TLDR

- Mike Novogratz believes Bitcoin is currently in a consolidation phase due to corporate treasuries focusing on altcoins.

- Bitcoin has been trading between $110,055 and $116,083 recently, with little price movement.

- Firms like BitMine Immersion Technologies and Forward Industries are investing heavily in altcoins, especially Ether and Solana.

- Novogratz predicts a potential Bitcoin surge towards the end of the year driven by favorable market conditions.

- Positive regulatory developments and the Federal Reserve’s actions could contribute to Bitcoin’s future price increase.

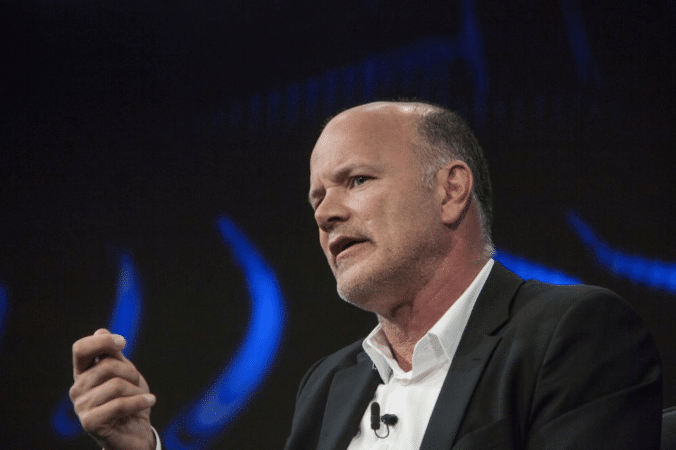

Mike Novogratz, CEO of Galaxy Digital, believes that Bitcoin is currently in a phase of consolidation. According to Novogratz, corporate treasuries have been focusing on accumulating altcoins rather than Bitcoin. However, he also sees a potential upswing for Bitcoin towards the end of the year.

Bitcoin Faces Consolidation Amid Altcoin Growth

Bitcoin has been trading in a narrow range, with recent prices fluctuating between $110,055 and $116,083. Novogratz explained that the current lull is due to treasury companies investing in other cryptocurrencies, such as Ether (ETH) and Solana (SOL). These moves are driven by firms like BitMine Immersion Technologies, which has built a $9 billion stockpile of Ether.

“Bitcoin is in a consolidation right now because companies are diversifying their treasury portfolios,” said Novogratz. He emphasized that firms are betting on altcoins for potential growth, while Bitcoin remains relatively stable. Novogratz predicts that the Bitcoin market may see a surge by the end of the year, triggered by favorable market conditions.

Altcoin Treasuries Drive Crypto Energy

Companies focused on altcoins, such as BitMine and Forward Industries, have brought significant energy into the crypto space. Forward Industries recently raised $1.65 billion to focus on a Solana-based treasury strategy. These deals, led by crypto-native firms like Galaxy Digital and Jump Crypto, are pushing capital into the crypto ecosystem.

“The momentum in the crypto space is undeniable,” said Novogratz, highlighting that large investments in altcoins contribute to the market’s overall energy. As these companies shift focus, Bitcoin continues to face sideways movement. However, Novogratz suggests that Bitcoin will likely benefit from this increased market activity later this year.

Novogratz believes that Bitcoin’s next major move will align with the Federal Reserve’s rate-cutting cycle. Additionally, positive developments such as SEC Chair Paul Atkins discussing modernizing securities regulations could boost the market. These changes could help the crypto space move forward with greater security and trust.

The Galaxy Digital CEO also pointed out that the Nasdaq’s filing for a rule change on tokenized stocks could impact Bitcoin’s price. He noted that while Bitcoin was once the primary blockchain innovation, stablecoins and decentralized finance now play a larger role in the space. Despite competition from altcoins, Novogratz remains optimistic about Bitcoin’s future potential.