- About IDEX

- How IDEX Works

- IDEX Account Security

- IDEX Trading Pairs

- IDEX Fees and Limits

- IDEX Customer Support

- IDEX Community Sentiment: Is IDEX Legit?

- Final Thoughts: Can You Trust IDEX?

IDEX is an Ethereum-based decentralized exchange featuring a wide variety of Ethereum and various ERC20 token trading pairs launched in 2017.

IDEX aims to bring the conveniences and user-friendly nature of centralized exchanges but with DEX-like custody and security. It employs smart contracts that enable users to manage their private keys and trade in a secure, peer-to-peer environment. It also features Ledger Nano S and Meta Mask Wallet integrations, safer alternatives for fund management than manually entering a private key, or trusting a third-party custodian.

When trading on IDEX, users still sign off on transactions with their private key, but the exchange broadcasts the transaction to the blockchain, enabling the exchange to update account balances and order books in real-time. This gives IDEX the user experience of a centralized exchange without sacrificing the security and user control of a decentralized exchange.

IDEX initially launched solely on Ethereum because Layer-2s, and now Layer-3s, didn’t exist. It has since moved to exploring an IDEX-specific “Layer-3” with the goal of ensuring the lowest fees and performance possible.

In normal human terms, IDEX has transitioned from using the pricy Ethereum base network to cheaper alternatives built on top of it, like Polygon and XCHAIN.

The following IDEX Review explores how IDEX works, and whether this decentralized exchange is a good fit for your trading needs. Note, trading on IDEX from the United States is currently blocked.

| Key Info |  |

|||

|---|---|---|---|---|

| Site Type | Decentralized Cryptocurrency Exchange | |||

| Beginner Friendly | ||||

| Mobile App | ||||

| Company Location | Republic of Panama | |||

| Launch | 2017 | |||

| Deposit/Withdrawal Method | Cryptocurrency | |||

| Available Cryptocurrencies | Ethereum and ERC20 Tokens | |||

| Community Trust | Good | |||

| Security | Great | |||

| Fees | Low | |||

| Customer Service | Good | |||

| Site | Visit IDEX |

About IDEX

IDEX launched in 2017 and has helped pioneer the path for the modern decentralized exchange. Despite it’s early entry into the DEX industry, however, it’s use base has lagged. The exchange currently has about $2.65m in Total Value Locked, about 1/7th of the 10th largest DEX, Balancer.

How IDEX Works

Smart contracts are the name of the game for any decentralized exchange. Users can manage all of their funds through the exchange’s smart contract. So long as no one else has their private key, their funds can’t be touched once they’ve been stored in the contract unless they’ve signed off on them.

