TLDR

- HYPE trades near $47 resistance level with whales adding over $40 million in recent accumulation

- Hyperliquid TVL hits record $2.81 billion while trading fees reach $7.7 million daily highs

- Technical analysis shows ascending triangle pattern pointing to potential $90 target above $48 breakout

- Platform captures 6.1% of perpetuals trading volume versus centralized exchanges

- Supply-Weighted P/E ratio of 3.39 suggests current undervaluation relative to protocol earnings

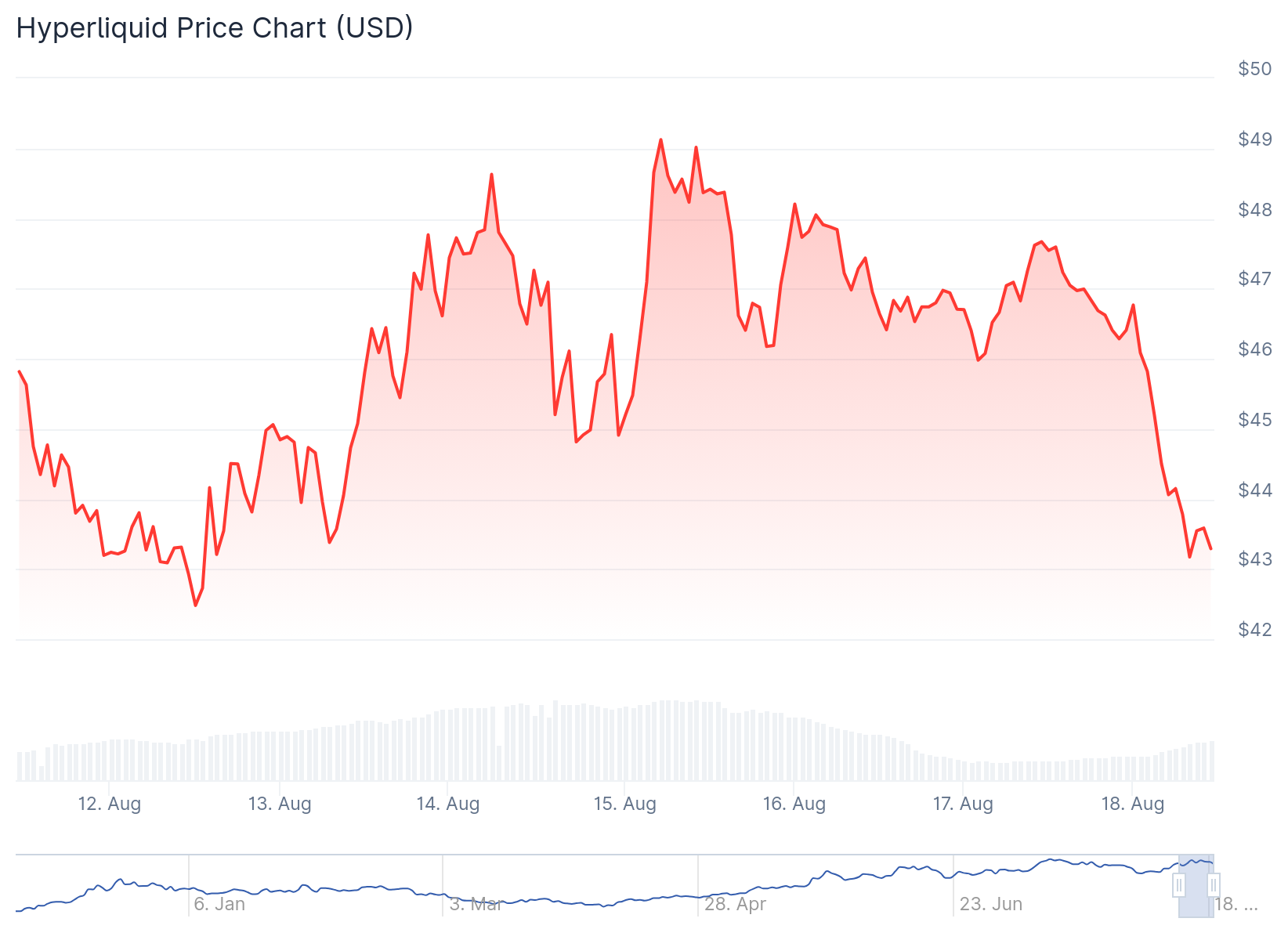

Hyperliquid price continues testing the $48 resistance zone as institutional demand builds around the decentralized exchange token. HYPE has formed what analysts describe as an ascending triangle pattern with repeated tests of this key level.

A whale wallet identified as 0xa523 deployed over $40 million USDC into Hyperliquid within 48 hours. The whale purchased more than 466,000 HYPE tokens valued at $21.5 million in a single transaction batch between $46 and $47 price levels.

This accumulation occurs alongside record-breaking protocol metrics for Hyperliquid. Total value locked reached $2.81 billion this week according to DeFiLlama data. The platform processed $29 billion in perpetuals trading volume over 24 hours with daily fees hitting $7.7 million on August 15.

Revenue Growth Drives Token Buybacks

The protocol redirects 97% of trading fees toward HYPE token buybacks. Current revenues average $3.45 million based on 30-day moving data. This buyback mechanism creates direct upward pressure on token price as trading activity increases.

Hyperliquid reached new all-time highs with $29B in 24h volume and $7.7M in 24h fees. pic.twitter.com/uTs0JE5ch8

— Hyperliquid (@HyperliquidX) August 15, 2025

Hyperliquid has captured 6.1% of perpetuals trading volume compared to centralized exchanges. The platform processed $320 billion in trading volume during July alone. This represents growth from near-zero market share one year ago.

The platform’s custom Layer 1 blockchain supports 100,000 orders per second with sub-second finality. This speed matches centralized exchange execution while maintaining decentralized infrastructure.

