Ripple’s XRP is making headlines with a mixture of ambitious long-term goals and immediate market turbulence. The company has made the bold claim that its XRP Ledger could handle 14% of SWIFT’s $150 trillion volume by 2030, representing a staggering $21 trillion in annual transactions. This vision for the future of global finance is attracting serious attention from institutional players, further solidified by the recent introduction of XRP ETFs for U.S. investors.

Despite this strong forward guidance, the token has experienced significant short-term volatility. Following a sharp crypto market selloff, XRP’s price recently dropped to $1.91, falling from a high of $2.13. This price action highlights the intense dynamics of the crypto market, where opportunities can appear and disappear in an instant. To navigate this landscape, investors require tools designed for speed, security, and multichain functionality, which is why the GeeFi Team created GeeFi.

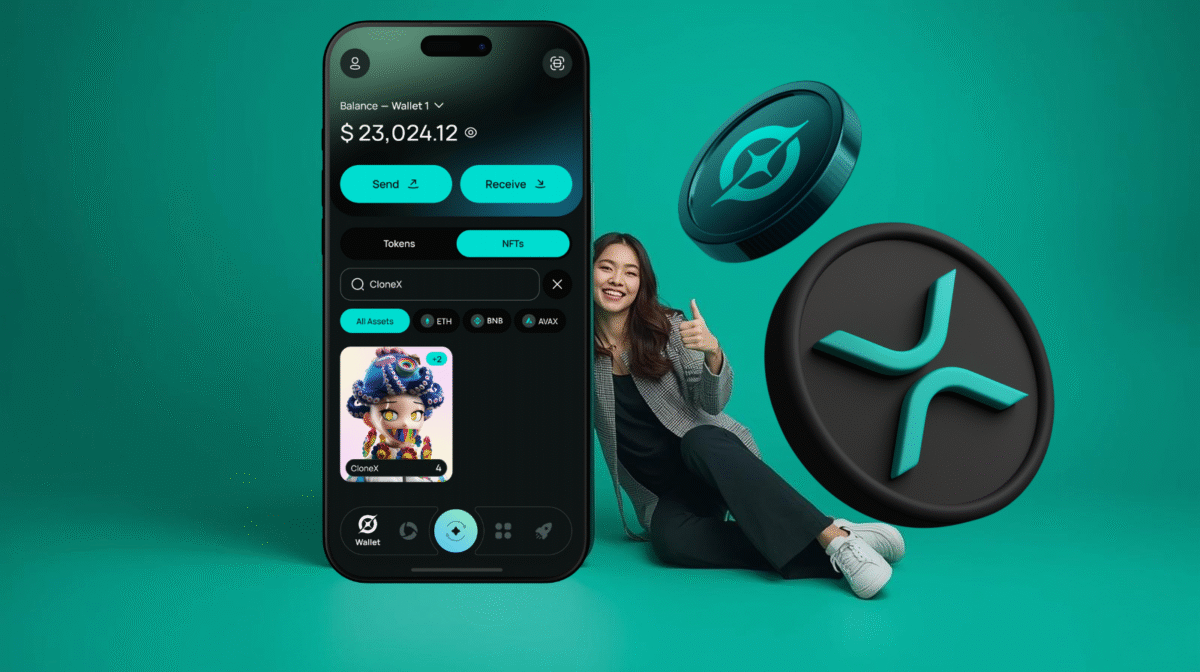

The Command Center for Multichain Finance

GeeFi is a high-performance, non-custodial mobile wallet designed to give you absolute sovereignty over your digital wealth. Since development began in 2023, the priority has been engineering a secure environment for the modern investor. Publicly released in 2024, the application supports a vast array of major networks, including Ripple, Bitcoin, Ethereum, and more, ensuring you are never restricted to a single ecosystem as the market evolves.

The platform functions as a comprehensive crypto hub. It features essential tools like built-in swaps, cross-chain bridging, and on/off-ramp services that allow for easy movement between fiat and digital currencies. Security is paramount, with integrated AML protocols and WalletConnect support for safe interaction with decentralized applications via the Web3 browser. The app is available now for Android, with an iOS version currently in development.

Future-Proofing with the GEE Token

The ecosystem is powered by the GEE token, an ERC-20 utility asset with a total supply of 1,000,000,000. Holding GEE unlocks the full potential of the platform, including benefits within the upcoming HUB, DEX, and GeeFi Card which are currently in development. The tokenomics are designed to be deflationary, creating long-term value retention mechanisms for holders who participate in the ecosystem’s growth.

The presale structure is designed to reward early conviction. There are 400 million tokens allocated for the public sale, distributed across 10 phases. Prices increase through tranches from $0.05 to $0.12, meaning the earliest participants secure the best possible entry. The market has responded aggressively to this structure, as over $250,000 was raised in the first 24 hours of its presale launch.

Capitalizing on the Early Window

The current price of $0.05 offers a specific advantage that will not last. Investors looking to maximize their position can also utilize the 5% referral bonus system. The dynamics of the offering will fundamentally change when the presale ends. Market valuation will be determined by public trading when the token launches.

Learn More

Website – geefi.io

Whitepaper – docs.geefi.io

Telegram Chat – @geefichat

Twitter/X – @GeeFiOfficial

Discord – discord.com/invite/geefi

Download App – geefi.io/download

Presale – hub.geefi.io/buy

CoinMarketCap – coinmarketcap.com/currencies/geefi/