- Kraken vs Bitstamp: Key Information

- Kraken & Bitstamp – Features and Set Up

- The Court of Public Opinion

- Customer Support

- Company History and Regulatory Compliance

- Safe and Secure

- Fees

- Kraken vs Bitstamp: Final Thoughts

Exchange Comparison: Kraken vs Bitstamp

Kraken and Bitstamp are both trusted cryptocurrency exchanges that have operated since 2011 and serve a substantial base of crypto investors distributed throughout the world.

Picking the right exchange you depends primarily on your experience in crypto investing and the type of cryptocurrencies you’d like to invest in.

In this Kraken vs Bitstamp exchange comparison, we’ll go over the advantages and disadvantages of trading on each.

Kraken vs Bitstamp: Key Information

|

||

| Reviews | Bitstamp Review | |

| Site Type | Cryptocurrency Exchange | Cryptocurrency Exchange |

| Beginner Friendly | ||

| Mobile App | ||

| Buy/Deposit Methods | Bank Transfer, Cryptocurrency | Bank Transfer, Credit Card, Cryptocurrency |

| Sell/Withdrawal Methods | Bank Transfer, Cryptocurrency | Bank Transfer, Credit Card, Cryptocurrency |

| Available Cryptocurrencies | Bitcoin, Ethereum, Litecoin, and 14+ more | Bitcoin, Ethereum, Litecoin, Ripple |

| Company Launch | 2011 | 2011 |

| Location | San Francisco, CA, USA | Luxembourg |

| Community Trust | Good | Good |

| Security | Good | Good |

| Customer Support | Good | Good |

| Verification Required | Yes | Yes |

| Fees | Low | Medium to High |

| Site | Visit Kraken |

Kraken & Bitstamp – Features and Set Up

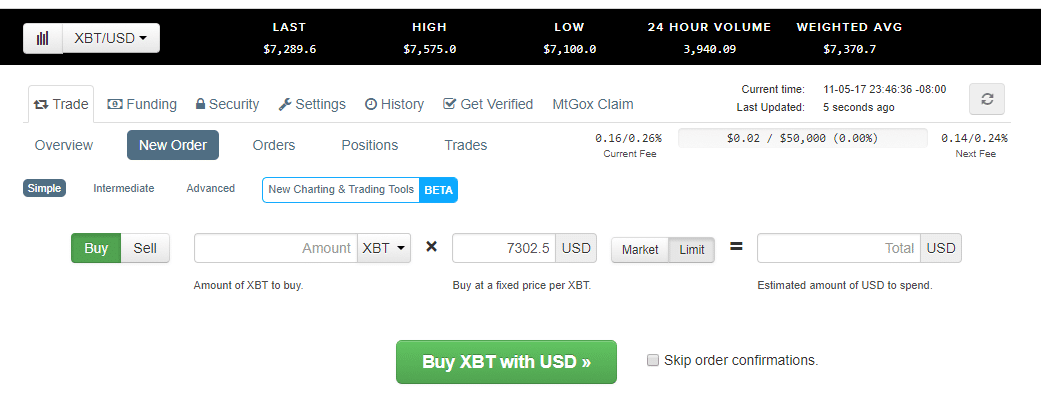

The most important thing to know about Kraken is that it offers more features and options than pretty much any exchange around. When you go to place your first order, it might not seem like that’s the case with “Simple” trading enabled:

