TLDR

- Coinbase expects a potential full-scale altcoin season to begin in September.

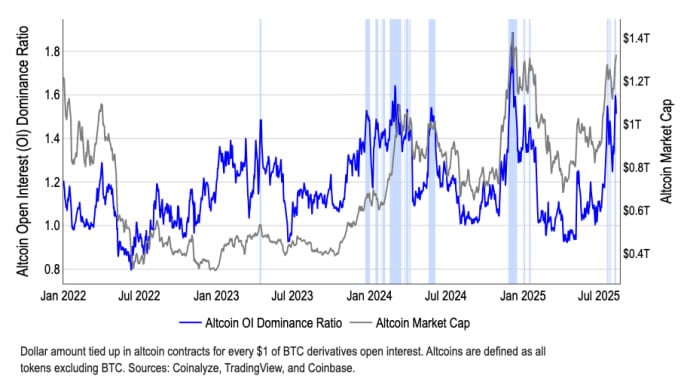

- Bitcoin dominance has dropped from over 65% in May to around 59% in August.

- Altcoin market capitalization has grown by more than 50% since early July.

- Macroeconomic data has increased the likelihood of a September Federal Reserve rate cut.

- A lower interest rate environment could attract more retail and institutional capital into altcoins.

Coinbase has indicated that the market may be on the verge of a full-scale altcoin season in September. The firm defines altcoin season as when 75% of the top 50 altcoins outperform Bitcoin over the prior 90 days. Analysts point to falling Bitcoin dominance and improving macroeconomic conditions as key drivers of this potential shift.

Coinbase Sees Shift Toward Altcoin Season

Bitcoin dominance has fallen from over 65% in May to around 59% in August, signaling early capital rotation into altcoins. Coinbase Institutional’s head of research David Duong stated, “Current market conditions now suggest a potential shift towards a full-scale altcoin season.” This marks the first monthly bearish cross in Bitcoin dominance since January 2021, according to day trader Ito Shimotsuma.

Shimotsuma noted that altcoins previously rallied for four months following such a cross, suggesting a similar outcome this cycle. Altcoin market capitalization has risen over 50% since early July, supported by increased institutional interest in Ethereum. According to Duong, stablecoin narratives and digital asset treasuries are also contributing to momentum.

Coinbase observes that despite gains, altcoin season indexes remain below the 75 threshold that historically confirms such a cycle. CoinMarketCap’s index is at 44, Blockchain Center’s is 53, and CryptoRank’s sits at 50. These levels indicate early signals but not yet a confirmed altcoin season.

Macroeconomic Factors Support the Shift

The July US Consumer Price Index held steady at 2.7% year-over-year, increasing expectations for a Federal Reserve September rate cut. Futures markets show a 92% probability of this cut, which could stimulate high-risk assets like altcoins. Duong highlighted “significant retail capital sitting on the sidelines” in money market funds that could enter the market.

- Source: Coinbase

A lower interest rate environment often drives new inflows into cryptocurrencies, increasing the likelihood of altcoin season. Previous market cycles have been driven by distinct catalysts such as ICOs, Layer-1 growth, and DeFi/NFT booms. Analysts believe a strong new narrative could complete the conditions needed for altcoin season.

Joanna Liang of Jsquare stated that three factors must align: a supportive macro backdrop, declining BTC dominance, and a compelling narrative. She added that the market still awaits a primary-market signal to ignite substantial capital inflows. Coinbase maintains that rising altcoin market caps and early index gains position September as a possible turning point.