TLDR

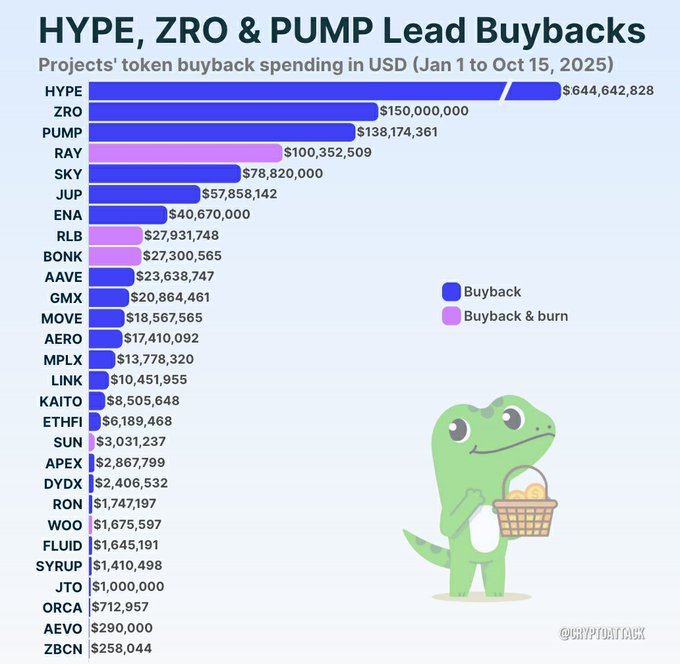

- Hyperliquid spent $645 million, nearly half of the $1.4 billion in buybacks.

- LayerZero and Pump.fun follow with $150 million and $138 million in buybacks.

- Buyback spending surged 85% month-over-month in July 2025.

- Monthly token buyback spending averages $145.9 million in 2025.

In 2025, the cryptocurrency market has seen a surge in token buybacks, with projects spending over $1.4 billion on repurchasing their own tokens. This trend has become a central part of tokenomics strategies for many leading crypto projects. Hyperliquid, a decentralized perpetual exchange protocol, has taken the lead in this space, committing a substantial portion of the total buyback spending. As the market adapts, these buybacks are reshaping the landscape of crypto economics.

Hyperliquid Dominates Buyback Activity

Hyperliquid has emerged as the dominant player in the ongoing token buyback trend, committing approximately $645 million to repurchase its tokens. This amount accounts for nearly half of the entire $1.4 billion spent on buybacks in 2025. The scale of Hyperliquid’s buyback program is notable, especially given that it surpasses the combined totals of the next nine largest projects in the market.

The decision to allocate such a large sum to buybacks indicates Hyperliquid’s confidence in its long-term prospects and its desire to increase the scarcity and perceived value of its token. Hyperliquid’s approach reflects the growing importance of token scarcity in crypto economics. The project aims to boost investor confidence and signal to the market that it is committed to supporting token value in the long term.

Other Major Buyback Participants

Following Hyperliquid, LayerZero and Pump.fun also made significant commitments to token buybacks. LayerZero dedicated $150 million to repurchasing its ZRO token. This one-time buyback, though large, was not part of an ongoing program and stands out as a key move in LayerZero’s strategic plans.

Pump.fun, another crypto project involved in buybacks, spent $138 million since July on repurchasing its PUMP tokens. These buybacks are part of a broader trend in which established crypto projects aim to use repurchase programs to stabilize or increase token value and attract new users and investors.

The involvement of these top projects shows how the market is increasingly relying on token buybacks as a tool for maintaining price stability and long-term growth. As more projects participate in similar programs, the buyback trend is expected to continue to gain momentum through the remainder of 2025.

Rising Monthly Spending on Token Buybacks

The frequency and scale of token buybacks have been on the rise since the middle of 2025. In July, the sector saw a notable 85% month-over-month increase in buyback spending, and this trend has continued into the second half of the year.

The overall monthly average for buyback spending has reached around $145.9 million. This is a marked increase compared to the first half of the year, when monthly buyback spending averaged just $99.3 million.

According to CoinGecko, the month of September saw a substantial spike in buyback spending, although much of this was driven by the one-off repurchase by LayerZero. “Although a jump in token buyback spending was attributed to September, this was due to the one-off LayerZero repurchase announcement,” said Yuqian Lim, a research analyst at CoinGecko. Excluding LayerZero’s $150 million buyback, September saw $168.45 million in buybacks.

Growing Confidence in Token Buybacks

The increase in buyback activity is largely driven by rising project profitability and a market psychology that favors scarcity models. Projects that implement token buybacks often do so as a way to demonstrate their financial health and commitment to long-term value creation. These programs help reduce the circulating supply of tokens, thereby increasing scarcity, which can lead to higher prices and greater demand.

The trend also indicates a maturation of governance structures within decentralized projects. With stronger governance frameworks in place, projects are able to make more strategic decisions regarding the allocation of resources for buybacks. These programs reflect an evolving approach to tokenomics, one that is more focused on creating sustainable value for both projects and investors alike.

As the year progresses, more cryptocurrency projects are expected to follow in the footsteps of Hyperliquid, LayerZero, and Pump.fun, contributing to an ongoing wave of token buybacks in the market.