TLDR

- Block increased its Bitcoin holdings by 108 BTC in Q2, bringing the total to 8,692 BTC.

- The company reported total revenue of 6.05 billion dollars in Q2.

- Gross profit rose 8.2% year over year to $2.54 billion.

- Cash App gross profit reached 1.50 billion dollars with a 16% year-over-year increase.

- Active users for Cash App remained steady at about 57 million monthly transactors.

Block increased its Bitcoin reserves and exceeded quarterly profit forecasts while reinforcing its commitment to cryptocurrency integration. The company posted stronger results in Q2, supported by its Cash App and Square merchant network. Analysts noted the combination of fintech growth and Bitcoin strategy as central to its performance.

Block Expands Bitcoin Holdings

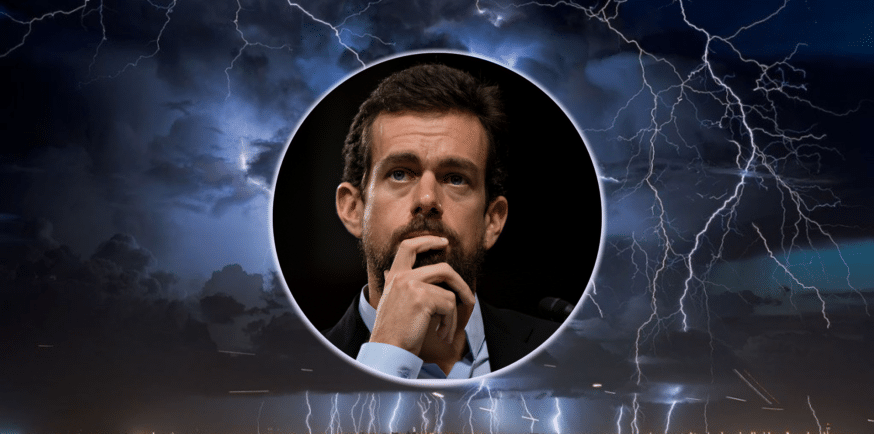

Block acquired an additional 108 BTC during Q2, bringing total corporate holdings to 8,692 BTC, according to a U.S. SEC filing. This purchase aligned with CEO Jack Dorsey’s goal of embedding Bitcoin into the digital economy. He reiterated that Bitcoin is the “only truly decentralized, net new form of digital money.”

The company recorded a $212.17 million revaluation loss on its Bitcoin holdings due to a drop in fair value. In the same quarter last year, it posted a $70.12 million revaluation gain. Despite the loss, Block maintained its focus on long-term Bitcoin value.

With nearly 8,700 BTC, Block joined other major corporate holders like MicroStrategy and Marathon Digital Holdings. Public companies, including Metaplanet, have also increased BTC reserves as a hedge against inflation. Dorsey emphasized Bitcoin’s potential as the “native currency of the Internet.”

Q2 Earnings Surpass Forecasts

Block reported total revenue of $6.05 billion for Q2, supported by robust Bitcoin-related income from Cash App. Gross profit rose 8.2% year over year to $2.54 billion. Bloomberg reported that the company raised its full-year profit outlook after beating Wall Street estimates.

Cash App delivered $1.50 billion in gross profit, a 16% increase from last year. Growth came from its Borrow feature, expanded card use, and buy-now-pay-later offerings. CFO Amrita Ahuja said growth in 2025 will rely on deeper engagement, not user base expansion.

She stated, “For our guidance in 2025 with acceleration in the back half, you do not need to believe there’s further growth on our active figure.” The active user count plateaued at around 57 million monthly transactors. Still, transaction volumes and lending demand provided strong revenue drivers.

Square Network and Strategic Growth

Square processed $64.25 billion in payments during Q2, growing 10% from the prior year. Merchant services growth came from steady processing volumes and expanded financing features. Block aims to expand buy-now-pay-later options linked to Cash App cards.

The company will also deliver its first Bitcoin mining chips via the Proto division this year. This initiative supports its wider cryptocurrency strategy. Block’s recent addition to the S&P 500 underscored its position among top U.S. companies.