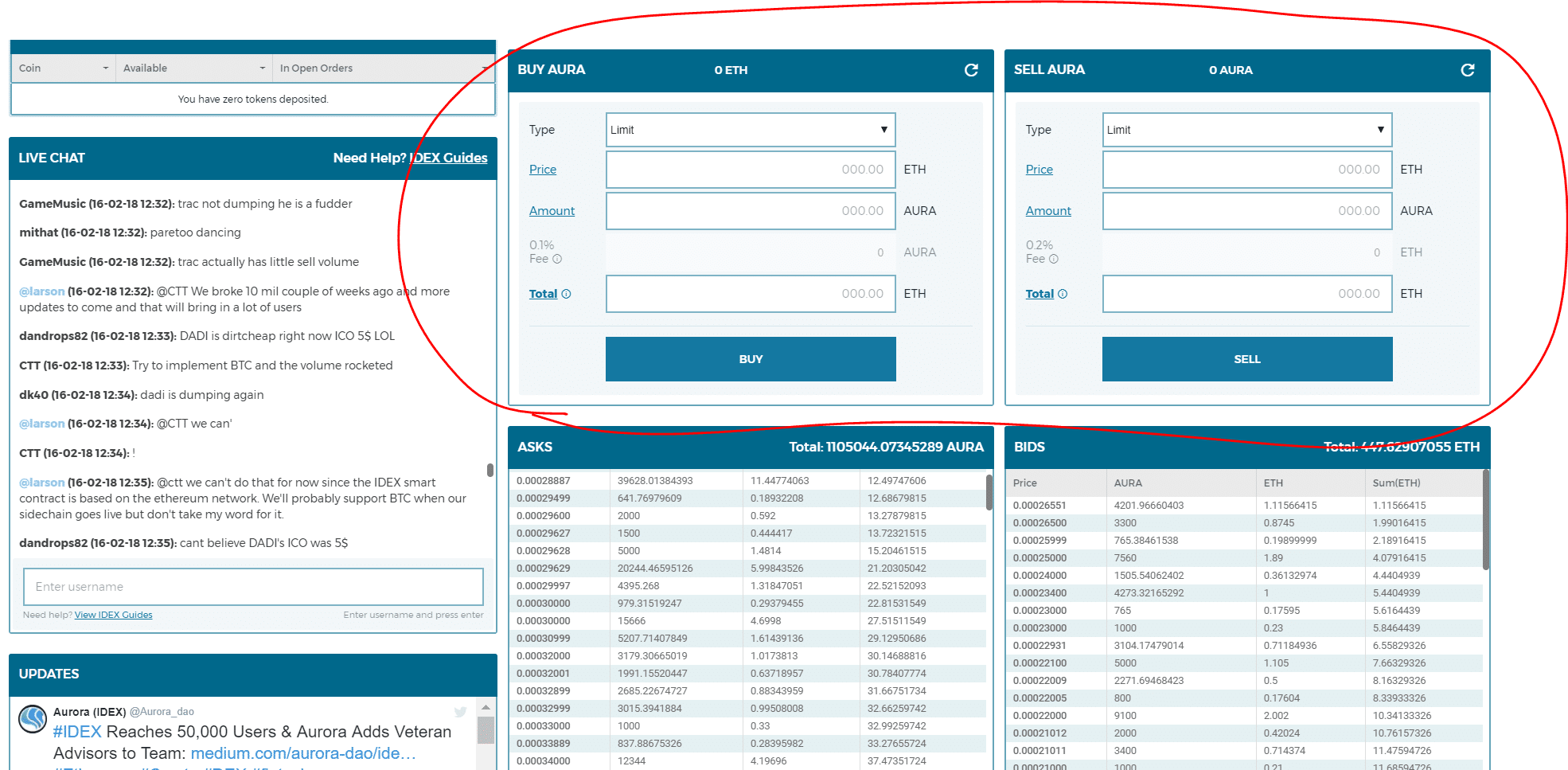

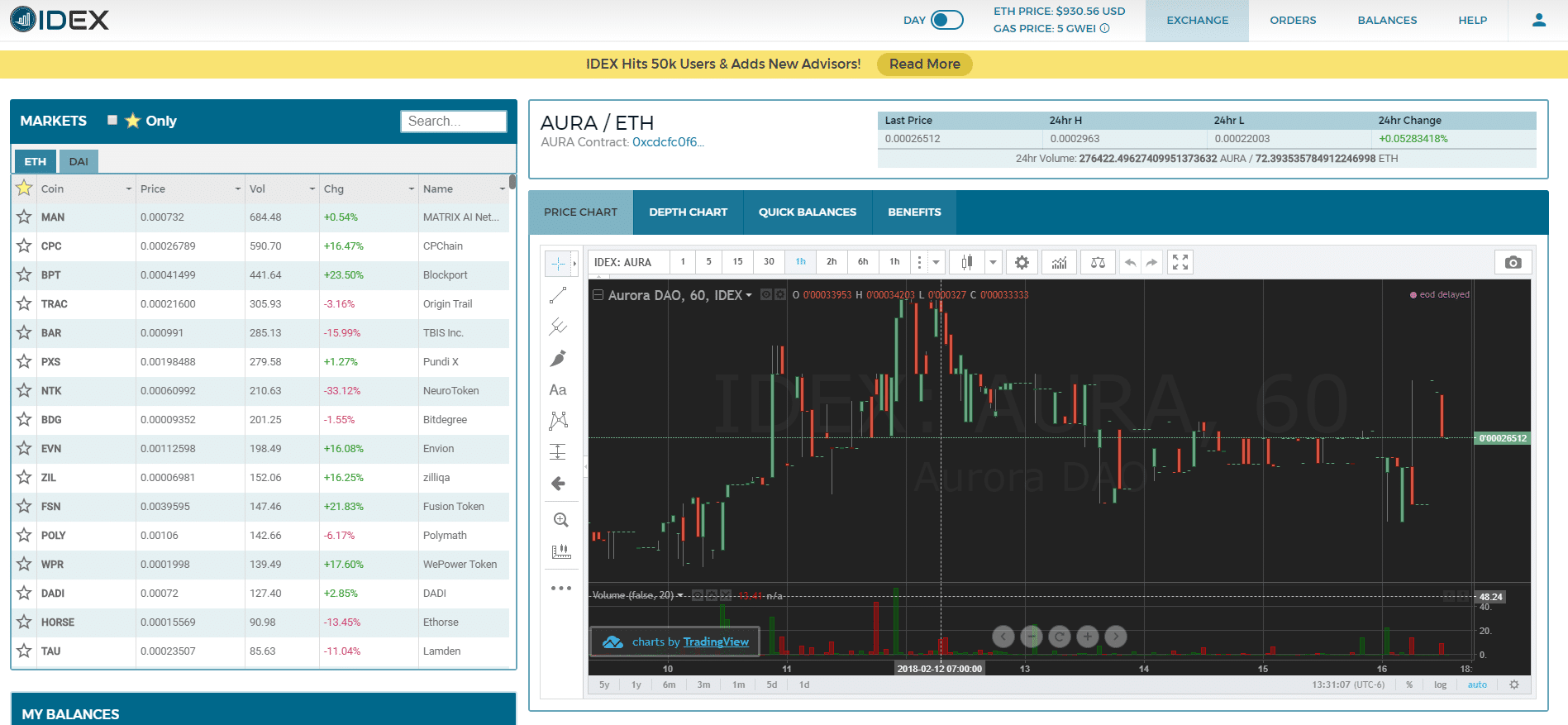

Once on the exchange, you’ll notice that everything you need to trade is immediately in front of you: wallet balances, the trading chart, the order book, trading pairs, and other tools are all displayed on a single page. It may seem overwhelming at first to have all of this bunched together, but we’ll be going over each component below–and having everything on one page actually makes exchanging a breeze.

