- What is Monaco Card (MCO)?

- A Visa Card, Funded by Crypto

- Cross-border, No Fees

- Cash Back

- Regulation & Compliance

- Team

- Roadmap

- Monaco Coin (MCO)

- How to Buy Monaco Coin (MCO)

- Where to Store Monaco Coin (MCO)

- Conclusion

What is Monaco Card (MCO)?

Monaco Card is a Visa-branded debit card that draws from a cryptocurrency-funded bank account. Since it’s a Visa card, you can use your Monaco card just like you would any other card.

The card and Monaco bank account are free for holders of cryptocurrency. In order to open an account, you simply sign up, verify your identity, and transfer any of the various accepted cryptocurrencies to your account. At this time, Monaco is available to customers in Asia. They also have a waitlist for European customers. Customers in the United States cannot currently use Monaco. However, there are plans to change that.

A Monaco card account has no minimum balance and no monthly fees. There is, however, a $200 limit on free ATM withdrawals and an interbank exchange limit of $2,000. If you choose to invest and hold the MCO token, then you can upgrade to a limited edition card. These cards have higher limits on ATM and interbank transfers in addition to looking cooler than the free card.

Solving the problem of everyday payments has the potential to be huge for cryptocurrency. However, Monaco card is not the only project attempting to create crypto-backed debit (or prepaid) cards. Other projects, such as TenX, are working on the same issue. All of these projects run into challenges implementing such cards in a large scale, compliant manner. Monaco hopes to crack the code, ultimately getting cryptocurrencies and popular payment methods to play nicely together.

A Visa Card, Funded by Crypto

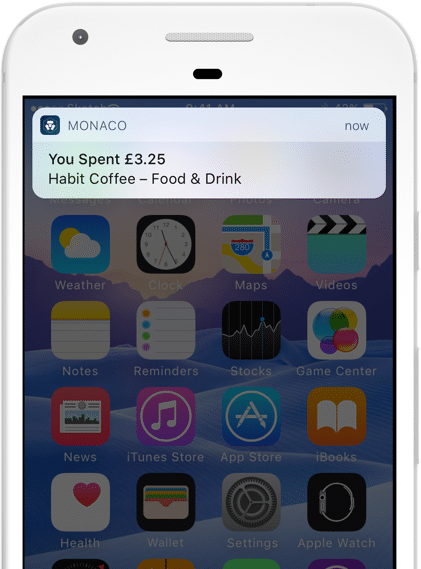

The whole idea behind Monaco is to make everyday spending with cryptocurrency easy. If more people can pay with cryptocurrency at coffee shops and grocery stores, then it becomes much more appealing to hold cryptocurrency. Up until now, however, the usefulness of crypto for spending has been a major roadblock to adoption.

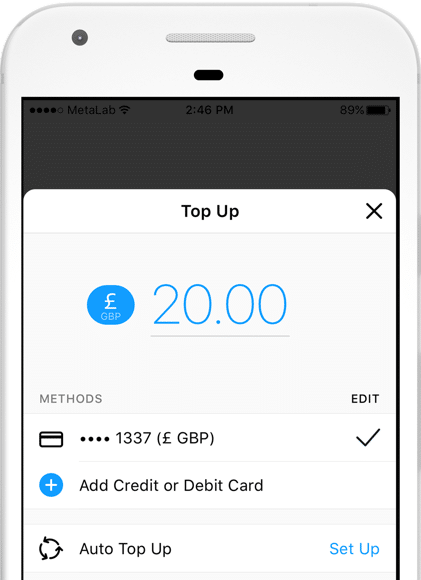

Monaco’s solution integrates a mobile app and a Visa-branded Monaco card. To get started, you would deposit cryptocurrency into their Monaco account. After that, you can spend the cryptocurrency using the Monaco card. Monaco takes care of the exchange and conversion.

What’s more, Monaco handles the exchange at the lowest cost possible, without charging the user any processing fees. As such, Monaco’s business model does not revolve around making money off its customers. Instead, Monaco makes its money from the merchants its customers shop with. Merchant card processing fees are typically 3-4% of the transaction. Of that, Monaco takes 1.5-2% on every transaction.

Monaco makes money when its customers use the Monaco card, so it has a strong incentive to make a user-friendly and highly compatible experience.

Wait a minute. Isn’t this going against Satoshi’s vision?

It’s important to mention that many crypto-diehards consider using a Visa card to be a sellout move. According to them, Satoshi wanted crypto to replace Visa, not work with it. This is largely a philosophical debate. On the one hand, Visa has an established system and market dominance right now. It makes sense to partner with them. On the other hand, relying on a centralized institution like Visa does undermine much of crypto’s appeal. Ultimately, it’s up to you to decide where you fall on this issue. One thing is for sure, more projects will come along addressing this issue.

Cross-border, No Fees

Since Monaco cards are backed by cryptocurrency, they don’t have border issues like fiat currencies. As a result, you can use your Monaco card anywhere you go. The card will automatically default to the local fiat currency when you make a purchase.

The low fees and exchange rates also apply in other countries. Transactions take place at the exact exchange rate that Monaco receives as an institutional trader. In contrast, when you use your debit card across borders with most banks, they’ll add an additional percentage to the exchange rate or include a transaction fee.

[thrive_leads id=’5219′]

Monaco has connections with eight of the top ten international foreign exchange banks to facilitate currency conversion.

So, we can see that Monaco has at least two ideal use cases for different types of customers. The first is the cryptocurrency holder/investor that would like to be able to spend their crypto easily without needing to convert it back to fiat. The second use case is for the international traveler who needs to easily make purchases in various currencies.

