Bitcoin is once again at the center of US financial debate, this time in Washington, D.C. MicroStrategy co-founder Michael Saylor is scheduled to meet with lawmakers to discuss the proposed Strategic Bitcoin Reserve bill. This policy shift could see the United States formally hold Bitcoin as part of its national reserves. The bill mirrors moves by countries like El Salvador and would mark a significant departure from the current US approach of auctioning seized Bitcoin rather than retaining it.

While lawmakers weigh the volatility and geopolitical implications of integrating Bitcoin into strategic reserves, the retail side of the market is being driven by a different kind of energy. BullZilla ($BZIL), a narrative-fueled meme coin, has entered Stage 3A of its presale, known as “404: Whale Signal Detected.” With over 26 billion tokens sold, 1,500+ holders onboarded, and $430,000+ raised, the project is positioning itself as one of the most closely watched presales of 2025.

Washington Eyes Bitcoin as a Strategic Asset

Saylor’s presence on Capitol Hill underscores how far Bitcoin has come in just over a decade. MicroStrategy, which holds more than 226,000 BTC, has become the poster child for corporate Bitcoin treasuries. Supporters of the bill argue that recognizing Bitcoin as a strategic reserve could strengthen US economic resilience, hedge against inflation, and cement America’s leadership in the digital asset space.

The proposal would also place the US in line with global peers experimenting with Bitcoin reserves, signaling that digital assets are no longer sidelined but considered part of mainstream fiscal debate. For advocates, it’s not just about Bitcoin price movements but about long-term positioning in a changing financial order.

Debate Over Volatility and Risks

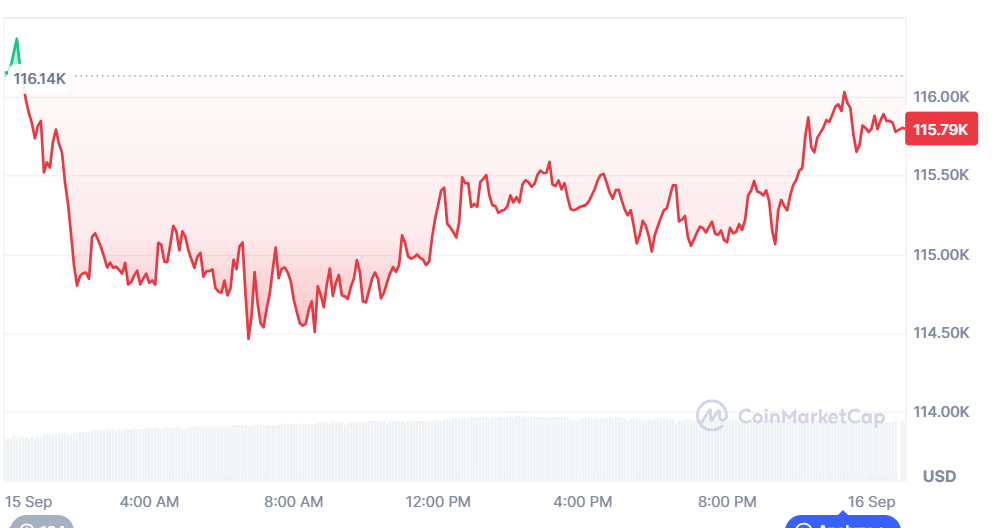

Critics remain cautious, warning that Bitcoin’s volatility and global market exposure could make it a risky federal reserve asset. Price swings, regulatory uncertainty, and geopolitical pressure are among the concerns. If Bitcoin price were to tumble during a macro downturn, skeptics argue, it could destabilize the credibility of the Federal Reserve.

Still, the debate itself is progress: just five years ago, Bitcoin was treated as a speculative outsider. Now, it has entered the halls of power, with serious discussions on whether it should be treated alongside gold, treasuries, and other sovereign reserve assets.

Whale Signal Detected: BullZilla’s Stage 3A Surge

While Bitcoin dominates institutional debates, BullZilla’s retail-driven presale is carving out its own momentum. Its staged model ensures automatic price hikes every $100K raised or every 48 hours, turning scarcity into a presale mechanic.

BullZilla Presale Snapshot

| Metric | Status |

| Current Stage | 3rd – Whale Signal Detected |

| Phase | 1st (3A) |

| Current Price | $0.00005908 |

| Tokens Sold | 26 Billion |

| Presale Raised | $430,000+ |

| Token Holders | 1,500+ |

| ROI (Stage 3A → Listing $0.00527) | 8,822.49% |

| ROI Until Stage 3A | 927.47% |

| Upcoming Surge | +11.27% (to $0.00006574) |

| Example Buy | $1,000 = ~16.926M $BZIL |

BullZilla builds on meme coin culture but anchors it with mechanics like Roar Burns (deflationary supply cuts), the HODL Furnace (staking up to 70% APY), and referral rewards through the Roarblood Vault. This layered approach has made it stand out as the best crypto presale to buy now, offering retail investors structured opportunities for outsized ROI.

Conclusion

The week’s headlines underscore two distinct but complementary stories in crypto. In Washington, policymakers are weighing whether Bitcoin should become a strategic reserve asset, a move that could reshape the future of global finance. At the same time, Bull Zilla’s Whale Signal Stage is driving grassroots enthusiasm with its progressive presale model, high ROI potential, and fast-growing community.

Together, they capture the dual energy of the digital asset space in 2025: Bitcoin seeking institutional legitimacy at the highest levels of government, while meme-born tokens like BullZilla thrive on retail passion and scarcity-driven mechanics.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About Bitcoin and the Best Crypto Presale to Buy Now

What is the Strategic Bitcoin Reserve bill?

A proposed US policy to hold Bitcoin as part of national reserves rather than auctioning seized BTC.

Why is Michael Saylor involved?

As co-founder of MicroStrategy, which holds 226,000 BTC, Saylor is one of Bitcoin’s largest corporate advocates.

What stage is BullZilla’s presale currently in?

Stage 3A (“Whale Signal Detected”), with tokens priced at $0.00005908.

How much has BullZilla raised so far?

Over $430,000, with 26 billion tokens sold and 1,500+ holders.

What ROI is projected for Stage 3A investors?

An estimated 8,822.49% at the listing price of $0.00527.

When will the next price increase happen?

At Stage 3B, the price will rise by 11.27% to $0.00006574.

What makes BullZilla unique?

It blends meme coin culture with token burns, staking, and referral rewards.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

![[LIVE] Crypto News Today, September 16: US Bitcoin Reserve Talks in Limelight Amid the Rise of the Best Crypto Presale in 2025](https://coincentral.com/wp-content/uploads/2025/09/s1-83-1200x800.png)