Read our Advertising Guidelines Here

-

Ledger and Noah launch Cash-to-Stablecoin feature inside Ledger Wallet, the world’s most trusted self-custody app

-

For the first time at scale, salaries, remittances and everyday fiat payments can flow directly into Ledger Wallet and convert to stablecoins instantly

-

With hundreds of thousands of accounts a month ready to launch, the move marks Ledger’s first step into payments and advances Noah’s mission to build a truly borderless economy

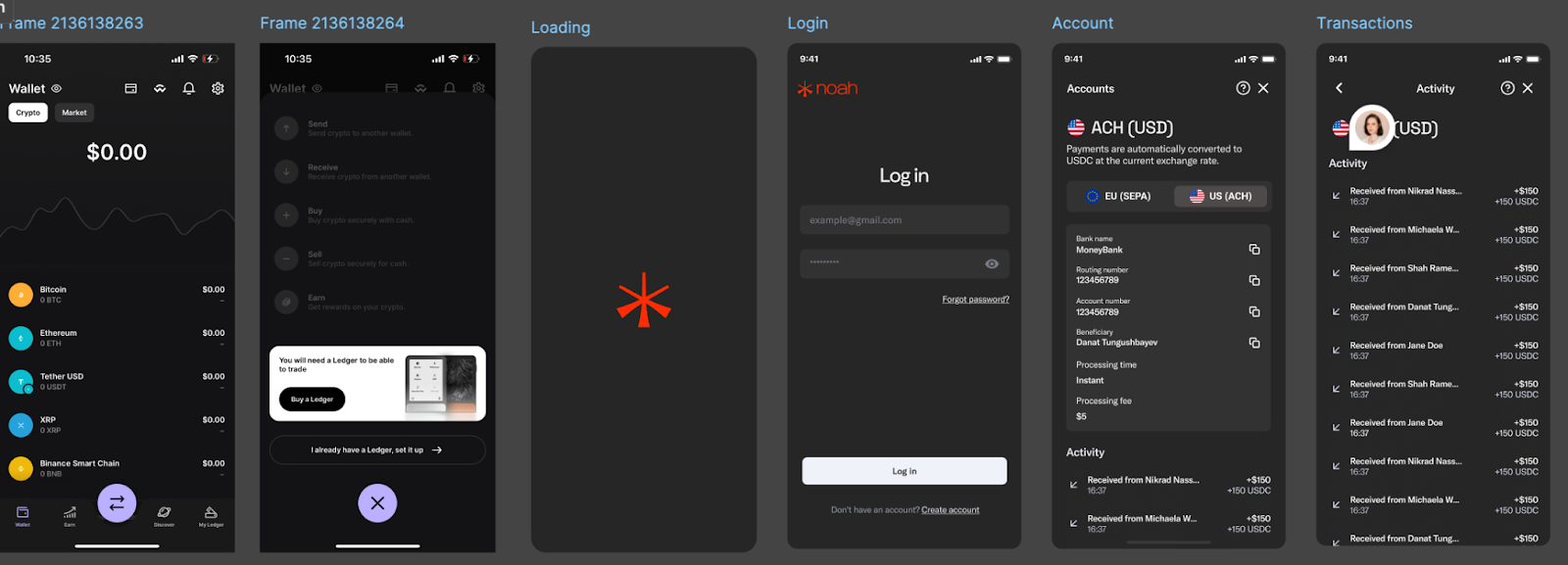

London/Paris – 23.10.2025: In a move that will rewire how money travels around the world, Noah, the global payments infrastructure provider, and Ledger, the world leader in digital asset security, have today launched virtual EUR and USD virtual accounts, available directly inside the Ledger Wallet app.

This is a first-of-its-kind integration at scale. It means millions of Ledger users can now send and receive money not just from their own accounts, but from third parties like employers, family, friends and businesses. This means salaries, remittances and everyday payments can now flow directly into Ledger Wallet, be instantly converted to stablecoins and ready to use – all in one place and with the security, control, and scale Ledger is known for. The integration marks Ledger’s first step into payments, with the global crypto giant entrusting Noah and its infrastructure with such a significant expansion.

