TLDRs;

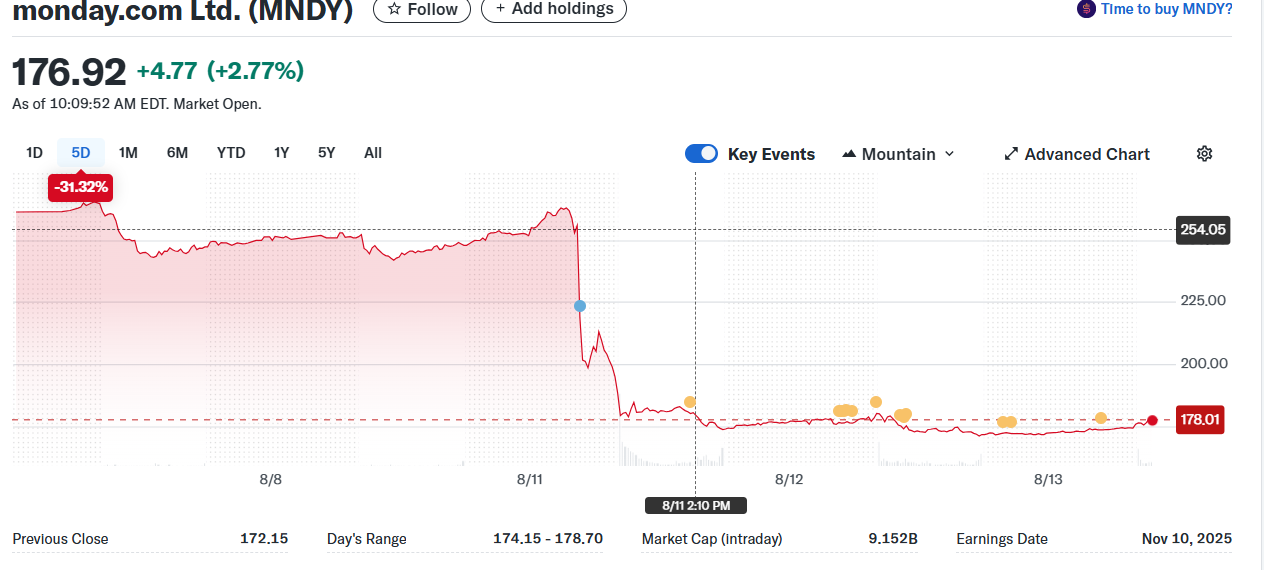

- Monday.com shares plunge 33% amid wider selloff as AI disrupts software industry outlook.

- SAP, Salesforce, Adobe among other major software firms seeing sharp losses due to AI competition fears.

- Analysts say AI disruption follows historic tech cycles, reshaping industries rather than eliminating them.

- Monday.com Q2 results show rising expenses and operating losses despite beating revenue expectations.

Global software stocks endured a brutal week, with Monday.com leading losses after its shares plummeted 33%.

The drop coincided with a sector-wide selloff sparked by mounting investor concerns over artificial intelligence (AI) accelerating software development, potentially lowering costs and heightening competition.

The downturn was not limited to the Israeli project-management platform. SAP, Europe’s most valuable company by market cap, fell as much as 7.1% in Frankfurt, erasing nearly €22 billion (US$26 billion) in market value at its intraday low. Other major names, including Sage Group, Dassault Systèmes, Salesforce, and Workday, also suffered steep declines.

Salesforce has lost over 30% of its value this year, while Adobe is down about 25%. Gartner cut its full-year outlook, citing tariffs, budget pressures, and AI-related market shifts as key risks.

Historic Patterns of Disruption Resurface

Market analysts point out that the current AI fears mirror historical cycles of technological disruption. Research tracking over 250 years of capitalism reveals that such transformations occur roughly every 50–60 years , from 18th-century canal booms to the internet revolution.

Rather than wiping out entire sectors, past disruptions have reshaped them fundamentally. Railways, for instance, didn’t replace transportation but redefined it entirely. Experts believe AI’s impact on the software industry could follow a similar trajectory, restructuring business models rather than rendering existing players obsolete.

AI adoption is already proving commercially viable. In finance alone, the AI market was valued at $9.45 billion in 2021, with 70% of institutions deploying it for fraud detection. Early movers like JP Morgan and Mastercard are integrating AI into core operations, with specialized vertical AI solutions emerging as a key growth driver.

Monday.com’s Mixed Q2 Results Add Pressure

The selloff was compounded by Monday.com’s latest earnings report. For Q2, the Tel Aviv-based company posted revenue of US$299 million, up 27% year-on-year and ahead of analyst estimates.

However, operating expenses surged from US$50 million to US$87 million, leading to an operating loss of US$11.6 million compared to a US$1.8 million profit in the same period last year.

Adjusted operating profit rose to US$45.1 million, but margins slipped to 15%. Net income was just US$1.5 million, buoyed by interest earnings.

For Q3, the company projects operating profit between US$34 million and US$36 million, with revenue growth of 24–25% to around US$313 million. It reaffirmed its 2025 revenue forecast of approximately US$1.2 billion.

Resilience Through Adaptation

Despite short-term market volatility, industry observers stress that software firms integrating AI effectively could strengthen their competitive positions.

Vertical-specific AI applications may allow certain providers to capture greater customer value, offsetting threats to traditional horizontal SaaS models.

For Monday.com, the challenge will be balancing rising development costs with its AI integration strategy, a critical factor in regaining investor confidence.