TLDRs;

- HPE stock fell 5% after issuing weaker fiscal 2026 revenue and EPS guidance than analysts expected.

- The company forecasts 5%–10% revenue growth and $2.20–$2.40 EPS, missing Wall Street’s 17% growth outlook.

- HPE plans $3.7 billion in share buybacks and 2,500 job cuts as part of its Juniper Networks integration.

- Long-term growth depends on executing AI and networking strategies while managing cost synergies.

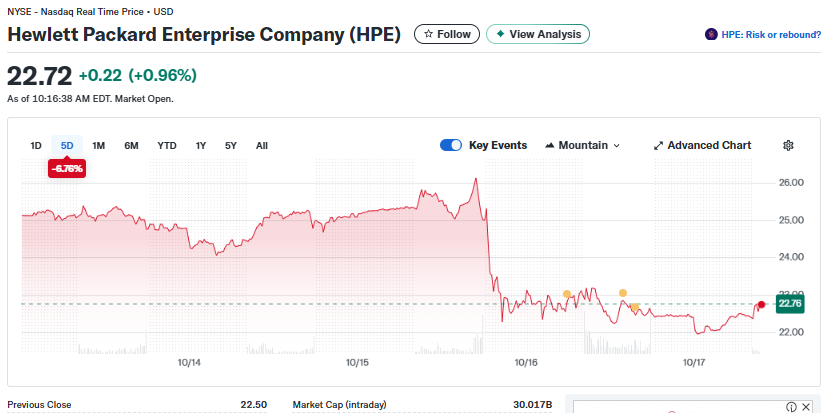

Hewlett Packard Enterprise (NYSE: HPE) shares dropped 5% in after-hours trading on October 15 before stabilizing at weeks end after the company released weaker-than-expected guidance for fiscal 2026.

The decline came despite HPE’s growing focus on networking technology and artificial intelligence (AI), as investors reacted negatively to the subdued financial outlook.

For fiscal 2026, the company projected adjusted earnings per share (EPS) between $2.20 and $2.40, slightly below Wall Street’s forecast of $2.40. HPE also expects revenue growth of 5% to 10%, well under the 17% analysts anticipated. The muted projections raised concerns about HPE’s near-term performance, even as it continues to integrate Juniper Networks and expand its AI portfolio.

Juniper Deal Shapes Future Strategy

HPE’s management emphasized that its outlook reflects a strategic realignment toward networking and AI-driven solutions, particularly following its $14 billion acquisition of Juniper Networks, which officially closed in July 2025.

The company said the integration is expected to yield at least $600 million in cost synergies by fiscal 2028, strengthening its position in enterprise networking and edge computing.

Executives highlighted that the Juniper merger will allow HPE to deliver more unified networking products across campus, data center, and wide-area environments, a key growth driver as organizations modernize their infrastructure. Despite these long-term benefits, investors appear focused on the near-term costs and slower revenue growth accompanying the integration process.

Shares of $HPE are down nearly 10% after Hewlett Packard Enterprise gave an outlook for profit and cash flow for the fiscal year ending Oct. 31, 2026 that fell short of analysts’ estimates.

The server and supercomputer maker said adjusted earnings per share would come in between… pic.twitter.com/wBbB4hhlHD

— Schwab Network (@SchwabNetwork) October 16, 2025

Workforce Reduction and Buyback Boost

Earlier in March, HPE announced plans to cut about 5% of its global workforce, approximately 2,500 jobs, over 12 to 18 months as part of a cost-optimization initiative linked to the Juniper acquisition.

The restructuring aims to deliver $350 million in savings by fiscal 2027 and streamline overlapping operations.

At the same time, the board authorized an additional $3 billion in share repurchases, bringing the total buyback program to $3.7 billion. Analysts noted that while the buyback may provide short-term support to the stock, it underscores management’s effort to reassure investors amid a challenging guidance cycle.

Non-GAAP Metrics Paint a Mixed Picture

HPE’s fiscal 2026 projections exclude several non-GAAP items, including approximately $1.63 per share in amortization of intangible assets, stock-based compensation, and other acquisition-related charges.

On a non-GAAP basis, the company expects operating profit margins to remain stable, but GAAP results could be distorted by the $1.4 billion goodwill impairment recorded in fiscal 2025.

The company’s pro forma forecast, which adjusts for Juniper-related changes, calls for compound annual revenue growth of 5% to 7% between FY25 and FY28. Meanwhile, under GAAP standards, operating profit growth is expected to rise sharply by 435% to 445% in FY26 as HPE recovers from prior-year write-downs.

Investor Sentiment

While HPE’s pivot toward AI and networking could yield long-term rewards, investors remain cautious. The weaker-than-expected guidance highlights the challenges of integrating large acquisitions amid macroeconomic headwinds and increased competition in enterprise IT services.

Market watchers say that success in delivering on Juniper synergies and AI expansion will be crucial for restoring investor confidence. Until then, the company’s financial outlook may continue to act as a drag on short-term performance.