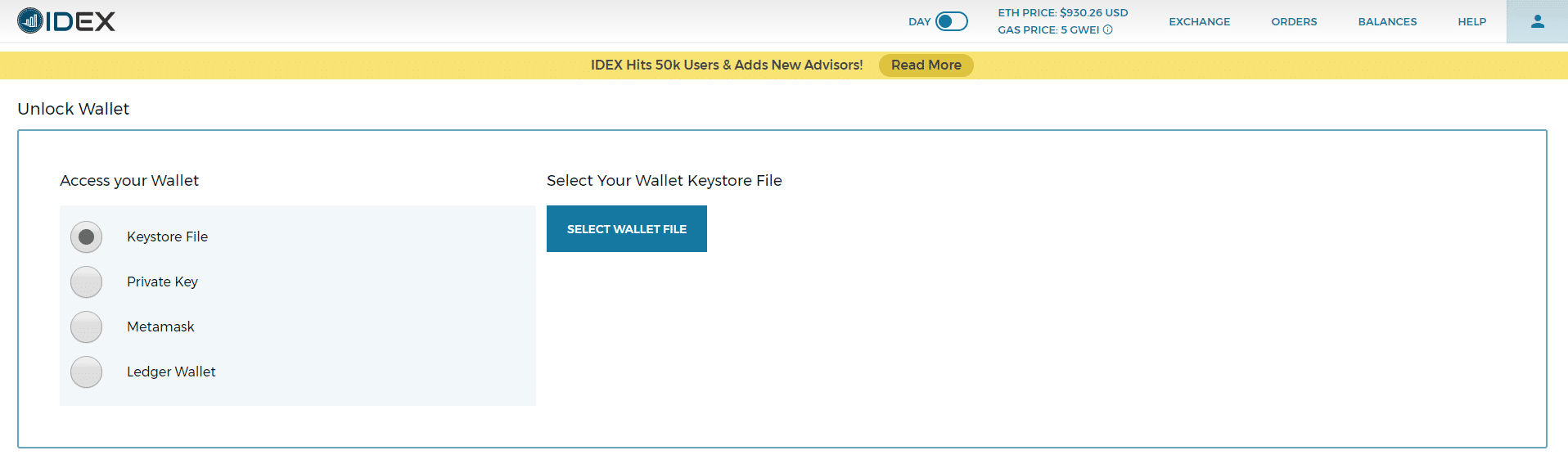

First things first, you’ll need to deposit funds into the exchange’s smart contract to get started. At the top right corner, there’s an account dropbox that allows you to integrate a new wallet or create one through the exchange. If you decide to create one, the exchange will produce a private key for you and a Wallet Keystore File. Whether you’re creating a new wallet or accessing an old one, you have four options for opening a wallet on the exchange:

- Keystore File: You can directly upload your private key using a KeyStore file for an Ethereum address you created on the exchange or otherwise.

- Manually Entered Private Key: You can choose to manually enter your private key to unlock an Ethereum address’ funds.

- MetaMask: You can unlock your MetaMask wallet and access it through the exchange.

- Ledger Nano S: You can integrate your Ledger Nano S into the exchange and deposit funds directly from it.

Hardware wallet integration is one of the greatest added benefits of using a decentralized exchange like IDEX. Using a Ledger to trade on IDEX insulates you from risks like malware and phishing attacks. Meta Mask will protect you from phishing attacks but not malware; manually entering your private keys leaves your funds ripe for phishing and is the most vulnerable option for accessing funds.

Once you’ve got your funds in hand on the exchange, you have to deposit them into the exchange’s smart contract. It seems like a silly extra step, but it’s actually in your favor, as this smart contract keeps your funds safe while you trade and allows the exchange to broadcast transactions directly to the network. You can deposit from your wallet into the exchange through the Quick Balances tab at the top of the page and adjust the gas price for this transaction at your leisure.

Once you’ve got funds on the exchange, you can start trading. IDEX allows you to create market/limit orders, and unlike other DEXs, you can cancel trades without paying gas.

This is where IDEX separates itself from the decentralized milieu. You can cancel trades on IDEX without having to pay extra because all trades are executed by the exchange itself. Thus, when you sign off on a trade, you agree to make that trade, but the exchange’s smart contract is in charge of broadcasting it to the network, so until the transaction is sent to be mined, you can ask the exchange to rescind it.

If you’ve ever tried to fill an order on EtherDelta, you’ve run the risk of having that transaction fail. Sometimes, orders are claimed by more than one party, and since the order book isn’t updated until after a transaction is processed on the network, a stale orderbook can result in users trying to make trades on orders that are already filled. IDEX’s system cures this headache by updating the orderbook in real time after an order is filled. This model offers users the advantage of user-controlled funds with the convenience of a freshly updated order system they’d find on a centralized exchange.

IDEX Account Security

In general, decentralized exchanges feature security buffs that centralized exchanges, by design, cannot support. IDEX is no exception. The exchange itself runs as a node on the Ethereum network, so it comes replete with all of the security a blockchain network entails for its users.