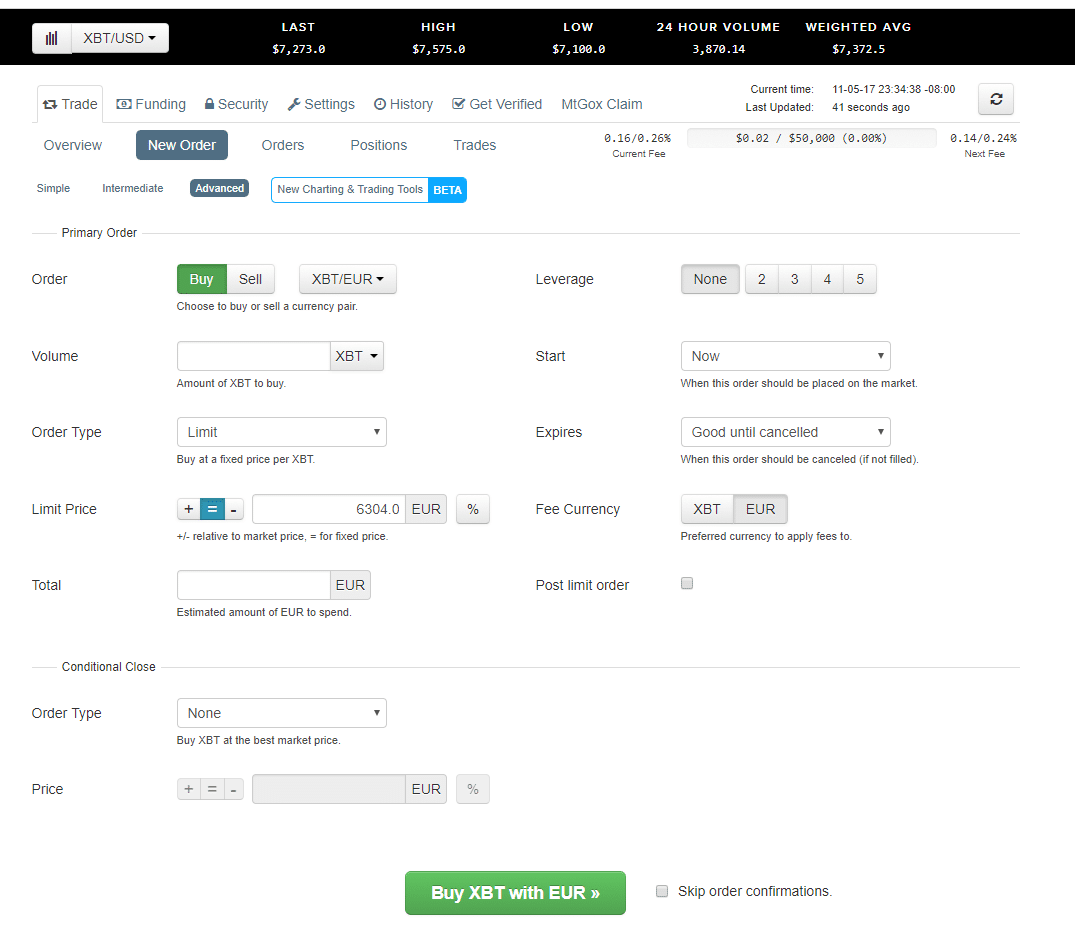

Just input the cryptocurrency, the price, and select market or limit order. Simple, right? But switch over to Advanced trading and you start to see what Kraken is really capable of:

Order start and expiration times, leverage up to 5x, conditional closes – you name it and Kraken can trade it for you. Be careful what you wish for; even experienced traders can get burnt trying to get cute with complex trades and high leverage. For novice investors, one highly-leveraged trade can wipe out their crypto holdings in minutes.

One major issue to watch for with Kraken is the website lags frequently. You might place a limit order but nothing will show up in your Orders page for several minutes. If you go to place a 2nd order, you risk having both come into effect at the same time and end up buying or selling twice the amount you meant to! This sounds like a minor issue, but the first time it costs you a significant amount of money you will start taking laggy orders seriously.

Verification at Kraken is pretty simple compared to other cryptocurrency exchanges. You can trade in cryptocurrencies by providing your name, date of birth, country, and phone number. Deposit/withdrawal of $2,000 per day or $10,000 per month is available after adding a verified address. You only need to provide a government ID if you are a serious investor looking to upgrade to limits of $25,000 per day and $200,000 per month.

