurrencies can no longer provide.

Visit the official website for more information.

FAQs

What are ETH staking rewards?

ETH staking rewards are incentives earned by participants who lock up their Ethereum to help secure the network and validate transactions.

How do Ethereum Network Upgrades impact its price?

Ethereum Network Upgrades, such as the transition to Proof-of-Stake and subsequent enhancements, are designed to improve scalability, security, and efficiency. Successful upgrades can positively impact the ETH long-term price outlook.

Why is DeepSnitch AI considered a better opportunity than Ethereum?

DeepSnitch AI is an early-stage presale project with a significantly smaller market capitalization compared to Ethereum. This allows for a much higher percentage growth to reach 100x returns.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.