Since January 13, 2026, crypto markets have sustained notable strength, with total valuation remaining above $3.1 trillion and daily volume still tracking near $150 billion. Sentiment has turned more optimistic, yet traders have become more selective. While momentum is back, not every rally carries the same potential.

The Monero price continues to show sharp and sudden moves. Meanwhile, the Ethereum price has remained elevated, backed by market-wide recovery and renewed inflows into major-cap coins. These trends still matter, but the potential for asymmetric upside may already be fading as these names get priced as established leaders.

Analysts are now asking a different question: where is the next wave of gains forming among top crypto gainers? Increasingly, Milk Mocha ($HUGS) is being highlighted. At Stage 11, priced at just $0.0008092, it presents a rare opportunity that some analysts describe as “public retail buying at private-level pricing”, an early entry window that may not stay open for long.

Milk Mocha ($HUGS) Stage 11: Where Retail Gets an Insider Price Point

Milk Mocha ($HUGS) is positioning itself differently from typical presales. With a brand that already commands over 50 million followers globally, the project isn’t starting from zero. Instead, it’s leveraging a culture-first approach to build a crypto-powered ecosystem, one where users don’t just engage, but participate economically.

The presale is structured across 40 stages, and it currently sits in Stage 11 with pricing at approximately $0.0008092. Over $276,000 has already been raised. However, what truly stands out is the pricing spread. With a confirmed listing target of $0.06, early participants are entering at a rate that resembles seed-stage access, not public exchange-level pricing.

Traditionally, a project with this scale of brand visibility would raise capital quietly through venture firms, and most retail buyers would only be invited in after initial upside was already extracted. Milk Mocha is flipping that model by opening early access to the public. That decision is why many analysts believe $HUGS fits the profile of a future top crypto gainer.

The economics are also designed to support long-term value. Weekly burns of unsold tokens steadily reduce supply. A staking APY of 60% incentivizes long holds. Additional features like HugVotes DAO for community-directed donations, NFT-based collectibles, and casual play-to-earn games are built into the roadmap. These features point toward broader utility and adoption, beyond speculative trading alone.

Researchers have pointed out that the current $0.0008 pricing in Stage 11 feels like a market oversight, or what some call a “public glitch.” It’s a rare situation where open-access buyers are getting prices that look more like early-stage venture entries than typical token launches. As listings approach, that window could close quickly.

