Recently launched and already bagging over $156k, DeepSnitch is gunning straight for the title of the next crypto to explode. With Bitcoin cooling near $115K after a fresh ATH and altcoins itching for rotation, the setup for breakout cryptos is as good as it gets.

Chainlink has already proven that the market still rewards strong fundamentals, but the real asymmetric opportunity may not be on the charts at all.

DeepSnitch is built around a team of five decentralized AI agents designed to filter noise, catch risks in real time, and arm retail traders with intelligence that used to belong to pros.

Read on to find out what Chainlink’s price prediction is for the upcoming period and why Deep Snitch AI is exactly what retail has been waiting for.

Deep Snitch AI finally gives traders the upper hand

Here’s the harsh truth: information is killing retail traders. It’s the perfect cover for scams, rugs, and whale manipulation. By the time the average person spots what’s happening, they are exit liquidity.

While most platforms dump endless charts and feeds on users, DeepSnitch distills actionable intelligence. Five AI snitches observe, filter, and react, essentially doing the hard work for you, each with its own role in sniffing out what really matters.

With AI crypto already valued at $30 billion and forecasted to hit $800M+ in blockchain-focused applications by 2030, the bulls are looming large. Coins like Qubic have already posted 60% gains in a month. DeepSnitch could go further in a bull run where timing is the difference between a 10x and a bag of regrets.

In its first presale stage at $0.01602, DeepSnitch has already raised more than $156K in record time. Early buyers are locking in the lowest possible entry point plus priority access as features roll out. And with Bitcoin around near $115K and the broader market gearing up for altcoin rotation, this launch feels perfectly timed.

Deep Snitch AI is a one-time shot at finally getting the same kind of real-time intel whales and insiders use every day.

Chainlink looks ready to test new highs: Is this the last chance to buy LINK under $25?

Chainlink has been one of the strongest movers this month, up nearly 20% in two weeks.

On August 7, Chainlink switched on its on-chain reserve mechanism, converting half of all protocol fees into LINK. Already, over 109,000 tokens ($2.8M) have been locked away. Supply is tightening at the same time demand is climbing.

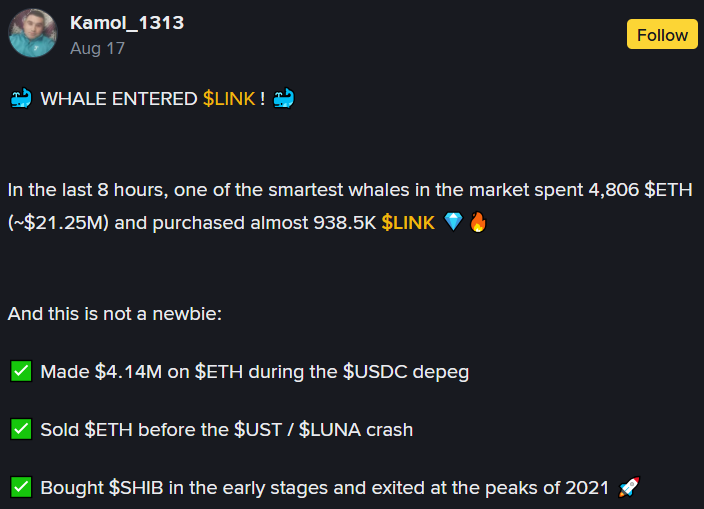

The new Intercontinental Exchange (ICE) partnership brings real-time forex and metals data on-chain, a huge leap toward making LINK the backbone of institutional-grade oracles. Then on August 17, a whale dropped $21.25M on nearly a million LINK, driving LINK price over $24.50 in hours.

Right now, LINK must break $26.32, its March 2024 high. A close above that level opens the door to $31.06 and potentially new yearly highs.

Deep Snitch AI vs Chainlink: Is this the next crypto to explode?

Chainlink’s surge shows exactly why traders are hunting for the next crypto to explode. Its new partnerships, token mechanics, and whale backing prove the market is rewarding projects with strong fundamentals. But for small investors, a 2x or even 3x isn’t the kind of life-changing upside bull cycles are famous for.

Deep Snitch AI is early and is only $0.01602 in stage 1, but not for long. Its AI agents that work around the clock to spot risks and opportunities, giving retail traders something they’ve never really had: a fighting chance against whales and insiders.

LINK is strong, but DeepSnitch has room to be explosive. In a cycle built on speed and timing, getting in early could make all the difference.

Visit the official website today.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.