Read our Advertising Guidelines Here

For decades, SWIFT has been the backbone of international payments, yet it remains slow, costly, outdated, and prone to delays. Ripple, on the other hand, promised a blockchain-based alternative, but previous regulatory hurdles and limited real-world adoption have tempered its momentum. Now, a new contender, Paydax (PDP), is stepping into the spotlight with its futurist lending protocol and Real-World Asset (RWA) integration. Paydax is positioning itself not just as an alternative to SWIFT or Ripple, but as a complete reinvention of how collateral, borrowing, and lending should work in the banking industry.

Paydax (PDP): A New Disruptive Force In The Banking Industry

The banking industry is long overdue for newer innovations. SWIFT remains outdated, while Ripple focuses mainly on cross-border payments. Paydax takes a broader approach, set to transform the banking industry with a lending protocol that turns static assets into productive collateral.

Users can borrow stablecoins like USDT and USDC against tokenized RWAs or cryptocurrencies without selling. This gives everyday users access to the instant liquidity once reserved for institutional players. Where Ripple tries to accelerate cross-border settlements and SWIFT relies on decades-old rails, Paydax is positioning itself as a new disruptive force in the modern banking industry. By integrating over 100 cryptocurrencies and employing Chainlink-compliant oracles for tracking price feeds, Paydax’s lending protocol could surpass both Ripple and SWIFT as the real driver of the banking industry.

Inside Paydax’s Lending Protocol: Features You’ll Want To Know

The Paydax lending protocol distinguishes itself by combining real-world usability with DeFi incentives. Unlike Ripple and SWIFT, which deal primarily with payments within the banking industry, this new DeFi lending protocol builds a financial ecosystem that helps users unlock value, borrow efficiently, and earn rewards.

- Tokenized RWA Collateralization – Borrow against art, gold, collectibles, luxury watches, real estate, etc.

- High-Yield P2P Lending Pool – APYs of up to 15.2%.

- Borrowing with High LTV Ratios – Borrow against crypto and RWAs with 50%, 75%, 90%, and 97% LTV.

- PDP Staking: Earn governance tokens and up to a 6% APY by staking PDP tokens.

- Redemption Pool: Lenders are insured against defaults and earn up to 20% APY.

Through these innovative features and framework, Paydax presents its lending protocol as a major contender and bold reinvention of banking that Ripple and SWIFT never pursued.

Partnerships And Security That Strengthen The System Dominated By SWIFT And Ripple

To stand alongside, and potentially even surpass, Ripple and SWIFT within the banking industry, Paydax’s development team and executives have ensured that its lending protocol is backed by trusted partners and fortified with robust security.

Collaborations:

- Sotheby’s: Renowned as one of the world’s oldest and most prestigious brokers of art and luxury assets.

- Brinks: A global leader in secure transport and protection of high-value assets like tokenized RWAs.

- Crypto Astronaut: A blockchain and crypto organization that builds communities and drives growth through engagement.

Security:

- Gnosis Safe multisig wallets

- Bug bounty programs

- Emergency shutdown functions

- Overcollaterization

A Verified Audit And KYC For Lasting Trust

Ripple faced years of regulatory battles, while SWIFT is under scrutiny for compliance issues within the banking industry. Paydax takes a proactive stance, completing a smart contract audit and undergoing a thorough KYC process with Assure DeFi.

| Verification Type | What it means for Paydax users |

| AUDIT |

|

| KYC |

|

First Mover Advantage: Paydax Launches 2025’s Hottest Presale

The PDP presale is heating up, and investors are snapping up tokens at maximum speed. With a growth potential that rivals traditional crypto assets, this presale is poised to become 2025’s hottest and most bullish opportunity. Stage one tokens are capped at just $0.015; however, the PDP price is expected to rise to $0.017 in the next phase.

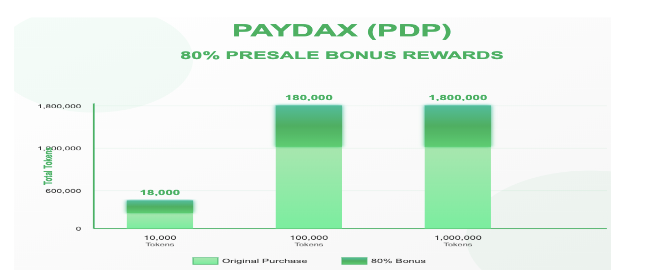

First moves have the advantage of an 80% presale bonus, boosting their holdings with each PDP token purchase. Bonuses can only be activated by using the promo code PD80BONUS. For perspective, imagine an investor buying $1,000 worth of PDP tokens. Normally, that nets 66,666 tokens. With the 80% bonus, the same investor secures almost 120,000 tokens—a huge addition before exchange listings.

To date, the PDP presale has raised more than $1.3 million in just over one week, highlighting investors’ strong demand for a DeFi lending protocol poised to compete against Ripple and SWIFT.

Paydax Breaks Banking Limits Set By Ripple And SWIFT

SWIFT and Ripple may dominate headlines, but both are stuck in the narrow lanes of payments within the banking industry. Paydax steps forward with its lending protocol, providing access to easy borrowing, staking, and lending. The PDP presale progress is a testament to its future growth potential. Investors ready to explore a new force in the banking industry can now dive into the Paydax presale and start accumulating tokens before prices soar.

Join The Future Of DeFi Lending With The Paydax (PDP) Presale:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.