TLDR

- Jerome Powell warned of high inflation uncertainty and tempered expectations for further Fed rate cuts in 2025

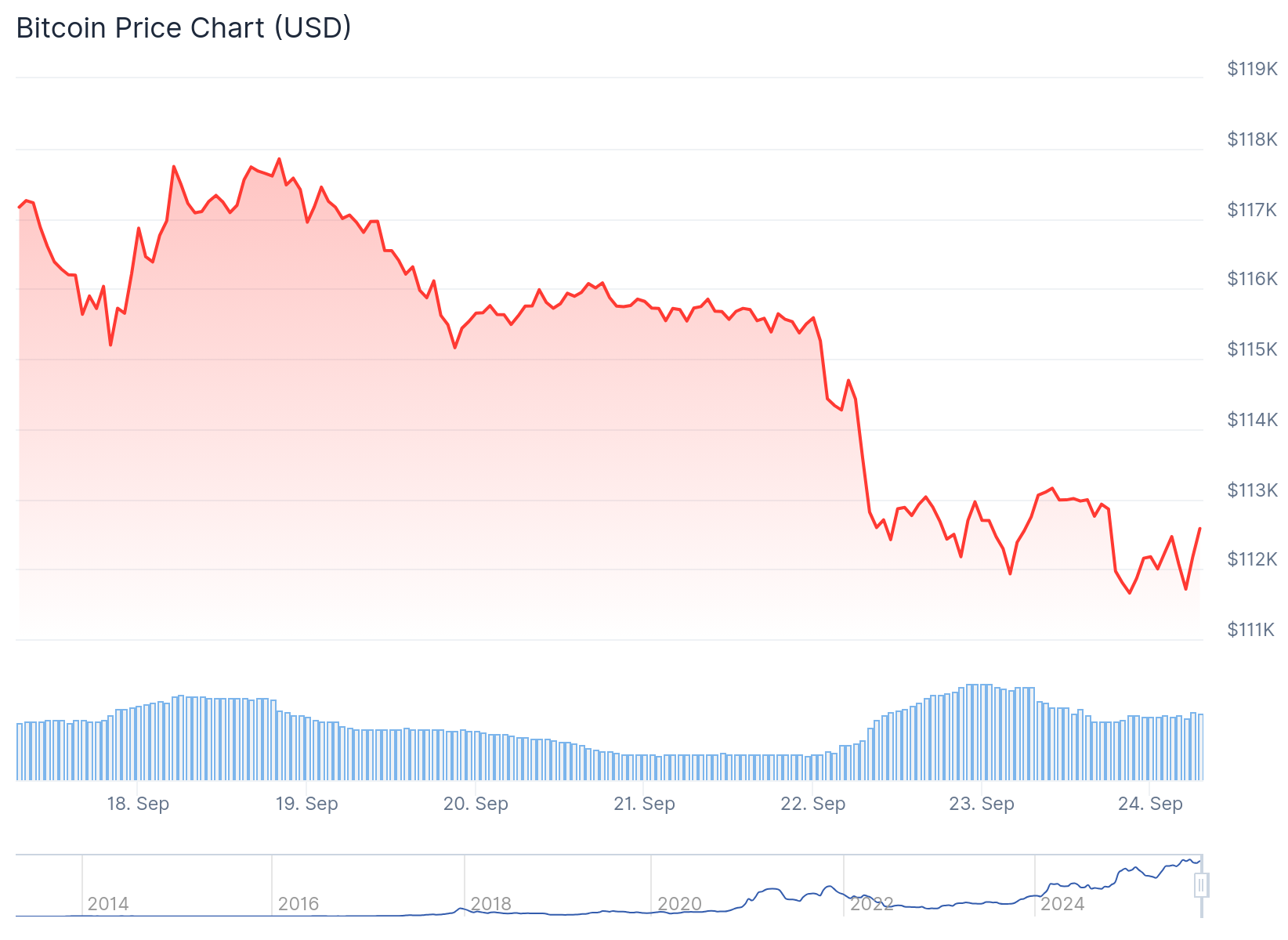

- Bitcoin dropped below $113,000 following Powell’s speech about cautious monetary policy approach

- Fed faces double-sided risks between managing inflation and preventing labor market weakness

- Powell said tariff effects will likely cause one-time price increases spread over several quarters

- Fed officials remain divided on future rate cuts, with some supporting cuts and others opposing them

Federal Reserve Chair Jerome Powell delivered cautious remarks about future interest rate cuts during a speech in Rhode Island this week. His comments led to immediate market reactions, with Bitcoin dropping below $113,000.

Powell spoke at the Greater Providence Chamber of Commerce’s economic outlook luncheon. He emphasized that the Fed does not have a preset course for monetary policy. Instead, officials will determine the appropriate stance based on incoming economic data and evolving conditions.

The Fed chair highlighted the challenging position facing policymakers. He noted that uncertainty around the path of inflation remains high. This creates what he called “double-sided risks” for the central bank.

Current situation:

1. Stocks are rising like the US economy is soaring

2. Oil prices are falling like we are entering a recession

3. Gold is rising like the Fed is cutting rates into inflation

4. Bitcoin is falling like Fed rate cuts are postponed

5. Home prices are rising…

— The Kobeissi Letter (@KobeissiLetter) September 22, 2025

Powell explained the delicate balance the Fed must maintain. If they ease monetary policy too aggressively, they could worsen inflation risks. This might force them to reverse course later to achieve their 2% inflation target.

On the other hand, maintaining restrictive policy too long could unnecessarily weaken the labor market. Powell stated there is no “risk-free path” forward given these competing concerns.

Labor Market Concerns Drive Policy

The Fed chair reiterated that downside risks to employment prompted last week’s rate cut. The Federal Open Market Committee voted to lower interest rates by 25 basis points. This marked the first cut in nine months.

Powell noted that recent data shows the pace of economic growth has moderated. The unemployment rate remains low but has edged higher. Job gains have slowed, creating increased downside risks to employment.

Vice Chair Michelle Bowman echoed these concerns at the Kentucky Bankers Association’s annual convention. She expressed worry about weakening labor market conditions and softer economic growth.

Despite these concerns, Powell emphasized that their current policy stance leaves them well-positioned. The Fed can respond to potential economic developments as they unfold.

Inflation and Tariff Impacts

Powell addressed the ongoing inflation challenges facing the economy. He stated that inflation has risen recently and remains somewhat elevated above the Fed’s target.

The Fed chair also discussed potential tariff impacts on inflation. He suggested that tariff-related effects would likely be a one-time shift in the price level. However, he warned this increase may not come all at once.

Powell predicted that tariff increases will take time to work through supply chains. This one-time price increase will likely spread over quarters and possibly lead to higher inflation during that period.

Federal Reserve officials remain divided on the path forward. Fed Governors Michelle Bowman and Stephen Miran believe the focus should be on the softening labor market. They support making more rate cuts this year.

However, other Fed presidents have expressed different views. Raphael Bostic said he doesn’t support further rate cuts this year. Alberto Musalem indicated he would only support cuts if the labor market continues weakening.

The market reaction was immediate following Powell’s speech. Bitcoin fell from an intraday high of around $113,300 to approximately $112,700. The cryptocurrency faced selling pressure as traders adjusted expectations for future rate cuts.