Japan’s decision to treat cryptocurrencies like traditional securities is reshaping global investor sentiment. The Financial Services Agency (FSA) and the Securities and Exchange Surveillance Commission (SESC) have unveiled a framework to ban insider trading in digital assets. This initiative, expected to reach parliament in 2026, will align Japan’s crypto oversight with its equity market standards.

As a result, the announcement comes at a time of a shifting investment environment in the best crypto to buy now. As regulators increase oversight, potential next crypto to explode like Tapzi are rising in popularity due to their openness and practical applications. Meanwhile, the long-running market favorite Dogecoin is also displaying indicators of strength with analysts re-examining its past rally trends.

Tapzi Introduces a New Era of Skill-to-Earn Gaming

Tapzi is a decentralized Web3 gaming ecosystem based on the BNB Smart Chain that has rapidly emerged as one of the most discussed projects of 2025. The token of the project, $TAPZI, is already available in the presale at a price of $0.0035, and it is planned to be launched at a price of $0.01.

Besides its price appeal, Tapzi introduces the world’s first Skill-to-Earn model, rewarding genuine player performance instead of luck or random chance. Players stake TAPZI tokens in real-time player-versus-player games such as Chess, Checkers, and Rock-Paper-Scissors. The winner claims the opponent’s stake directly, creating a transparent, fair reward system.

Besides its price appeal, Tapzi introduces the world’s first Skill-to-Earn model, rewarding genuine player performance instead of luck or random chance. Players stake TAPZI tokens in real-time player-versus-player games such as Chess, Checkers, and Rock-Paper-Scissors. The winner claims the opponent’s stake directly, creating a transparent, fair reward system.

Hence, Tapzi, the next crypto to explode, solves long-standing issues in GameFi, including inflated reward emissions and bot manipulation. Every match outcome is recorded through smart contracts, ensuring fair play and eliminating treasury drains. Moreover, Tapzi’s ecosystem uses a fixed token supply of 5 billion tokens with structured vesting 25% unlocked at launch and the rest released over three months.

Tapzi’s Global Potential Draws Investor Attention

Significantly, the Tapzi presale has already reached over 57% completion, signaling strong early interest. Analysts note that the project’s sustainable model could capture both casual and professional gamers across markets.

Also, Tapzi is set to grow into Tier-1 economies, including the United States, Singapore, and Japan, and pursue high-growth gaming markets, such as Brazil, India, and Turkey. This approach will make Tapzi reach out to more than 1.5 billion mobile gamers, who are still a demographic unexplored by Web3 gaming. Moreover, Tapzi functions as a launchpad for independent developers. By providing SDKs, staking modules, and a large user base, it empowers creators to integrate new skill-based games seamlessly. This developer-driven model, combined with gasless gameplay and instant browser access, positions Tapzi as a gateway for mainstream gamers entering blockchain entertainment.

Japan Prepares to Criminalize Crypto Insider Trading

At the same time, Japan’s regulatory agencies are preparing a legal overhaul that could redefine crypto trading ethics. The Financial Services Agency and the SESC intend to criminalize cryptocurrency insider trading, treating it under the same standards as traditional securities violations.

According to a report from Nikkei Asia, the bill is expected to be submitted to parliament in 2026. Once passed, the SESC will gain investigative powers to identify suspicious trades and recommend financial penalties or criminal charges. The FSA will also establish a dedicated working group by the end of 2025 to define specific actions that qualify as insider trading.

For instance, trading tokens before their exchange listings or after learning about undisclosed network vulnerabilities would constitute violations. Additionally, exchanges will be required to adopt stronger compliance mechanisms to prevent leaks of privileged information.

Hence, authorities expect the framework to restore fairness and transparency in Japan’s fast-growing crypto market, which now counts over 7.8 million active trading accounts, a nearly fourfold increase since 2020. Institutions like Nomura, through its Laser Digital arm, are also in talks with the FSA to secure formal crypto trading licenses, reflecting growing institutional demand under regulated conditions.

