Ethereum is dropping once more towards the price of $3,000 as the cryptocurrency market becomes a bit cooler, but there is a chance of a recovery. While many traders focus on technicalities, the growing demand for Remittix, a PayFi project bridging blockchain technology and traditional finance, adds an interesting twist to current sentiment. Remittix has already raised over $28.1 million through the sale of 686 million tokens at $0.1166, attracting strong attention from crypto investors looking for utility beyond speculation.

A solid Ethereum price base here could support both ETH and the broader altcoin sector, as institutional adoption and product-driven narratives like Remittix’s real-world payments continue to drive optimism across crypto trends and DeFi ecosystems.

Ethereum Price: Important Support and Indications to Monitor

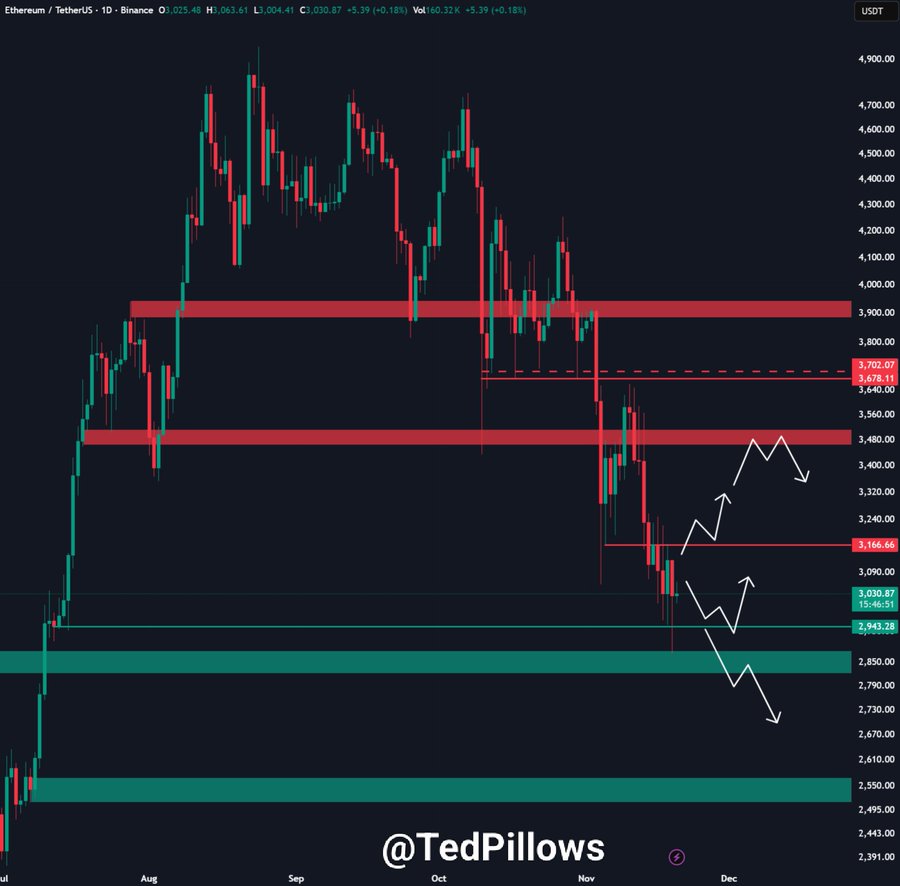

Source: Ted Pillows on X

On the daily chart, the Ethereum price is not coping with the critical resistance of $3000 of support. The token is trading far below the 100-day and 200-day moving averages, which is a confirmation that sellers are still ruling the structure. RSI is at approximately 32 – near the oversold range – as a chance of a short-term bounce.

Analyst Ted Pillows noted on X that ETH dipped below $2,900 before quickly rebounding, warning that a failure to reclaim the $3,200 level could invite deeper losses toward $2,600 or even $2,100. However, a strong reclaim above $3,200 with volume could mark the start of a reversal.

Interest rates in crypto exchanges have become cooler, too, declining by more than 30 billion to 18 billion, and it shows that leveraged traders are de-risking. Traditionally, such a reset usually occurs just before escalation in market volatility and new purchasing energy. Should Ethereum stabilize at this point, the next target by the bulls would be $3,500 and even higher by $3,800.

Remittix: The PayFi Star Powering Real-World Crypto Adoption

While Ethereum holds its breath, Remittix is exploding in visibility. The project is ranked #1 on CertiK Skynet with a top Skynet Score of 80.09 (Grade A) and more than 24,000 community ratings, a major vote of confidence in its security, transparency, and decentralized finance (DeFi) innovation.

The Remittix Wallet Beta has been expanding, bringing in more community testers for real transactions, while the Web App is preparing for its crypto-to-fiat payments Beta that will plug directly into the wallet. These integrations aim to make sending and receiving money as simple as a bank transfer but faster, cheaper, and borderless.

Key highlights driving investor excitement

- Ecosystem expansion includes wallet, web app, fiat rails, and API integrations for developers and payment providers.

- Team fully verified by CertiK for transparency and accountability

- Supports 30+ fiat currencies and 40+ cryptocurrencies at launch

- Web app beta aims at direct crypto-to-bank payouts in one workflow

- $250,000 community giveaway campaign is active until the next milestone

This combination of utility, incentive, and verified trust has made Remittix a leading PayFi contender, the kind of innovation that reinforces confidence in the wider crypto market and can even boost Ethereum Layer 2 activity through cross-chain adoption.

Why Ethereum and Remittix Could Rebound Together

If the Ethereum price rebounds from the $3,000 zone, it could lift the entire digital assets space, especially projects like Remittix that offer real-world payment solutions. The synergy between DeFi infrastructure (Ethereum) and PayFi products (Remittix) shows how the next crypto bull run may be driven by usable tech, not hype.

For now, traders are watching $3,000 as Ethereum’s make-or-break level. A clean recovery could reset momentum, while Remittix continues climbing on fundamentals. Both are two sides of the same coin, one of them driving smart contracts and Web3 infrastructure, and the other one making that technology global financial rails.

Frequently Asked Questions

- What is the best cryptocurrency to buy right now?

No single best choice can be offered to all investors. Significant depth and the network effects make Ethereum be looked at; Remittix has real-life payments and high growth. Investigations should always be made into the tokenomics, roadmap, on-chain activity, and listings. - Is Ethereum a good long-term investment?

Many consider ETH a fundamental digital asset due to the fact that it runs decentralised applications (dApps) and Ethereum Layer 2 scaling. Long-term value is impacted by usage, charges, and upgrades, as well as ecosystem expansion. Monitor the Ethereum price in significant support and trendlines. - Is now a good time to buy Ethereum?

When you will depend on the profile of your risk. The price of Ethereum is near $3,000, and it is one of the key levels. A more powerful indication of momentum would be to get back to $3,200. Considering scaling in, stop losses, and monitoring crypto news and volume can be considered. - How do I avoid scams when looking at new crypto projects?

Check third-party audit, KYC status, security reports, and exchange listing. Read the whitepaper and browse through the team and cross-examine the community sources. Never promise returns that have to be guaranteed, and never risk a lot of money before you put in a lot of money. - How risky are new crypto tokens?

They can be very dangerous because they don’t have much liquidity, they change quickly, and there is a risk of execution. To lower your risk, spread your investments out, use cold storage, and keep an eye on crypto trends that have real value and clear goals.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://glem.io/competitions/nz84L-250000-remittix-giveaway