TLDR

- JD.com Eyes Global Reach with Stablecoins, but Stock Stays Steady

- Bold Crypto Move, Calm Market: JD.com’s Stablecoin Vision Unfolds

- JD.com Plans 90% Faster Payments—Investors Hit Pause

- From B2B to Global Retail: JD.com Bets on Stablecoin Future

- Stablecoin Ambitions Rise, JD Stock Barely Budges

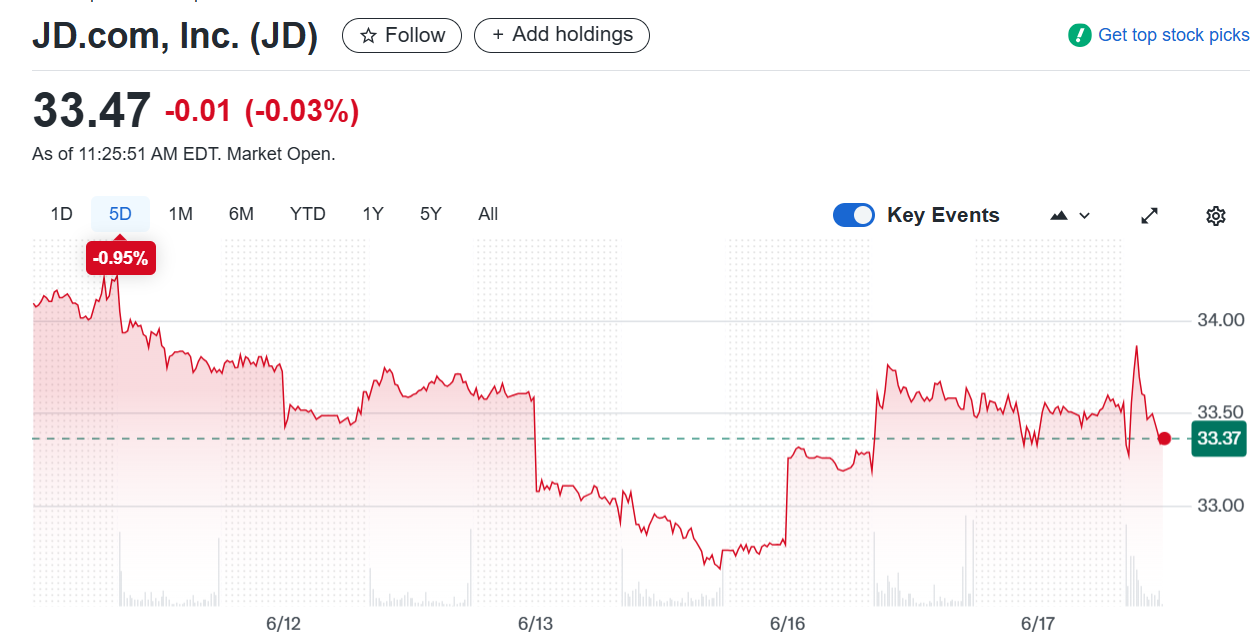

JD.com stock showed minimal movement in early trading despite major company announcements. A brief morning spike brought shares near $33.90 but they soon dropped back. By 11:25 AM EDT, the price settled around $33.47 with a net change of -0.01.

JD.com Seeks Global Reach Through Stablecoin Licenses

JD.com plans to apply for stablecoin licenses in all major economies to support global cross-border payments. The initiative targets a 90% reduction in transaction costs and promises settlements in under 10 seconds. The company intends to use these licenses to streamline international business transfers.

Liu Qiangdong outlined this vision during a public sharing session reported by Chinese media on June 17. According to the plan, JD aims to transform the speed and efficiency of global company transactions. The company sees current delays of 2 to 4 days as a major obstacle to international commerce.

JD will deploy stablecoin-based services to facilitate foreign exchange across corporate borders. This strategy could significantly lower costs and enhance liquidity flows. JD’s ambition signals its intention to lead in digital payment infrastructure worldwide.

Expansion Beyond B2B to Consumer Payments

JD.com will begin with business-to-business(B2B) payments before expanding to consumer transactions globally. Once operational at the enterprise level, the company plans to roll out retail stablecoin use. The goal is for consumers worldwide to use JD stablecoins for everyday spending.

The company believes stablecoins can eventually become a common method for international retail purchases. JD will integrate the payment option into its e-commerce ecosystem over time. This approach aligns with the company’s broader fintech ambitions across emerging markets.

By building stablecoin infrastructure for both businesses and individuals, JD seeks a long-term competitive edge. The company views this shift as necessary for keeping pace with rapid financial innovation. JD’s strategy reflects growing interest in blockchain among major tech-driven firms.

JD Stock Reacts Calmly to Strategic Crypto Expansion

JD.com shares remained steady even as Chairman Liu Qiangdong revealed plans to enter the global stablecoin market. Market watchers noted the early morning price spike but considered the pullback a sign of restrained investor response. Trading activity normalized quickly, reflecting limited short-term volatility.

The trading volume stayed consistent through the morning session with no significant deviation from prior averages. The price action suggested cautious optimism from investors amid broader sector uncertainty. Despite the bold announcement, the overall stock trend continued to track established technical patterns.

Investors appeared to weigh the news carefully, balancing long-term potential with near-term market sentiment. While some expected a bigger move, analysts pointed to low beta levels. JD’s focus on operational stability might have tempered immediate enthusiasm despite the innovation strategy.