- Hodlnaut Review: Quick Summary

- The Hodlnaut Team

- Hodlnaut Review and Interest Rates: How Does Hodlnaut Compare?

- How Did Hodlnaut Make Money?

- Hodlnaut's Platform Security

- Hodlnaut Review Final Thoughts: How Did Hodlnaut Fail?

Hodlnaut was a Singapore-based cryptocurrency interest account company that offered compound interest of 10% for stablecoin assets and 6% for Bitcoin. On August 8th, 2022, Hodlnaut suspended all withdrawals, token swaps, and deposits– making it one of a chain of mid to large-sized CeFi “crypto interest account” platforms suspending withdrawals and filing for bankruptcy, such as Celsius and Voyager.

The following Hodlnaut review examines its interest account product, security practices, usability, and community trust.

Hodlnaut Review: Quick Summary

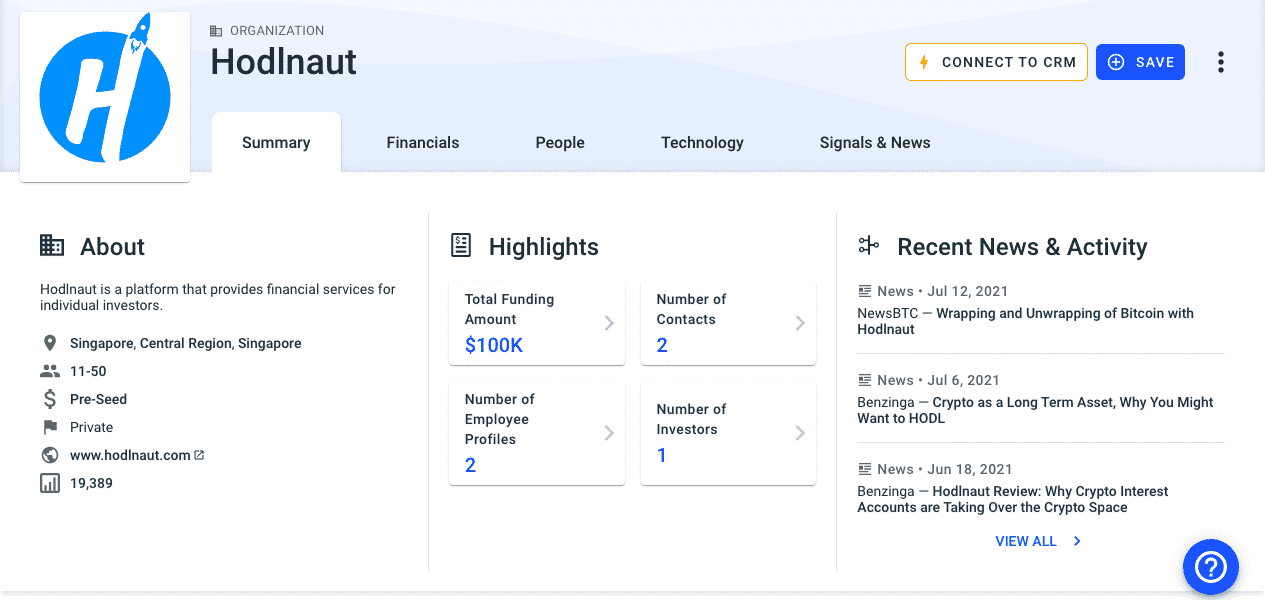

Hodlnaut was a Singapore-based company founded in 2019., available worldwide, excluding locations prohibited by Hodlnaut Policy or Sanction Laws.

Hodlnaut derived its name from the crypto slang HODL (Hold On for Dear Life), which is an enthusiastic expression that refers to keeping your digital assets rather than selling them, regardless of the volatility of the market. Ironically, Hodlnaut ended up HODLing their customers’ assets against their will.

The latter part of the company name is in the motif of “astronaut.” The platform accumulated about $250M in assets under its management from over 5,000 users, according to its site. Hodlnaut raised about $100,000 in funding from one pre-seed funding round with Antler, a Singaporean startup accelerator and venture capitalist firm.

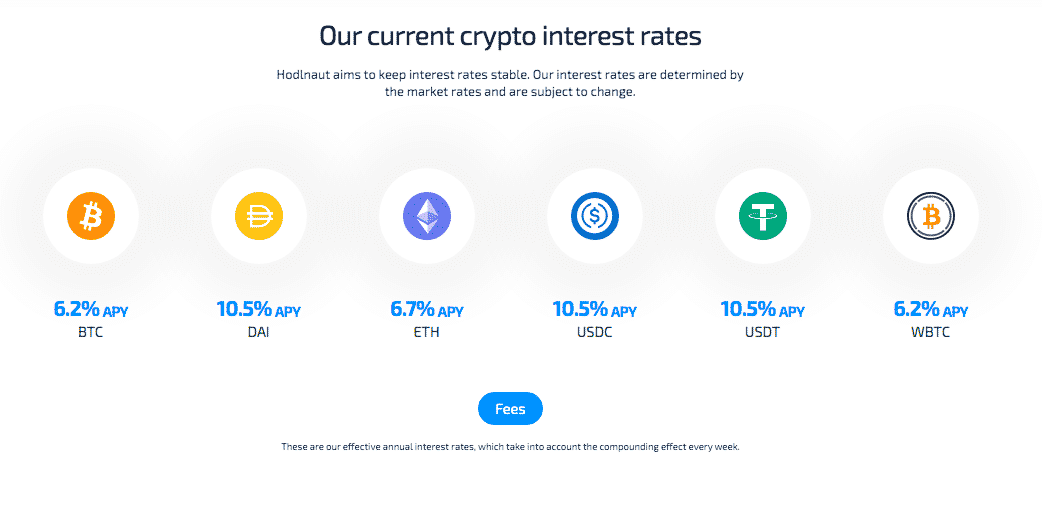

There is no minimum balance to qualify for crypto interest. Hodlnaut offers:

- 6.2% APY on BTC

- 6.7% APY on ETH

- 10.5% APY on stablecoins.