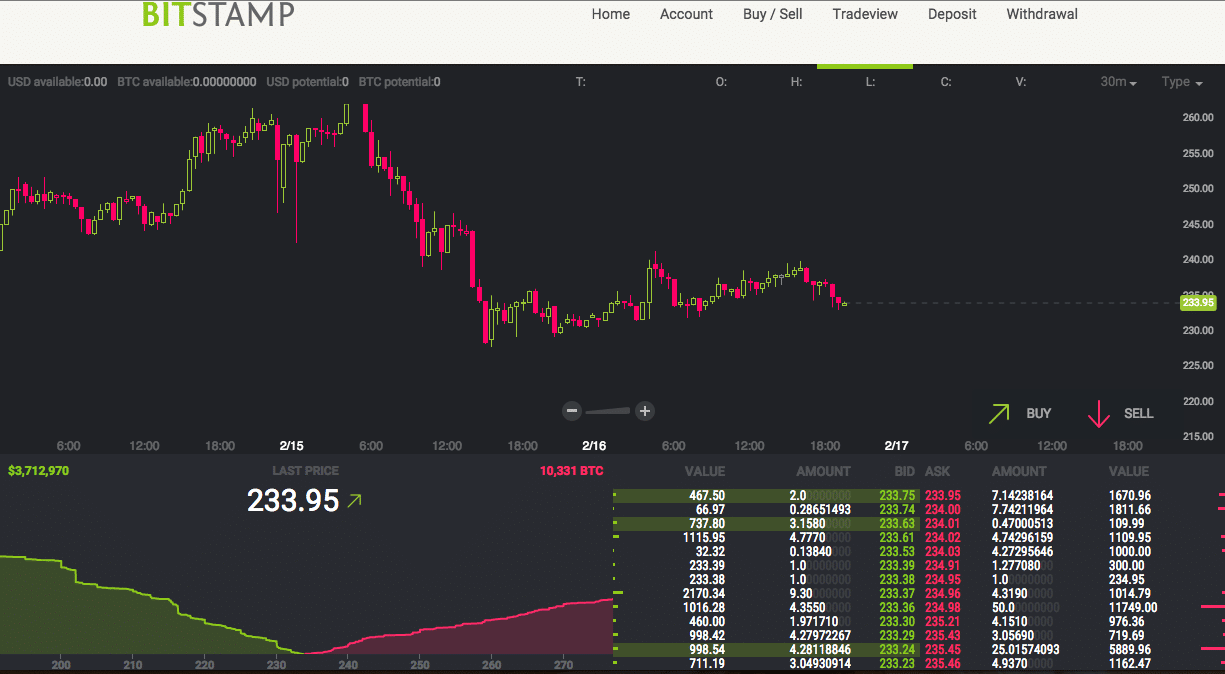

Bitstamp’s user interface doesn’t appear very user-friendly at first, but it can be easier to navigate than Kraken simply because it doesn’t have so many exotic trading options. It features some technical trading tools, so it’s not strictly a beginner’s crypto exchange.

Compared to Kraken, the verification at Bitstamp is a pain. They will ask you for a front and back picture of your government ID (passport or driver’s license) and a bank/utility statement to trade. This can be an annoyance when you just want to make your first small trade, and for a lot of investors providing all these ID documents goes against the cryptocurrency ethos to begin with. That said Bitstamp is a well-known exchange, so you’re not handing off your personal info to some fly-by-night organization.

The Court of Public Opinion

Kraken’s reputation is not the best among crypto exchanges. The most common complaint is about Kraken’s trading engine which frequently lags, causing traders to miss trades and duplicate orders. The criticism is so common that many users have started to believe that the exchange’s behavior is deliberate on the part of the Kraken team, used as a way to front-run trades.

Bitstamp has a much better rep among cryptocurrency enthusiasts, ever since it became the first nationally-licensed crypto exchange in the world. The exchange also gained a great deal of credibility for the customer-first approach it took to a major wallet hack, ensuring that no customers lost any of their deposited funds.

Customer Support

Kraken’s customer service has endured a lot of criticism from the crypto community, largely in part due to the issues mentioned above. They take quite some time to reply to users, though posting to social media does tend to draw the attention of support staff.

Bitstamp has a reasonably good record for customer support and often answers customer complaints directly on social media channels like Reddit. Many user complaints have been for account closures after unusually large deposits, which could be argued is Bitstamp being a little overzealous when it comes to combating fraud – hardly the worst thing you can be accused of!

Company History and Regulatory Compliance

Kraken was founded by Jesse Powell in 2011 and counts as an investor SBI Holdings, a leading Japanese financial conglomerate. It’s based in San Francisco and claims to abide by all relevant regulations, though their website is light on details of that compliance. Kraken also claims to undergo yearly audits, at least one of which was completed by Stefan Thomas, CTO at Ripple Labs.