Further, the exchange’s smart contracts keep funds locked in until the private key signs a transaction to move them. You could keep your funds on the exchange and not break a sweat over it being compromised like we’ve seen too many times with centralized ones. The reason being, that there’s no central point of failure for a hacker to tap into funds. All funds are held in smart contracts on the Ethereum blockchain, so there’s no threat of someone hacking into a wallet reserve because IDEX doesn’t hold user funds in one.

The Ledger Nano S integration is another of IDEX’s key benefits, and, taken with the exchange’s overall decentralized structure, it makes for one of the most secure trading experiences out there.

The only thing you’d have to worry about in terms of security is if IDEX’s domain name service provider is compromised and a hacker hijacks its URL. We saw this happen to Ether Delta, but if something like this were to happen, your funds would be safe as long as you don’t manually enter your private keys into the fake website.

IDEX Trading Pairs

As we went over earlier, the exchange deals exclusively with Ethereum and ERC20 tokens. Specifically, IDEX offers 2 base trading pairs– ETH and USDC.

As such, you won’t have access to anything outside the Ethereum family, but that still leaves you with plenty of options.

IDEX Fees and Limits

IDEX charges a 0.1% fee for market makers (those who make liquidity by creating a new order for the order book) and 0.2% for takers (those who take liquidity by filling an order already on the book). Takers are also responsible for paying the gas fee for a transaction.

“Market takers are responsible for covering the gas fees associated with each trade. Given our design, the exchange must pay this gas fee, priced in ether, when dispatching the trade to the network and then deduct it from the balance of the market taker. When exchanging tokens for ether the amount of eth deducted matches that of the gas fee. When exchanging ether for tokens, IDEX deducts the equivalent amount of tokens based on the price of the asset in ETH. This price is calculated using the average of the last 10 trades.

Ethereum gas prices have been increasing, and often this fee is higher than the IDEX exchange fee of 0.2%. These high gas prices have led us to institute order minimums in an attempt to reduce costs for our users.”

Thus, the taker fee could be more than 0.2%, depending on the network’s traffic. This also means that all orders must be at least 0.15 ETH for makers and 0.05 for takers so that the exchange can manage transaction fees efficiently. In addition, there’s a 0.04 ETH minimum withdrawal amount for Ethereum and tokens alike. IDEX does not have trading or withdrawal limits.

IDEX Customer Support

The exchange features a chat box where users and support teams alike can answer queries and concerns. Alex and Phil Wearn, IDEX’s founders, are also active on the project’s subreddit and usually respond promptly to customer questions and complaints.

The site also features a contact form for reaching out to the team and a Linktree link to various IDEX community channels.

IDEX Community Sentiment: Is IDEX Legit?

IDEX has been around since 2017– our initial review of the exchange was published in 2018. Since then, the exchange has remained relatively scandal-free.

Final Thoughts: Can You Trust IDEX?

By all measures, IDEX lives up to its growing reputation as EtherDelta’s more attractive little brother (perhaps little only applies to age here, as IDEX actually outranks EtherDelta by trading volume). The bi-layered transaction settlement model circumvents the same pitfalls that plague EtherDelta’s system, and it makes for a generally easier, less frustrating trading experience.

Still, this model has its drawbacks, namely that it makes the exchange not completely trustless. You still control your private keys, but you’re relying on the exchange to execute trades for you, leaving the final step of the process somewhat centralized. Thankfully, the IDEX has introduced the AURA token and their new staking model to solve this issue, so expect the exchange to become even more decentralized as 2018 progresses.

It’s still beholden to the Ethereum blockchain like any Ethereum-powered DEX, and at times of network trouble, users can run into problems. All things considered, however, IDEX’s design mitigates many of the issues that network congestion can cause for a DEX, and its user experience/interface is cleaner than its competition. IDEX is a rising star in the decentralized exchange space, and if you like EtherDelta but find yourself exasperated from using it, it’s definitely worth trying out.

[wp-review id=”6328″]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.