Trendy altcoins often deliver the biggest rallies in the market. The top picks for this week are Solana, Pi Network, and Unilabs Finance. All three cryptos are stealing the spotlight with upcoming upgrades and achievements. The Solana price is poised to retest $200 after its blockchain successfully processed 100,000 transactions per second.

Similarly, Pi Network has rolled out key upgrades for its users’ security and has migrated tokens. Unilabs Finance has also launched its first-ever AI-powered hedge fund platform, offering cutting-edge technologies and features such as AI Market Pulse, EASS, and Memecoin Identification Tool. Experts believe that UNIL with outpace Solana price momentum with a 25x rally after its listing in 2025.

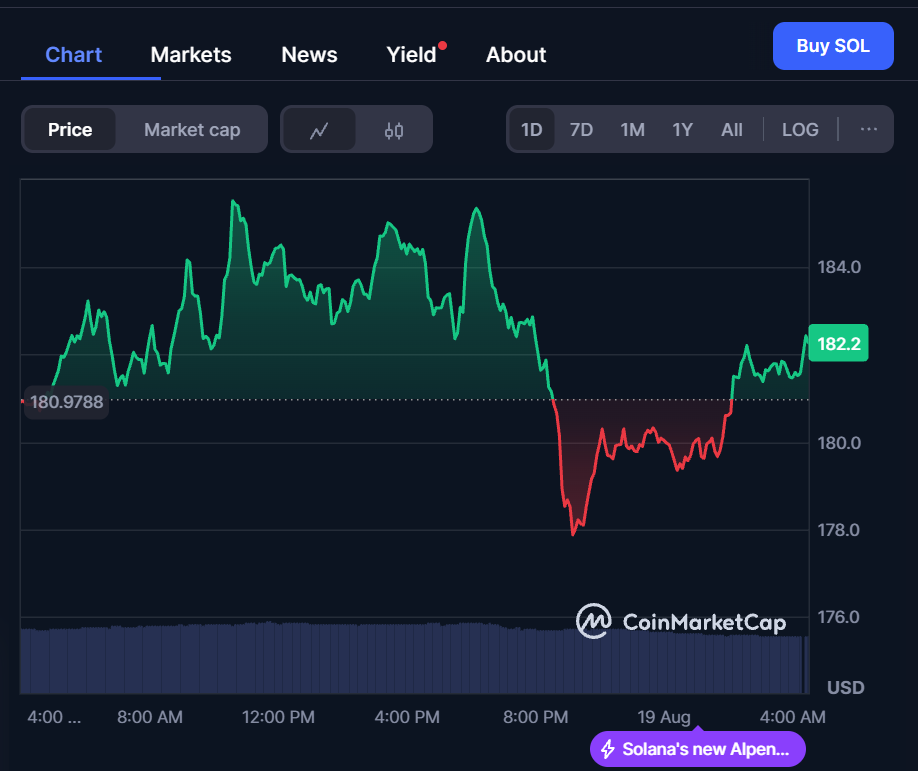

Solana ETF Hype Fails to Defend Bullish Setup: 162K SOL Dumped

Solana price continues to surge despite broader market pressures as its community celebrates a major achievement. The co-founder of the Solana developer tooling firm Helius revealed that the SOL blockchain recorded over 100,000 transactions per second (TPS) on its mainnet, becoming the “first major blockchain” to achieve this milestone.

Moreover, the ETF hype continues to trigger upside momentum for the Solana price. In the last 24 hours, the Solana price has gained 0.5% value, and tokens are exiting exchanges at a bullish rate. Experts have confirmed that even after a potential pullback due to volatility, the Solana price is poised to climb to 2025 highs.

Pi Network

Pi Network faced backlash after its launch due to allegations of scam, data theft, and fraudulent activities. However, the first migration proved the project’s worth, and now the Pi Network team has revealed plans for a second migration to focus on unmigrated tokens, including referral bonuses and newly KYC-approved balances.

Furthermore, Pi Network has also launched a passkey setup for app users to provide an extra security layer while logging in. These updates and advancements put Pi Network in the spotlight, and experts hope for notable price rallies above the $0.6 region as the project continues to improve and showcase credibility through community-driven initiatives.

Unilabs Ready to Rally 220x After Launch: $12.7M Raised In Stage 6

Unilabs Finance (UNIL) is ready to surpass large competitors with its innovative and revolutionary approach to the existing hedge fund sector. The platform leverages AI-driven trading and automation, streamlining critical tasks such as portfolio management, early opportunity detection, AI Market Pulse, and multi-market access, including RWAs and Mining ventures.

Beyond that, Unilabs’ multi-strategy AI ecosystem introduces advanced tools in the memecoins ecosystem alongside research, listing potential, and tokenomics. Unilabs is already managing $32 million in assets, and has raised a whopping $13.1 million in stage 7 of the public presale with more than 2 billion tokens sold at just $0.108.

Beyond that, Unilabs’ multi-strategy AI ecosystem introduces advanced tools in the memecoins ecosystem alongside research, listing potential, and tokenomics. Unilabs is already managing $32 million in assets, and has raised a whopping $13.1 million in stage 7 of the public presale with more than 2 billion tokens sold at just $0.108.

Conclusion

The Solana price is bullish; however, it may surge less until more clarity comes on the ETF decision. Pi Network continues to gain attention with its new security upgrades, emerging as a low-entry opportunity. However, the best decision is to buy UNIL tokens as the project can yield the highest returns among all by the time of its mainnet launch in a few months.

Early buyers have already secured 100x return potential as experts predicted the UNIL price hitting $1 by 2026. While stage 7 has started already, it’s still not too late to participate in the presale and enjoy 25x gains in the next few months as investors are actively pumping capital to push the presale to higher stages.

Learn more:

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.