As the price of Ethereum hovers around $300, you may be wondering to yourself whether or not it’s worthwhile to begin mining. Like Bitcoin, Ethereum is a proof-of-work coin that uses miners to confirm network transactions. The profitability of mining varies from person to person and changes over time – usually becoming less profitable as the coin matures.

There are three important factors to consider when figuring out if Ethereum mining will be profitable for you:

- Mining difficulty

- Hash rate

- Electrical costs

Mining difficulty

Putting it simply, your mining rig needs to solve a mathematical algorithm to mine Ethereum. The mining difficulty of the network is a measurement of how difficult this algorithm is to solve. The higher the difficulty, the less Ethereum you receive for each unit of energy the GPU on your mining rig expends. As more miners join the network, this difficulty increases.

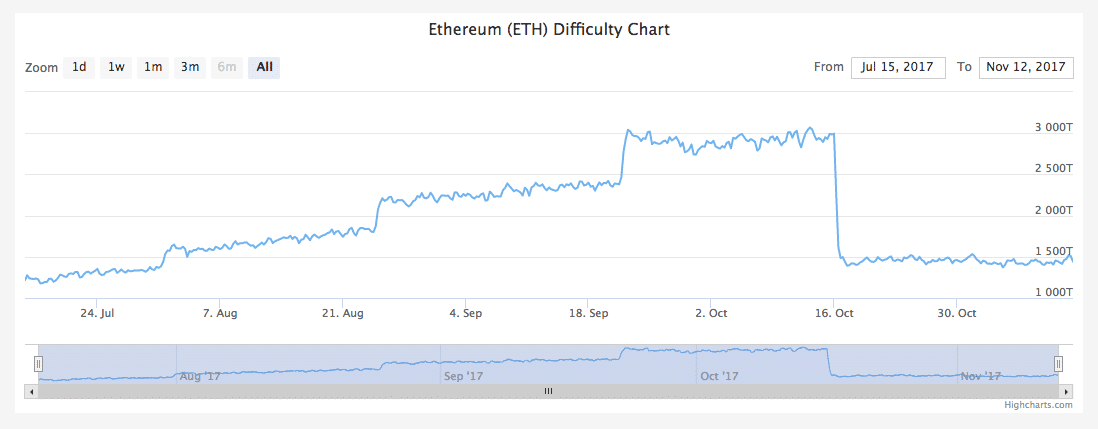

The Ethereum mining difficulty had been steadily increasing since July but recently dropped from a high of ~3,000T to ~1,500T. This dip was caused by the Byzantine fork but isn’t as advantageous as it seems. Even though the difficulty decreased, the block reward also decreased from 5 ETH to 3 ETH effectively canceling out any benefit from the difficulty change.

You can view the past and current difficulty on the Ethereum network.

Hash rate

The hash rate is the speed at which your mining rig can solve the mathematical algorithm needed to validate a transaction. New miners are constantly entering the market with better and faster hash rates.

There’s more to buying a miner than just picking the one with the highest hash rate, though. Miners with a high hash rate usually come with a high price tag. On top of that, they also typically use more electricity as they operate which could further drive your costs up.

Electrical costs

Each mining rig operates at a different level of efficiency and uses a variable amount of electricity. On the low end, miners typically draw ~100 W at their maximum load, but this can increase up to over 1000 W with more powerful and less efficient miners. With the amount of mining variation, you’ll want to calculate your power cost per day and compare that to the estimated return per day when picking out a miner.

The move towards proof-of-stake

Vitalik Buterin, the creator of Ethereum, announced earlier this year that the Ethereum network is going to switch from a proof-of-work to a proof-of-stake framework to confirm transactions. With a proof-of-stake system, holders of Ethereum stake coins by putting them up as collateral to validate transactions. This means that miners will soon be obsolete.

With the current saturation of miners and the stated plans to switch the network to a proof-of-stake system, I would avoid mining Ethereum at this time. There are several other coins available for mining, like Monero, that may be a better choice for you depending on your goals.

If you do decide to mine Ethereum, you’ll also want to join an Ethereum mining pool.

Read Next: How to Buy Ethereum

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.