Hodlnaut’s Token Swap let users exchange tokens directly in the app e.g, BTC to ETH

Deposits are free, and users can withdraw anytime– prior to the freezing of all withdrawals.

The Hodlnaut Team

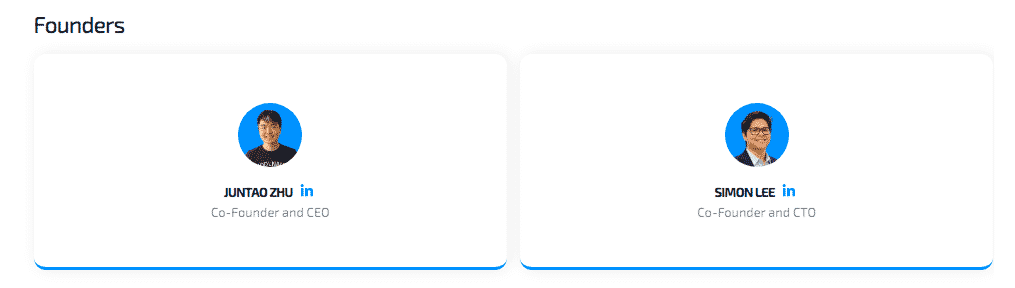

Hodlnaut was founded by CEO Juntao Zhu and CTO Simon Lee. The duo previously founded Cypher Forge, a cryptocurrency trade execution platform.

Zhu spent over three years as an analyst and developer with the Swiss wealth management firm Credit Suisse.

Lee spent over three years in engineering management roles. The two founders hold a combined nine years of experience in software development, finance, and engineering.

Hodlnaut Review and Interest Rates: How Does Hodlnaut Compare?

Hodlnaut supported six cryptocurrencies: BTC, ETH, DAI, USDC, USDT, and WBTC, offering between 6.2% and 10.5% APY.

How Did Hodlnaut Make Money?

Like most other crypto interest accounts claimed to do, Hodlnaut used your assets as collateral to offer loans to corporate creditors, making profit the difference between the interest it pays users and what it charges to offer loans to its institutional borrowers.

“We have incredibly stringent capital requirements in place of our counterparties,” commented Zhu, in 2021. “In any case, we’re very selective with whom we lend to. We only lend to corporate entities with good credit scores, and we will verify this with them during the onboarding process. The loan-to-value (LTV) Ratio of our loans is usually 70% or lower.”

The team noted the platform also made money by earning interest from lending its assets to decentralized protocols.

Behind the scenes, Hodlnaut had converted $317 million of user funds (nearly everything) into UST to earn a 20% APY on Anchor Protocol, a dApp on the Terra blockchain.

Hodlnaut took a critical hit when UST, the algorithmic stablecoin began to fail in maintaining its 1:1 peg in May 2022 and lost a majority of its value. It did not disclose to its users its involvement and allowed users to continue to deposit and withdraw as usual. On July 14th, the Singapore Police Force demanded the remainder of the assets be transferred to them, which also was not communicated to its users.

On August 8th, 2022, Hodlnaut suddenly suspended all withdrawals citing “recent market conditions,” also revealing on a blog post it owed about $281 million and only had $88 million remaining.

Hodlnaut is currently in bankruptcy proceedings.

Hodlnaut’s Platform Security

The platform required users to set up 2FA before they can make a withdrawal, which helps keep accounts secure and prevent unauthorized withdrawals. Hodlnaut used industry-standard encryption and other safety regulations to ensure that assets and information on its platform are protected.

Hodlnaut has never been hacked, and its losses were due primarily to poor decision-making and terrible risk management by its owners.

Hodlnaut’s primary custodian was Fireblocks, a digital asset custody solution that employs various methods to ensure the safety of assets. Fireblocks holds assets in a mix of offline cold storage and insured hot wallets; all user deposits are never in the same place at once.

Hodlnaut gave the option of purchasing insurance on your crypto via a partnership with European company Nexus Mutual, which paid out just about $1 million out of an estimated $193 million shortfall. The Nexus blog post specifies, “members who protected their deposit with Custody Cover from Nexus Mutual received the first-ever on-chain payouts for a custodial loss event.”

The Hodlnaut insurance with Nexus stood at $22 million.

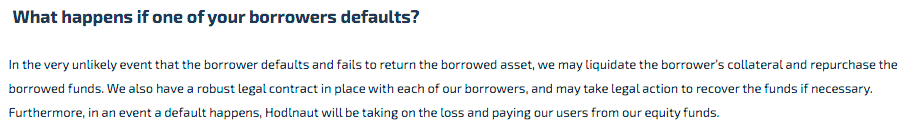

Hodlnaut outlined its procedures in the case of a borrower default.

Hodlnaut was certified by the Singapore Fintech Association, which is recognized by the Monetary Authority of Singapore

Hodlnaut Review Final Thoughts: How Did Hodlnaut Fail?

Hodlnaut offered a competitive product in an increasingly competitive industry, but rather than generating its rates from cryptocurrency lending, as it had specified, it plunged a majority of its customers’ funds into an algorithmically traded stablecoin. When Terra collapsed, so did any of Hodlnaut’s hopes of remaining solvent.

The collapse of UST also triggered a domino effect, wiping out billions of dollars of value from the cryptocurrency industry.

Hodlnaut’s irresponsible risk management has left hundreds of millions of its customers’ money in bankruptcy court, and it’s a small excerpt of 2022 crypto interest account disasters.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.