TLDR

- Mike Novogratz believes new crypto policies will disrupt the traditional four-year market cycle.

- The GENIUS Act and CLARITY Act are seen as key to unleashing new investor participation in crypto.

- Novogratz states that stablecoin regulations will allow easier use of crypto in mobile apps and social media.

- Coinbase CEO Brian Armstrong expresses confidence that the CLARITY Act will pass and redefine crypto regulations.

- Novogratz dismisses concerns over the Trump family’s involvement in crypto, confident that the SEC will address any issues.

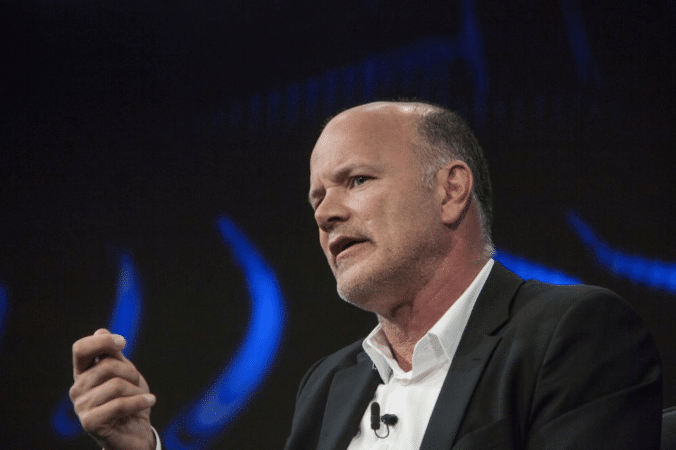

Mike Novogratz, CEO of Galaxy Digital, believes the passage of two key crypto bills will spark a significant shift in the market. Novogratz said in an interview with Bloomberg on Tuesday that these legislative changes could break the traditional four-year market cycle seen in the past.

He specifically pointed to the GENIUS Act and the CLARITY Act. The GENIUS Act, signed into law in July, regulates stablecoins, while the CLARITY Act clarifies regulatory agencies’ roles in the crypto space. Novogratz emphasized that these bills will drive new crypto participation, disrupting long-established market cycles.

Novogratz noted that in the past, the market followed a predictable pattern, primarily influenced by Bitcoin halving events every four years. However, with new legislation in place, he believes the market may no longer adhere to this cycle. He said,

“With those two bookends of legislation, it’s going to unleash a tremendous amount of new participation in crypto.”

GENIUS Act to Boost Stablecoin Use and Growth

The GENIUS Act regulates stablecoins and creates a more transparent framework for their use. According to Novogratz, this change allows stablecoins to be used more easily in social media apps and on mobile devices. He emphasized,

“People couldn’t previously use stablecoins on their iPhones, but now they can.”

Stablecoins have long been seen as the bridge between traditional finance and the crypto market. As regulations become more transparent, more investors will likely feel confident engaging with cryptocurrencies. With these policy changes, Novogratz believes the market will experience an influx of participants who were previously hesitant due to regulatory uncertainty.

The introduction of these policies marks a turning point for the market. Novogratz believes it will bring in not only new investors but also institutional interest. As regulations stabilize, confidence in the crypto space will likely grow, leading to greater participation.

New Crypto Bill to Attract More Investors

The CLARITY Act aims to define the roles of the U.S. financial regulatory agencies in relation to crypto. Coinbase CEO Brian Armstrong echoed Novogratz’s thoughts, expressing confidence that Congress will pass the bill.

Armstrong said, “I’ve never been more bullish on the market structure [bill] getting passed.”

The bill’s passage would provide clarity on how crypto markets are regulated. This shift will likely draw in a wider range of investors, who will know that the rules governing their investments are clear. Novogratz believes that as more regulatory certainty is established, more individuals and companies will enter the crypto space.

🚨NEW: Chairman @RepFrenchHill on the importance of enacting the CLARITY Act: "The United States can’t be competitive and lead in fintech if we don’t have this digital asset market framework.”

Watch more @SquawkCNBC 📺⬇️ pic.twitter.com/m0XTc2rdTy

— Financial Services GOP (@FinancialCmte) September 17, 2025

Regulatory clarity also addresses long-standing concerns about the security and legitimacy of crypto markets. Novogratz suggested that the new laws would encourage more people to participate without fear of sudden legal changes. With these developments, both novice and experienced investors can engage in the crypto market with greater confidence.

Novogratz addressed concerns about the Trump family’s involvement in the crypto market. He stated that such matters would not deter the advancement of crypto legislation.

“You can’t prevent the children of people in power from participating in business,” he said.

He acknowledged that some lawmakers, particularly Democrats, might oppose the crypto market structure bill. However, Novogratz noted that enough Democratic support exists to ensure its passage. He remarked that it was “dumb for Democrats to be anti-crypto” during last year’s presidential election.