Cash Back

The Monaco card also comes with a 2% cash back program for cardholders. These cash back rewards come in the form of MCO tokens. As such, the actual value of the cash back rewards varies with the value of the MCO token. Your cashback balance could grow or shrink depending on how well Monaco is doing as a company.

Of course, MCO trades on many major exchanges and you’re free to exchange it for another currency as soon as you receive your cash back rewards.

Regulation & Compliance

Regulations and compliance have been a huge issue for competitors attempting to set up similar payment methods backed by cryptocurrency. Monaco card is thinking long and hard about the best ways to operate a compliant Visa card. Additionally, they’ve partnered with established industry leaders to provide the cards and compliance services.

Gemalto is the company that’s producing the physical cards. They’re an international card manufacturer with an established history of producing Visa cards.

Thomson Reuters World-Check is providing KYC/AML verification. Jumio will take care of ID verification and other identity services.

Finally, a level-one PCI DSS-compliant Visa/Mastercard processor will handle all transaction processing for Monaco cards.

Team

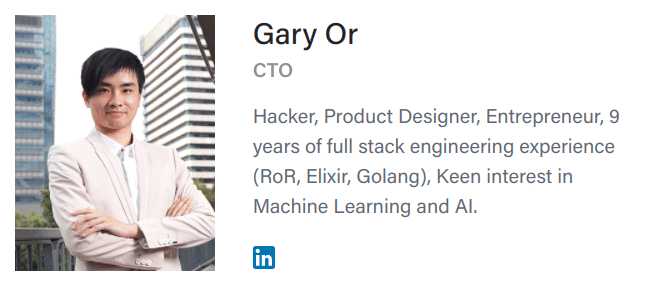

Since their initial ICO, the Monaco team has grown into a full-fledged operation. They’ve established a reputation for being very responsive on social media and forums, where they talk openly about the challenges they’re facing. The team is especially active on Bitcointalk.

Kris Marszalek is Monaco’s CEO. He’s been an entrepreneur in Southeast Asia for many years, taking multiple companies from zero to $100 million. Most notably, he was CEO at Ensogo when it was in its rapid growth phase. Some investors felt nervous about this since Ensogo collapsed soon after Marszalek left the company. However, there’s no evidence to suggest that he was involved in Ensogo’s demise.

The remainder of the leadership team consists of established executives. Monaco has an older, more seasoned team than many of the crypto projects you may have seen. They also present a high level of professionalism in their messaging and images they present of themselves.

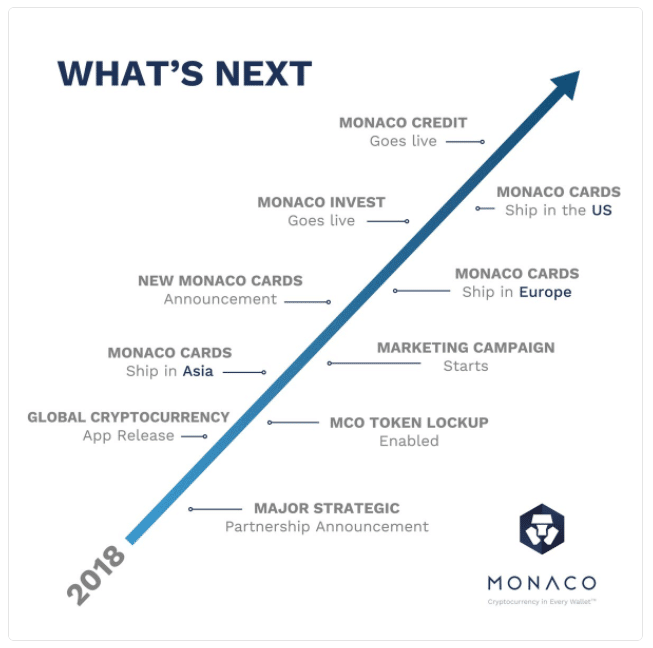

Roadmap

The Monaco card has yet to fully launch and ship to customers. Additionally, the cards are only available in select countries. The rollout strategy focuses on Asia first, then Europe, then the United States.

Monaco has released their mobile app already, and it’s available in the App Store and Google Play.

Expect cards to ship, more partnerships announced, and added functionality for the app over the coming year.

Monaco Coin (MCO)

The MCO token launched in June 2017 with a public token sale that generated over $26 million for Monaco.

MCO helps with liquidity within the Monaco network; it also is the currency for cash back rewards. In addition, you can hold MCO in order to unlock higher-value Monaco cards with different transaction and withdrawal limits.

MCO reached a high of over $20 shortly after launch. Its price has fallen since then.

How to Buy Monaco Coin (MCO)

Monaco Coin (MCO) is available on many major exchanges, but you can’t buy it directly with fiat. You’ll need to convert to ETH or BTC first.

Supported exchanges include Binance, Bit-Z, Huobi, Bittrex, and Liqui.

Where to Store Monaco Coin (MCO)

MCO is an ERC-20 token on the Ethereum blockchain. As such, you can store it in any Ethereum-compatible wallet.

MyEtherWallet is probably the simplest and easiest to use. For added security, consider a Ledger Nano S or Trezor hardware wallet.

Conclusion

The Monaco card is a compelling option for anyone looking to make everyday purchases with cryptocurrency. It also makes sense for cross-border travelers. However, we can expect the rollout to take a long time and hit a lot of bumps along the way. The financial industry is highly regulated and cryptocurrency-backed payments is a complex issue, even if Monaco’s solution seems to make it simple and user-friendly.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.