- Linus vs. Voyager Invest: Key Information

- Company Bios: Linus vs. Voyager Invest

- Feature #1: Who Pays More, Linus or Voyager?

- Winner: Voyager wins by offering interest-earning opportunities on crypto assets, while Linus doesn’t. Coincentral readers can receive a $25 bonus when trading $100 on Voyager.

- How Do Linus and Voyager Invest Make Money?

- Feature #2: Payouts and Withdrawals

- Feature #3: Linus vs. Voyager Invest Security

- Feature #4: Ease of Use

- Linus vs. Voyager Invest Standout Features

- The Court of Public Opinion: Linus vs. Voyager Invest Reddit

- Linus vs. Voyager Invest Customer Support

- Can You Trust Linus and Voyager Invest?

- Final Thoughts: Which is the Better Crypto Interest Account, Linus or Voyager Invest?

If you’re weighing your cryptocurrency interest-earning opportunities, Linus vs. Voyager Invest is a comparison worth making.

On one hand, Linus is basically a crypto interest account you can use without ever purchasing or holding cryptocurrency assets yourself. You simply deposit USD, earn your APY paid in USD, and withdraw in USD– Linus handles all the conversions in the back-end. Linus pays up to 4.5% on USD.

Voyager Invest is a cryptocurrency exchange app that also offers interest on Bitcoin, Ethereum, Litecoin, and many other cryptocurrencies, paid in those cryptos. Voyager offers about 4% on most cryptocurrencies and a whopping 12% on Polkadot. Voyager doesn’t offer interest on USD or stablecoins.

These two companies address two different types of users:

- Linus is better for people that don’t want to buy or hold cryptocurrency assets directly and are OK with a flat 4.5% APY.

- Voyager Invest is a smarter choice for people who want to earn interest on crypto assets directly.

But that’s just part of what you need to know to decide between Linus or Voyager, or even how to use both services strategically.

Let’s explore.

Linus vs. Voyager Invest: Key Information

|

Linus |

Voyager Invest |

|

|

Reviews |

Linus Review (Added soon!) |

|

|

Site Type |

Blockchain-based high yield savings account |

Crypto exchange + crypto interest account |

|

Beginner Friendly |

Yes |

Yes |

|

Mobile App |

In development |

Yes |

|

Buy/Deposit Methods |

Bank account transfer or debit card |

Debit card, credit card, bank wire, external crypto transfer |

|

Sell/Withdrawal Methods |

Bank account transfer |

External crypto wallet transfer |

|

Available Cryptocurrencies |

None |

Bitcoin, Ethereum, Litecoin, and around 60 others |

|

Company Launch |

2019 |

2017 |

|

Location |

Brooklyn, NY, USA |

Jersey City, New Jersey, United States |

|

Community Trust |

Still developing |

Great |

|

Security |

Okay |

Unclear |

|

Customer Support |

Good |

Okay |

|

Verification Required (KYC) |

Yes |

Yes |

|

Fees |

Great |

Okay (uses a hidden spread system instead of flat fees) |

|

Site + Promo |

Earn $25 in BTC when trading up to $100 on Voyager |

Company Bios: Linus vs. Voyager Invest

Linus is a relatively new company; Matt Nemer and Matt Hamilton founded it in 2019 after getting some experience with companies like IBM and BTC, Inc. Linus doesn’t have any investors because it’s still in the pre-seed phase of its growth trajectory.

Voyager has been around a little longer than Linus. It was founded in 2017 by Stephen Ehrlic, Serge Kreiker, Oscar Salazar, Philip Eytan, and Gaspard de Dreuzy.

Voyager Invest is listed on the Canadian Stock Exchange, under the ticker symbol VYGR. It raised $100 million in private funding before going public.

Feature #1: Who Pays More, Linus or Voyager?

There is zero overlap between the interest-earning opportunities offered by Linus and Voyager Invest.

Linus only accepts USD, and it doesn’t offer interest on any crypto assets.

Voyager, on the other hand, only offers interest-earning opportunities on crypto assets. It doesn’t offer interest on USD or stablecoins.

