TLDR

- Figma (FIG) stock has dropped 52-59% since its IPO debut in July, despite initial 250% surge

- Revenue growth is slowing from 46% in Q1 to projected 30% in Q4, concerning growth investors

- Stock trades at expensive 32x sales ratio compared to tech sector average of 9x

- Company already serves 78% of Forbes 2000 companies, limiting future customer acquisition opportunities

- Analysts maintain $69 median price target suggesting 17% upside, but only 4 of 11 analysts rate it a buy

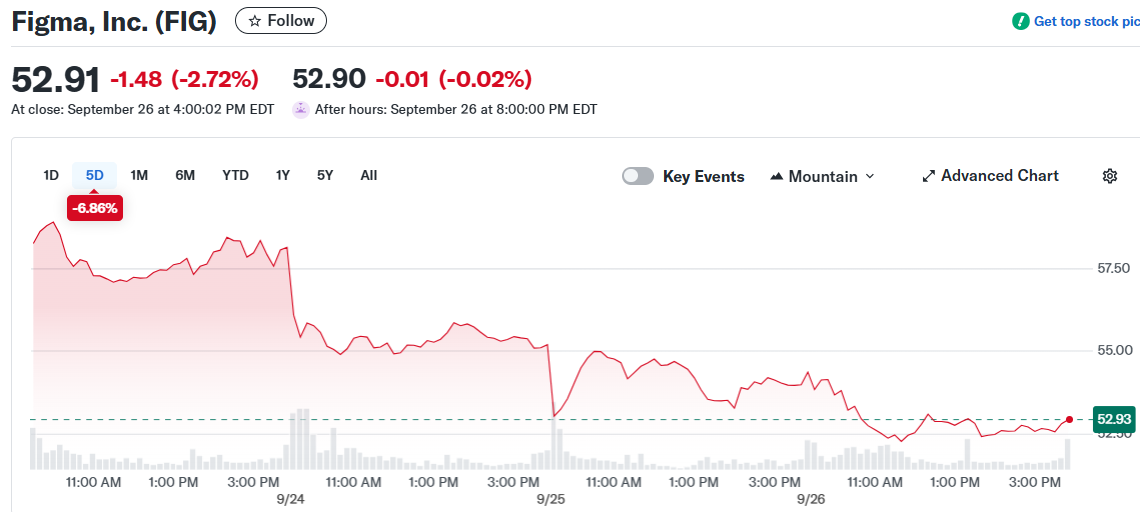

Figma stock has experienced a dramatic reversal of fortune since its market debut less than two months ago. The collaborative design platform’s shares soared 250% on their first trading day July 31, but have since fallen 52% through August and September.

The initial euphoria surrounding the IPO quickly faded as investors got their first look at the company’s financial performance as a public entity. Figma’s second-quarter earnings report in early September failed to meet the high expectations set by its meteoric stock price rise.

The company reported $250 million in second-quarter revenue, representing 41% year-over-year growth. While this growth rate appears strong in isolation, it represents a deceleration from the 46% growth achieved in the first quarter.

Management’s forward guidance has further dampened investor enthusiasm. The company projects 33% revenue growth for the third quarter, with full-year 2025 growth expected at 37%. This trajectory implies fourth-quarter growth of just 30%.

The slowing growth trend has raised questions about Figma’s ability to maintain the rapid expansion that initially attracted growth investors. The company’s stock price had reached valuations exceeding 66 times sales at its peak, a multiple that few companies can sustain without accelerating revenue growth.

Valuation Concerns Mount

Despite the recent selloff, Figma continues to trade at elevated multiples. The stock currently carries a price-to-sales ratio of 32, compared to the broader technology sector average of 9. Its forward earnings multiple stands at 153, well above typical market benchmarks.

This rich valuation becomes more problematic when considering the company’s customer base composition. Figma already serves 78% of the Forbes 2000 largest public companies, indicating limited room for major new customer acquisitions. Two-thirds of existing customers already use three or more Figma products, suggesting upselling opportunities may be constrained.

The company’s net-dollar retention rate for customers generating over $10,000 in annual recurring revenue has declined from 159% in Q1 2023 to 129% in the most recent quarter. New customer additions in the high-value segment grew 31% in Q2, down from 42% in the prior-year period.

Price Increases Drive Revenue Growth

A closer examination reveals that much of Figma’s projected growth stems from price increases rather than organic expansion. The company raised prices by over 20% earlier this year, contributing to revenue growth but raising questions about sustainable expansion strategies.

Analysts covering Figma maintain a median 12-month price target of $69, suggesting potential upside of 17% from current levels. However, only four of eleven analysts covering the stock recommend buying, with the remainder maintaining hold ratings.

The analyst community’s cautious stance reflects concerns about the stock’s valuation relative to its growth trajectory. Some analysts have set price targets as low as $49, representing potential downside of 16% from current levels.

Figma maintains $1.6 billion in cash and marketable securities, providing resources for research and development or potential acquisitions. The company continues to benefit from its position in the collaborative design software market, serving major enterprise customers across industries.

The stock’s recent performance illustrates the challenges facing newly public companies with premium valuations when growth rates begin to moderate, with shares continuing to trade at over 30 times sales despite the substantial price decline since the IPO.