Monero Price Snapshot: Strong Moves in a Niche Sector

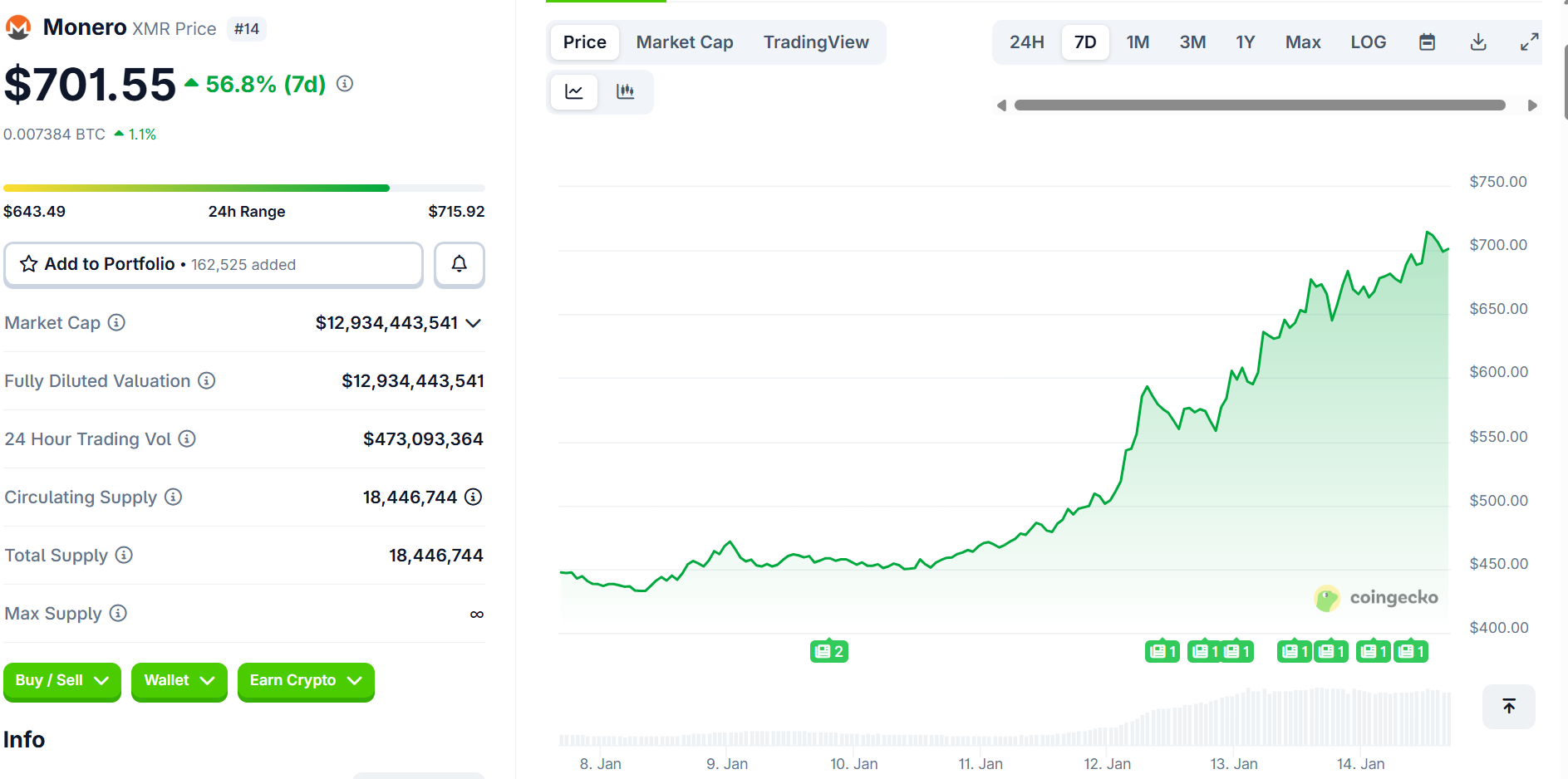

The Monero price has posted one of the more notable surges in January 2026, ranging between $690 and $715 following a swift rally. Daily volumes remain elevated, typically landing between $470 million and $515 million. With a market capitalization near $13 billion, Monero holds large-cap status, yet still manages to deliver volatility when privacy-related themes return to the spotlight.

Between January 8 and January 14, the price moved from around $436 to $709, a sizable shift in just under a week. The most aggressive moves came between January 12 and 14. One driver appears to be increasing regional restrictions on exchange access, which often amplifies demand for privacy coins like Monero.

Analysts note that Monero’s recent momentum is more event-driven than structural. While these sharp movements are notable, they also reflect how pricing can overreact to near-term narratives.

Ethereum Price Outlook: Momentum Holding Near Critical Levels

Ethereum remains in a relatively stable uptrend. The Ethereum price has held within the $3,310 to $3,335 range since January 13–14, 2026, after a sharp rally that recaptured trader interest. With a market cap near $400 billion and daily trading volumes above $33 billion, ETH is still the second-largest crypto asset by market size.

Notably, Ethereum jumped by over 7% on January 13, closing near $3,330, and maintained that strength into the following day. Much of the support has come from broader market optimism, especially as institutional flows return to major-cap assets. Traders are watching closely to see if ETH can maintain price action above $3,075, a level seen as key for sustaining its recent trend.

Still, some experts suggest that while Ethereum remains structurally sound, its current valuation leaves limited room for the kind of explosive upside typically seen in smaller or earlier-stage projects.

Final Outlook

Monero and Ethereum have delivered solid performance this month, but their roles in the market are already well-established. Monero’s price action is fast, driven by privacy interest and regional dynamics. Ethereum’s movements are steadier, reflecting its large-cap utility and place in the broader ecosystem.

However, both appear to be priced as mature plays. That limits the magnitude of further gains for traders looking for asymmetrical opportunities. Historically, top crypto gainers often emerge not from established names, but from well-positioned early entries, tokens that are still priced for growth and have room to re-rate dramatically.

Milk Mocha ($HUGS) is beginning to fit that model. Analysts keep highlighting Stage 11 as an opportunity that mimics private market access. The $0.0008 entry against a $0.06 listing target provides a pricing gap that few projects offer this openly. As more stages are completed, that gap narrows, and the opportunity fades.

For those evaluating where the next surge of gains may come from, $HUGS provides a structurally different path. Backed by an active fanbase, driven by deflationary mechanics, and priced well below its confirmed listing level, it stands out as one of the more compelling entries among current presale options.

Explore Milk & Mocha Now:

Website: https://www.milkmocha.com/

X: https://x.com/Milkmochahugs

Telegram: https://t.me/MilkMochaHugs

Instagram: https://www.instagram.com/milkmochahugs/