To put the impact of this integration into perspective, if just 10% of last year’s $685B global remittance flows were routed through stablecoin rails in this way, it could generate as much as ~$2.3B in savings for senders and households.

A historic shift

With stablecoin settlement already surpassing $4 trillion in the first half of 2025 – more than Visa and Mastercard combined – this launch puts Ledger and Noah at the centre of a historic shift toward faster, cheaper and fairer money.

As one of the biggest names in the crypto sector, Ledger already secures over 20% of the world’s digital assets and 27% of the world’s dollar stablecoins. This partnership transforms its self-custody platform into a true bridge between traditional and digital assets.

At the same time, Noah already powers payments across 70+ countries and 50+ currencies through its global API and hosted checkout. The tie-in with Ledger further advances its mission to set money free by working with leading financial institutions to build a truly borderless economy.

Noah CEO and founder Shah Ramezani said: “By enabling EUR and USD virtual accounts inside Ledger Wallet, we’re setting money free for millions of people. This is about making digital payments accessible at scale, whether you’re paying salaries, sending money home, or converting funds instantly into stablecoins. The fact that transactions now settle in seconds instead of days is transformative.”

A step change in access

To achieve this step change in access and make money move as easily as sending a text, each of the new virtual accounts can be opened in a matter of clicks from within the Ledger Wallet app. Each one comes with a unique IBAN and the entire onboarding, conversion and settlement flow is handled seamlessly by Noah’s regulated payment infrastructure.

In particular, compliance is completed by Noah’s KYC technology without the user ever having to leave the Ledger app, and without Ledger having to take on the regulatory checks itself. The result is what once took days and cost billions in fees now happens in seconds.

Such is the power of this integration, and the wider, soaring demand for stablecoins, the partnership is designed to support hundreds of thousands of new accounts per month, opening the door to new use cases in payroll, remittances, and everyday payments.

Jean-Francois Rochet, EVP of Consumer Services at Ledger, said: “Ledger Wallet is already the trusted platform for securely managing digital assets. With Noah, we’re taking the next leap – giving users regulated EUR and USD accounts built directly into the app, so they can move between traditional money and stablecoins instantly and with confidence. Noah brings the speed, flexibility and trust that match our own mission to make stablecoins mainstream and between us we continue to reshape how money moves globally.”

A shared global ambition

Ledger is the latest in a line of global names trusting Noah to manage its payments flow. The fast-growing stablecoin infrastructure provider has already signed partnerships with Circle and Paxos, bringing its services to millions more stablecoin users.

As adoption grows, Noah and Ledger plan to introduce additional account features, new currencies, and further integrations. Together, the two companies are building the infrastructure for a financial system that is instant, borderless, and built on trust.

Frederic Court from Felix Capital, which is an investor in both Ledger and Noah, said: “Our conviction in Noah was its vision to rewire global payments through stablecoins, and in Ledger, its unmatched ability to safeguard digital assets. This partnership unites those missions – giving millions of people instant, compliant access to stablecoins within the world’s most trusted self-custody app. It’s a milestone for both companies, and for the future of money.”

About Noah

Noah provides infrastructure for global on- and off-ramps, integrating stablecoins and fiat payments for real-time cross-border transactions. Its products include Bank On-Ramp, Global Payouts API, Hosted Checkout, Rules Engine, and OTC Desk and it works directly with banks to build controls and policies to their specifications to future-proof the sustainability of their payment methods. Noah is licensed as a VASP in the EU and is registered as an MSB in the US and Canada..

About Ledger

Ledger is the global platform for digital asset security, trusted by millions of consumers and enterprises. With its hardware wallets, Ledger Wallet app, and enterprise solutions, Ledger enables secure self-custody and seamless interaction with the digital asset ecosystem.

Learn more at www.ledger.com

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.