Dogecoin Repeats Historical Pattern Before Possible Rally

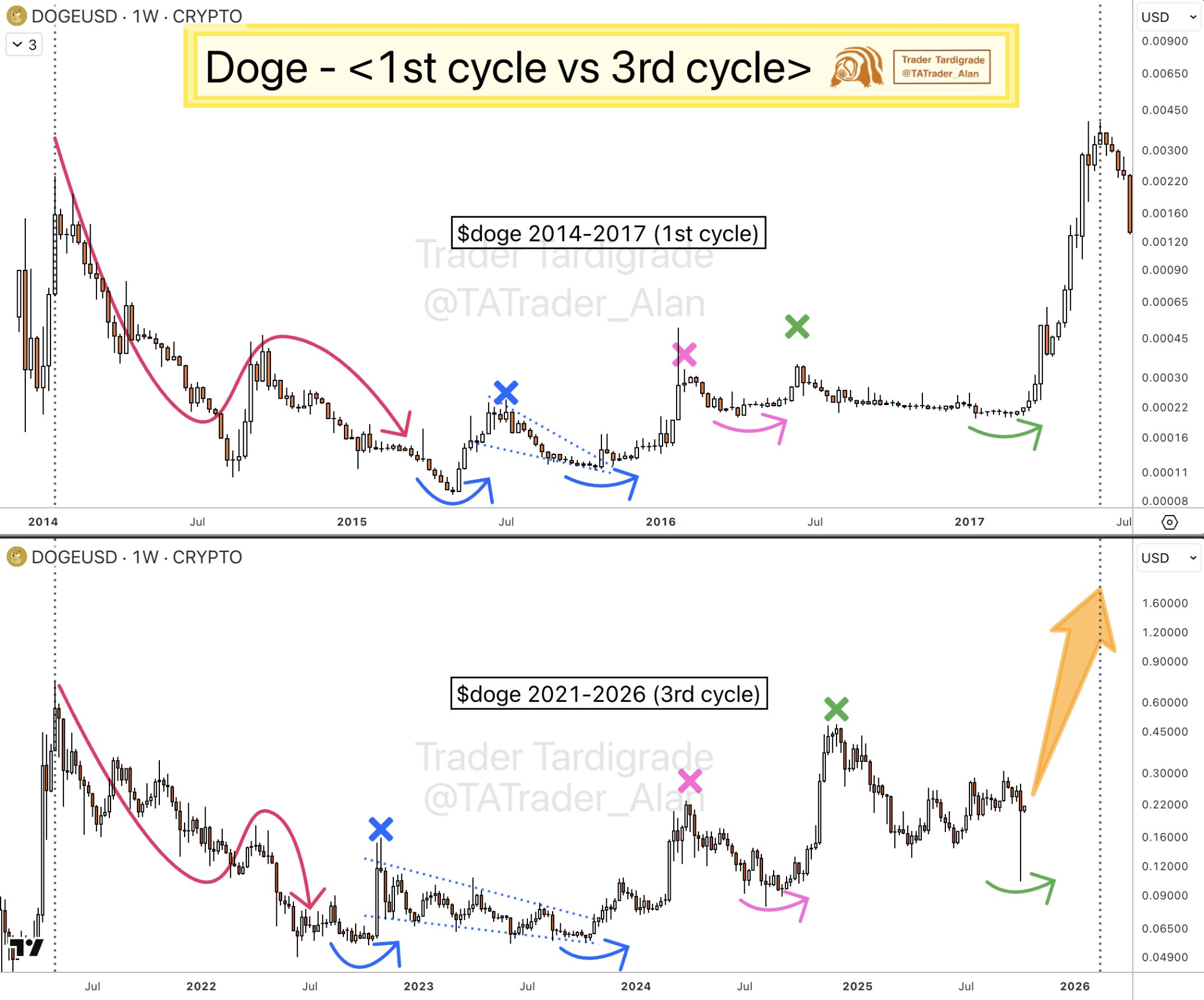

Meanwhile, analysts are watching Dogecoin (DOGE) closely as it mirrors price behavior seen before its past rallies. Market watcher Trader Tardigrade observed that DOGE is replicating the 2014–2017 accumulation pattern, which historically preceded a strong upward breakout.

Dogecoin is trading around $0.2049 as of press time, with a 24-hour trading volume of $4.54 billion and a market cap of 31 billion. Although the token dropped by 4.4% per day and by 18% per week, analysts indicate that the structure is not lost in the long run.

In addition, another leading analyst, BitGuru, pointed out that DOGE remains above its major support point at $0.18, which has been a consistent anchor among the buyers. The resistance level is just around the range of $0.23-$0.25; a breakout beyond this level may reflect a new wave of bullish activity. Moreover, traders are closely monitoring short-term volatility. Sustained strength above support could pave the way for a return toward $0.30, signaling the start of another bullish phase similar to early-year rallies.

Conclusion: Next Crypto To Explode

Conclusion: Next Crypto To Explode

Overall, the crypto industry is entering a turning point. The insider-trading regulations coming to Japan are meant to build trustworthiness of the market, and innovations such as Tapzi and old currencies such as Dogecoin are still drawing investors worldwide.

Besides, the hybrid framework that Tapzi has developed to integrate transparency, the game concept, and investor-friendly tokenomics defines how the future generation of blockchain projects can flourish with responsible regulation. With Japan matching digital assets to the securities laws, the wider market seems to be entering a more sophisticated and trust-based stage.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.