TLDRs;

- Nvidia stock jumps 1.67%, bolstered by AI sector optimism and strong “Magnificent 7” tech performance.

- Analysts anticipate 48% earnings per share growth, underscoring Nvidia’s influence on the broader AI market.

- Q2 results expected to reflect Nvidia’s central role in driving S&P 500 tech gains in 2025.

- Market concentration risk rises as Nvidia controls nearly 8% of the S&P 500, impacting index volatility.

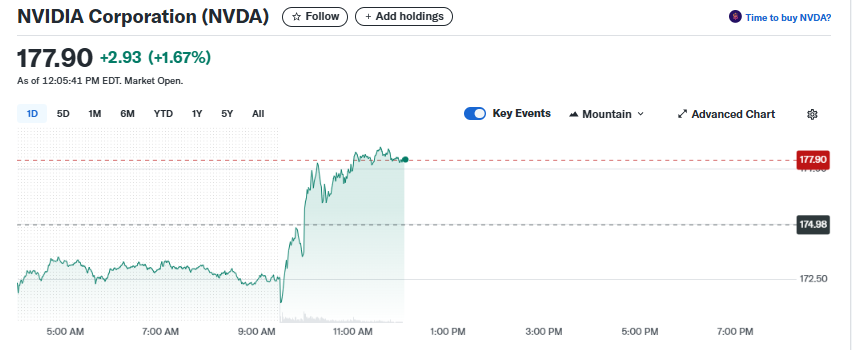

Nvidia Corporation (NVDA) shares surged 1.67% to $177.90 in mid-day trading Friday, fueled by investor confidence in its AI-driven growth and the broader momentum of the “Magnificent 7” megacap tech group.

The spike comes ahead of Nvidia’s anticipated Q2 earnings release, drawing heightened attention after a recent pullback in U.S. technology stocks.

Analysts expect the company to post a 48% rise in earnings per share on revenue of approximately $45.9 billion, according to LSEG data. With Nvidia often viewed as a proxy for the broader AI trade, its performance is seen as a key indicator of the sector’s strength and potential impact on the tech-heavy S&P 500.

AI Sector Growth Powers Tech Rally

The AI sector has been the engine behind much of the S&P 500’s gains in 2025, and Nvidia remains central to this narrative. Since October 2022, the company’s stock has surged over 1,400%, highlighting the unprecedented investor enthusiasm for AI technologies.

Despite these gains, studies suggest that while AI adoption has produced measurable consumer benefits companies have captured a smaller portion economically, generating roughly $7 billion in revenue. This reveals a growing gap between AI’s market potential and its immediate financial impact for corporate adopters.

“Magnificent 7” Strength Highlights Market Concentration

Nvidia’s rise exemplifies the influence of the “Magnificent 7” tech companies, a group poised to increase earnings by 26% year-on-year, significantly outperforming the rest of the S&P 500, which is projected to grow by just 7%.

With Nvidia alone accounting for nearly 8% of the S&P 500, its stock movement increasingly drives the performance of the technology sector and, by extension, the broader index.

This level of market concentration introduces potential volatility risks, as any unexpected shortfall in Nvidia’s earnings could ripple through the S&P 500, affecting hundreds of other companies indirectly. Investors are closely watching Q2 results to gauge whether Nvidia can sustain its rapid growth trajectory without triggering market-wide disruptions.

Earnings Season to Test AI Optimism

Nvidia’s upcoming Q2 results will conclude a largely positive earnings season that has exceeded analyst expectations. For investors, the results will not only measure Nvidia’s ability to capitalize on AI demand but also provide insight into the health of the tech sector amid shifting market conditions.

Market watchers note that Nvidia’s influence is unlike any other, with the company’s performance shaping investor sentiment and impacting valuations across the S&P 500. As AI continues to dominate discussions on corporate strategy, Nvidia’s results will serve as a critical barometer for both tech stocks and the broader investment landscape.