Anchorage Digital recently began offering institutional custody services for HYPE tokens. This development may encourage additional institutional participation in the protocol.

Valuation Metrics Signal Undervaluation

Analyst HoodieChicken notes HYPE’s Supply-Weighted P/E ratio sits at 3.39. This metric compares float-adjusted market cap to protocol earnings. The current ratio trades below historical averages while revenues trend higher.

Institutional holders include Paradigm with over 20 million HYPE tokens and Galaxy Digital controlling more than 10 million tokens. Laurent and Hyperion maintain multi-million token allocations. This concentrated institutional demand reduces circulating supply.

Technical Analysis Points to Breakout Potential

Crypto Target identifies an ascending triangle formation on HYPE charts. The pattern shows repeated $48 resistance tests while higher lows compress price action. A decisive break above $48 would confirm bullish momentum according to this analysis.

The measured move from this triangle pattern projects potential targets near $90 if volume supports the breakout. Short-term support levels sit at $45.8 with immediate resistance at $48.

However, analyst Ali Martinez warns of rejection risks at the $48-$50 resistance zone. The area has triggered multiple rejections in recent sessions forming a triple-touch pattern. Failure to flip this zone could target $39 on corrective downside.

$39 could be next if Hyperliquid $HYPE gets rejected here! pic.twitter.com/QKxiC1baIQ

— Ali (@ali_charts) August 16, 2025

HYPE/ETH pair analysis shows price stabilization around 0.0108 support levels. This zone has acted as decisive support after previous retracements suggesting downside momentum exhaustion.

Analyst Don identifies a potential rising wedge pattern which typically signals bearish structures. A breakdown below $45 support could invalidate bullish momentum targeting the low $40s range.

HYPE price has gained over 1,376% from November 2024 lows of $3.20. The token remains below its July 2025 all-time high of $49.86. Current price trades at $47.3 with the next major test at $48 resistance where institutional accumulation and technical patterns converge.