Linus users can get the following APY rates on USD:

- 4.0% for $1.00 – $2,499.99

- 4.25% for $2,500 – $9,999.99

- 4.50% for $10,000+

Since Linus doesn’t offer interest on cryptocurrency assets, the following sections will only focus on what Voyager offers.

Bitcoin

- Voyager offers 5.75% on all the BTC that a user stores on the platform, provided they maintain a minimum balance of 0.01 BTC.

Ethereum

- Voyager offers 4.6% APY on ETH. But users must maintain a minimum balance of 0.5 ETH to earn any interest.

Stablecoins

- Voyager doesn’t offer any interest-earning opportunities on stablecoins

Alts

|

Cryptocurrency |

Linus |

Voyager Invest |

|

Aave |

N/A |

3.00% |

|

Chainlink |

N/A |

4.50% |

|

Bitcoin Cash |

N/A |

2.00% |

|

Compound |

N/A |

4.00% |

|

Cosmos |

N/A |

3.00% |

|

Dogecoin |

N/A |

2.00% |

|

Litecoin |

N/A |

5.50% |

|

Polkadot |

N/A |

12.00% |

Winner: Voyager wins by offering interest-earning opportunities on crypto assets, while Linus doesn’t. Coincentral readers can receive a $25 bonus when trading $100 on Voyager.

However, Linus is still an attractive option for those that want to throw in some USD to start earning APY. See for yourself and earn $20 by signing up for Linus today.

How Do Linus and Voyager Invest Make Money?

Linus makes its money by taking users’ funds and using them to provide liquidity in Ethereum smart contracts. Linus earns interest by doing this and pays out an undisclosed percentage of that to its users while pocketing the rest.

Voyager makes money through its exchange. It uses a hidden-spread trading system in which the rate a user pays for a crypto asset is slightly higher than the rate Voyager pays for it.

This means that Voyager gets a small cut of every transaction that happens on its exchange. Most exchanges charge transaction fees but Voyager’s is essentially hidden, which makes it difficult for a user to understand exactly how much they’re being charged for a trade.

Feature #2: Payouts and Withdrawals

Linus’ payouts and withdrawals are great. Users earn interest daily and are free to withdraw their money as often as they want without incurring any fees.

Voyager only pays its users’ interest monthly. It offers unlimited penalty-free withdrawals but doesn’t allow users to withdraw their crypto directly. Instead, someone would need to sell their crypto asset and withdraw the USD that they get from it. This incurs a tax liability if profits were made.

Winner: Linus wins this category since it pays out interest daily and offers unlimited free withdrawals. You can sign up for Linus here to earn a $20 bonus.

Feature #3: Linus vs. Voyager Invest Security

Both Linus and Voyager Invest are a little behind the competition when it comes to security.

Linus’ security features are a work-in-progress. The company says it secures users’ funds with third-party insurance coverage and digital asset collateral. But it doesn’t share enough information about these things for users to effectively gauge how protective they are.

Voyager offers 2-factor authentication and provides up to $250,000 in insurance for USD funds (note, this doesn’t cover crypto assets). But it doesn’t provide much information beyond that about how it protects its users’ funds.

Winner: It’s a tie. Neither company provides enough information about its security practices to differentiate itself from the other. Neither company has FDIC insurance– your deposits in Linus aren’t held in USD in the back-end, and they are not insured.

Feature #4: Ease of Use

Linus is very easy to use for people who aren’t experienced with the cryptocurrency ecosystem. Its main purpose is to provide individuals who don’t want to have to buy and hold crypto-assets with a way to take advantage of cryptocurrency interest-earning opportunities.

With Linus, a crypto newcomer can gain access to a blockchain-based high yield savings account just by making a cash deposit.

Voyager is also really easy to use. It has an excellent mobile app and allows debit, credit, and bank transfer deposits. The only downside is that Voyager Invest doesn’t currently have a web app.

Winner: Linus wins here because it enables users to access cryptocurrency interest-earning opportunities without even having to own crypto assets.

Linus vs. Voyager Invest Standout Features

Linus is a relatively new company and is pretty lean in terms of offerings at this point. So its primary standout feature is its main one. That is, giving users access to high yield-earning opportunities on the Ethereum blockchain without ever having to own a cryptocurrency asset.