Bitstamp was also founded in 2011 and is backed by Pantera Capital, a major cryptocurrency investment fund. Bitstamp is audited each year by a “Big Four” accounting firm, though it’s not clear exactly which one that is.

Safe and Secure

Kraken exchange wallets have never been hacked, which is impressive considering the exchange has been operating for more than 6 years. But there have been trading issues that caused large customer losses. In a high-profile incident in May, a massive sell order for ETH coincided with a DDoS attack on the Kraken servers. The end result was that hundreds of traders with leveraged long positions had their positions closed with huge losses, while simultaneously these users could not access Kraken to repurchase ETH as it crashed from $90 to $26 in a matter of minutes. Kraken honored all trades and refused to roll back any losses caused by the events, claiming they were not responsible for losses caused by legitimate sell orders and that the timing of the DDoS attack was a coincidence.

Bitstamp has suffered one major hack in its history: 19,000 BTC were stolen in January 2015, a loss of more than $5 million at the time. That may have been enough to finish off many exchanges, but Bitstamp was already an established exchange and chose to guarantee all customer accounts and pay for the losses out of company profits. That showed character on the part of management and Bitstamp continues to carry a strong reputation today.

Fees

Kraken’s fees are some of the lowest in the industry. There are no deposit fees for cryptocurrencies transactions, and fiat deposit are either free (EUR SEPA, CAD wire, JPY domestic deposit) or cheap ($5 for USD wire). Withdrawal fees are also low; $5 for USD bank withdrawals, .09 Euros for SEPA withdrawals in the EU, 300 yen to Japan, or $10 Canadian dollars. Unfortunately, there are cryptocurrency withdrawal fees as well, which can be even higher. 0.001 BTC or 0.005 ETH doesn’t sound like much, but those currently equate to $7.30 and $1.50.

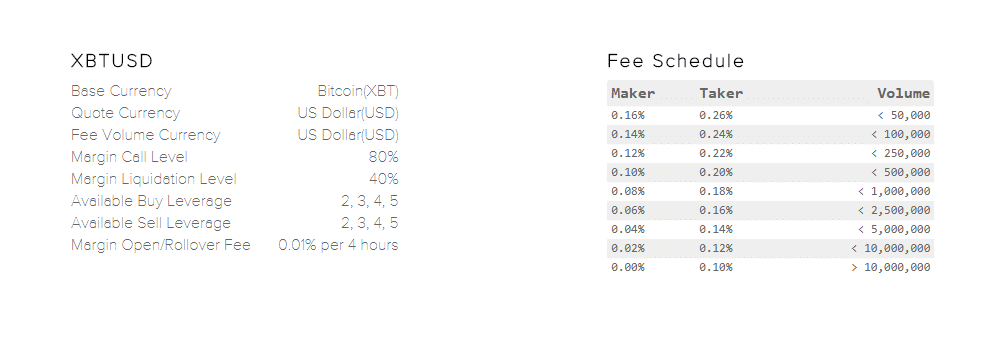

For trading fees, Kraken offers significant discounts if you’re on the “maker” side of the transaction, which rewards traders who fill out the order book and increase the exchange’s liquidity.

