TLDR

- Hyperliquid’s HYPE token rose 6.2% on February 5 after integrating Ripple’s technology stack for improved settlement efficiency

- XRP dropped 10-11% during the same period, tracking losses across major altcoins like Ethereum, Solana, and BNB

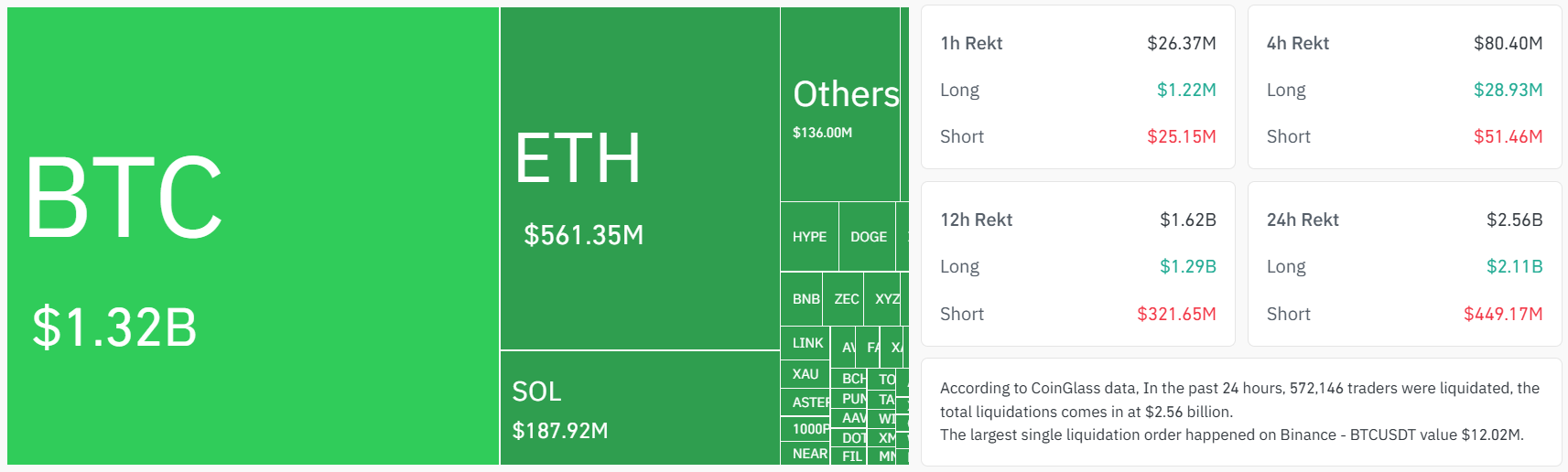

- The crypto market saw over $800 million in liquidations on February 5, mostly from long positions

- Bitcoin traded near $71,000 after a sharp pullback, with total crypto market cap falling more than 6%

- HYPE price dropped to $27 before recovering to current levels around $34

Hyperliquid’s HYPE token posted gains on February 5 while most crypto assets declined. The token rose 6.2% following news of its integration with Ripple’s technology infrastructure.

XRP moved in the opposite direction during the same trading session. The token fell 10% as broader market pressure weighed on major altcoins.

The February 5 trading session showed how different assets can perform under the same market conditions. Hyperliquid integrated Ripple’s technology stack to improve interoperability and settlement efficiency.

Market participants responded positively to the integration announcement. HYPE outperformed the wider crypto market despite bearish sentiment across the sector.

Hyperliquid, meet Ripple Prime: https://t.co/RZWdbRfHoe

We’re now enabling institutions to access onchain derivatives liquidity through @HyperliquidX in a streamlined and secure way. Customers can also efficiently cross-margin crypto with all asset classes supported by our prime…

— Ripple (@Ripple) February 4, 2026

Bitcoin traded near $71,000 after a sharp pullback on February 5. Total crypto market capitalization fell more than 6% during the day.

Trading volumes in HYPE increased following the Ripple integration news. The price movement remained measured rather than showing signs of excessive speculation.

HYPE price initially dropped to $27 during the market downturn. The token has since recovered and currently trades around $34.

XRP Tracks Broader Altcoin Losses

XRP fell close to 11% over a 24-hour period on February 5. The token declined alongside Ethereum, Solana, and BNB as risk appetite faded.

The drop occurred despite positive developments in other parts of the Ripple ecosystem. Broader market conditions outweighed individual project news for large-cap tokens.

Derivatives activity increased selling pressure on XRP. Falling open interest and forced liquidations on centralized exchanges added to downward momentum.

The XRP price movement appeared driven by sentiment rather than project-specific factors. The defensive market tone pushed traders away from high-leverage positions.

Market Liquidations Exceed $800 Million

The crypto market experienced over $800 million in liquidations on February 5. Most of these liquidations came from long positions as prices fell.

Stalled discussions around a US crypto market structure bill contributed to volatility. Ongoing debates over stablecoin regulation also affected trader sentiment.

Institutional positioning showed changes during the period. Grayscale removed Cardano from its CoinDesk Crypto 5 ETF and replaced it with BNB.

The institutional move reinforced focus on liquidity and market depth. These factors continue to influence where capital flows in the crypto market.

Hyperliquid’s integration with Ripple’s technology attracted trader interest despite market weakness. HYPE currently trades at $34 after recovering from its $27 low.