TLDR

- Nvidia announced a $100 billion partnership with Microsoft-backed OpenAI to build 10 gigawatts of AI data centers

- The deal gives Nvidia equity stake in OpenAI and positions it as preferred compute partner for ChatGPT infrastructure

- Data center spending expected to grow from $600 billion currently to $3-4 trillion by 2030

- Stock trades at 39.67 forward P/E ratio, down from 59.68, with strong growth outlook

- Multiple partnerships including Intel investment and CoreWeave deal strengthen Nvidia’s market position

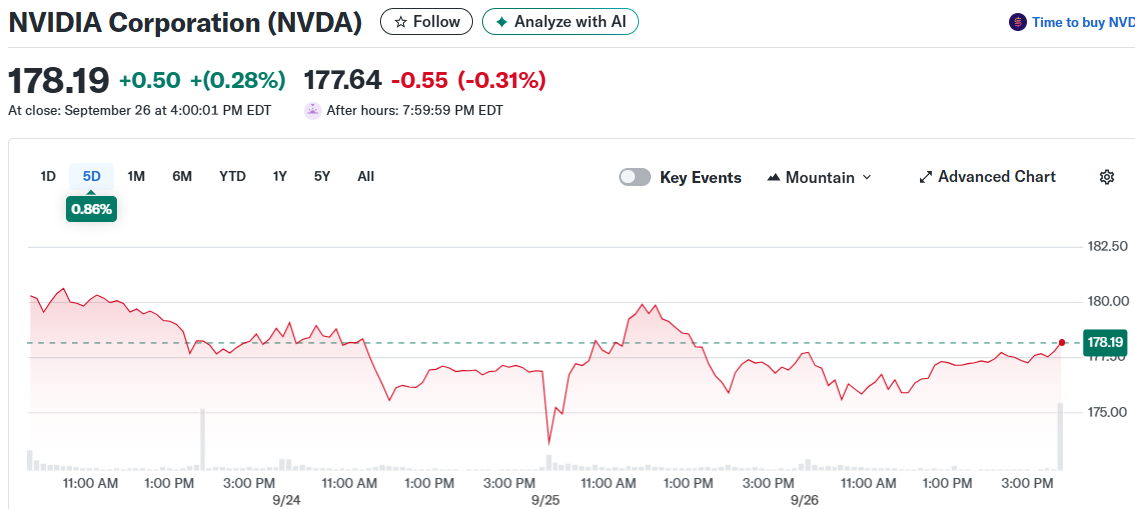

Nvidia stock jumped this week following news of a massive partnership with OpenAI that could reshape the AI infrastructure landscape. The chip giant announced a $100 billion commitment to build and deploy at least 10 gigawatts of next-generation AI data centers for the ChatGPT maker.

The partnership goes beyond a simple customer relationship. Nvidia will receive equity stake in OpenAI and serve as the company’s preferred strategic compute and networking partner. This means millions of Nvidia GPUs will power OpenAI’s future models, with the first gigawatt of capacity expected online in late 2026.

OpenAI has grown to over 700 million weekly active users. The compute demands to support this massive user base create enormous revenue opportunities for Nvidia. Bank of America estimates this single deal could generate $500 billion in revenue over time.

The partnership allows both companies to optimize their development roadmaps together. Nvidia’s hardware and software will align closely with OpenAI’s model and infrastructure needs. This creates deeper integration that competitors will find hard to replicate.

Crucially, the deal doesn’t prevent Nvidia from working with OpenAI rivals like Anthropic or xAI. This non-exclusive arrangement keeps the door open for additional major partnerships and revenue streams.

Growing Market Opportunity

Current data center spending sits around $600 billion annually. However, Nvidia management expects global data center buildouts to reach $3 trillion to $4 trillion by 2030. This represents a massive expansion in AI infrastructure investment.

The growth potential extends beyond current markets. Only the US and China are heavily investing in AI technology today. Europe is just beginning to embrace the AI trend, representing another huge economy that could drive GPU demand.

Data center construction timelines also favor Nvidia’s planning. These facilities take years to build from announcement to operation. Companies are already communicating with Nvidia to secure computing units for future installations.

The AI hyperscalers continue committing more cash flow to infrastructure buildout. They’re seeing such strong demand that spending keeps accelerating rather than plateauing.

Strategic Positioning Through Partnerships

Beyond OpenAI, Nvidia has secured several other key partnerships. The company invested $5 billion in Intel to expand its product line into CPUs. This allows better control over GPU performance and strengthens Nvidia’s ecosystem dominance.

CoreWeave received a $6.3 billion order for Nvidia GPUs. CoreWeave’s business model involves purchasing top-tier GPUs and renting them to clients for AI workloads. This partnership ensures multiple companies remain tied to Nvidia’s ecosystem.

These relationships create switching costs for customers. Once integrated with Nvidia’s hardware and software ecosystem, companies face expensive transitions to move to competitors.

The partnerships also provide Nvidia with better visibility into future demand. Close collaboration with major AI companies helps the chip maker plan production and development cycles more effectively.

Nvidia maintains its technological advantages through both hardware performance and software integration. This combination creates a competitive moat that rivals struggle to cross.

The company’s GPUs currently power the majority of AI data centers globally. This installed base gives Nvidia ongoing advantages in winning future contracts and partnerships.

From a valuation perspective, the stock trades at 39.67 times forward earnings. This represents a decline from the previous year’s 59.68 multiple. The falling P/E ratio suggests earnings growth is outpacing stock price appreciation.

The forward price-to-earnings-to-growth ratio sits at 1.11, below the sector average of 1.87. This metric indicates strong expected earnings growth relative to the current stock price.

Revenue growth has maintained 40-50% quarterly rates. Management expects this pace could continue for several years given the infrastructure spending projections.

While the absolute valuation multiples remain elevated versus traditional technology stocks, the growth rates justify premium pricing for investors seeking long-term exposure to AI infrastructure buildout.

The OpenAI partnership represents the latest validation of Nvidia’s market position and could drive continued stock appreciation as the AI infrastructure boom accelerates through the remainder of the decade.