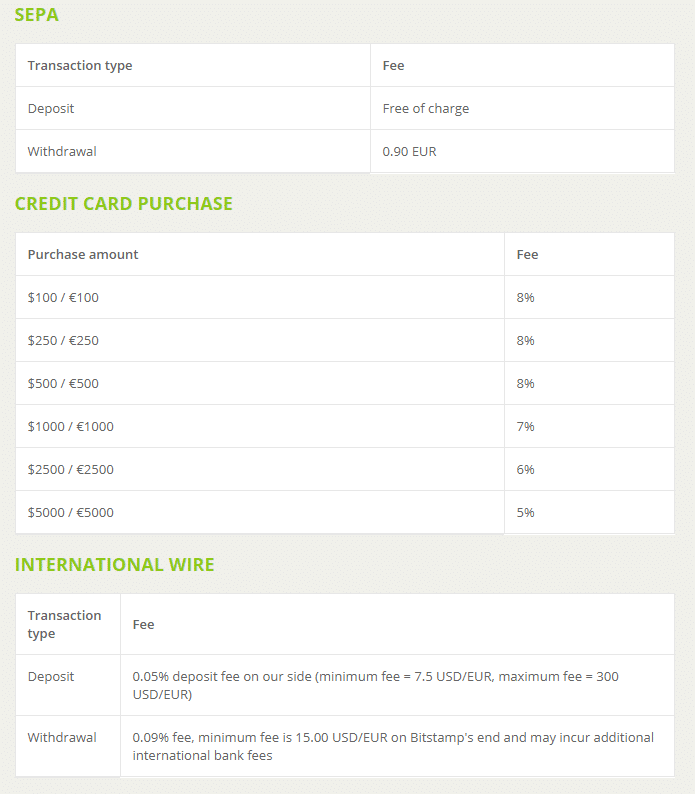

Bitstamp fees are also pretty cheap if you’re an EU resident. SEPA deposits are again free, and you only pay a 0.90 euro on withdrawals. Wire transfers will cost you 0.05% on deposit and another 0.09% upon withdrawal. There is no fee for cryptocurrency deposits or withdrawals. The only fees you will want to stay clear of are for credit card deposits, which range between 5% and 8% of your total deposit.

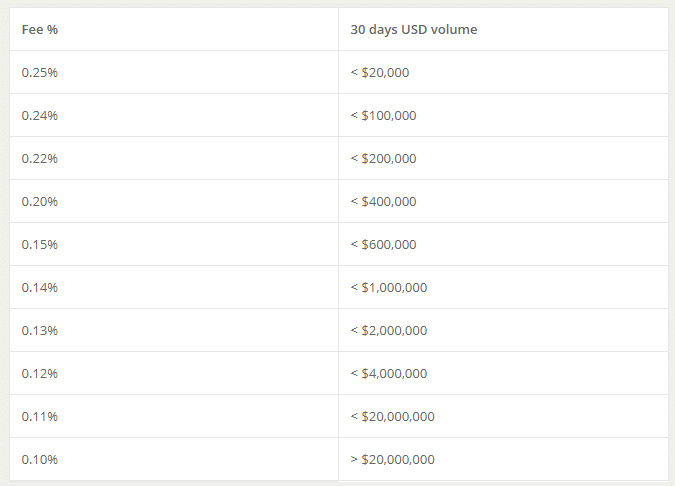

Trading fees at Bitstamp are higher than at Kraken, and the biggest issue is that there’s no discount for “makers”. This means less liquidity at Bitstamp (all else being equal) so you end up paying a hidden cost in that the bid/ask spreads are wider than at Kraken.

Available Cryptocurrencies

Kraken definitely shines in this category; the full list of cryptocurrencies offered includes Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Dash, EOS, Ethereum Classic, Iconomi, Augur, Stellar Lumens, Monero, Ripple, Zcash, Gnosis, Dogecoin, Melonport, and Tether. It also stands out by offering BTC and ETH trading pairs among a variety of fiat currencies including the US Dollar, British Pound, Canadian Dollar, Euro, and Japanese Yen.

Bitstamp offers a more limited range of cryptocurrencies with trading pairs for major cryptocurrencies BTC, ETH, LTC, and XRP. All but BTC were added in 2017, so it does seem like the exchange is moving to add more altcoins. Bitstamp also announced it was facilitating withdrawals of Bitcoin Cash, but trading has been delayed for the time being.

Kraken vs Bitstamp: Final Thoughts

Kraken and Bitstamp attract much of the same clientele in crypto trading by virtue of both accepting fiat currencies like USD and EUR. If you are an experienced trader who wants to trade altcoins and use leverage, the choice is clear and you’ll want to use Kraken.

Kraken has yet to resolve ongoing issues with laggy trading and poor customer support though, so if you are a less experienced trader and just want to make the occasional trade in a major cryptocurrency, you’re better off sticking with Bitstamp.

(View Our Full Lists of Recommended Bitcoin Exchanges and Ethereum Exchanges)

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.