Voyager’s standout feature is something the company calls “interest boosts”. If a user holds at least 2,500 VGX (Voyager’s native token), they can earn an extra 1% APR on qualifying coins.

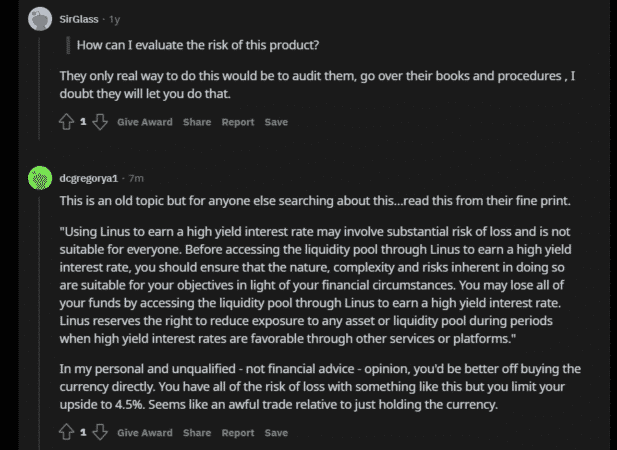

The Court of Public Opinion: Linus vs. Voyager Invest Reddit

Linus is still a new company so it hasn’t been discussed as much as its competitors have on Reddit. That being said, Redditors seem to think that the risks of using Linus don’t outweigh the benefits.

This is a valid point. But it neglects to consider that Linus’ primary audience is individuals who wouldn’t buy and hold cryptocurrency themselves.

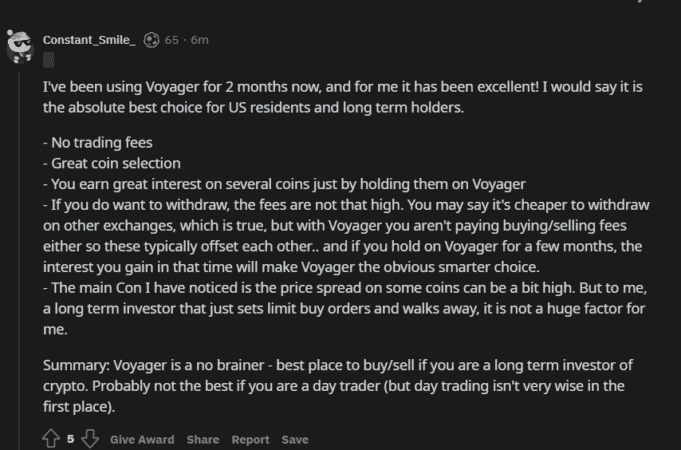

People on Reddit generally have positive things to say about Voyager Invest. They like the company’s interest rates and appear to trust it.

Linus vs. Voyager Invest Customer Support

Linus has an online FAQ page and offers live agent support through this email address: [email protected].

Voyager only has an online contact form that users can fill out with their questions and concerns.

Can You Trust Linus and Voyager Invest?

Linus is a new company that hasn’t gotten much of an opportunity to build a reputation for itself yet. The early signs from the company’s public beta are good but risk-averse individuals may want to wait a bit longer for Linus to fully establish itself before storing a large number of funds on the platform.

Voyager experienced a DNS attack in 2021 but its users’ funds were never threatened. The company has been around for what amounts to a very long time in the cryptocurrency industry and has never given users a reason to distrust it.

Final Thoughts: Which is the Better Crypto Interest Account, Linus or Voyager Invest?

Linus and Voyager Invest address two different markets. The option that’s best for you will depend on what you’re looking for.

If you don’t want to have to buy and hold cryptocurrency assets, then pick Linus. It enables users to take advantage of cryptocurrency interest-earning opportunities with straightforward cash deposits.

But if you want to earn interest on your crypto assets, then Voyager Invest is the better option. It offers solid rates on most major cryptocurrencies and has a built a reputation for trustworthiness.

You can receive a $25 bonus on Voyager when you trade at least $100, and you can get $20 when signing up for Linus.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.