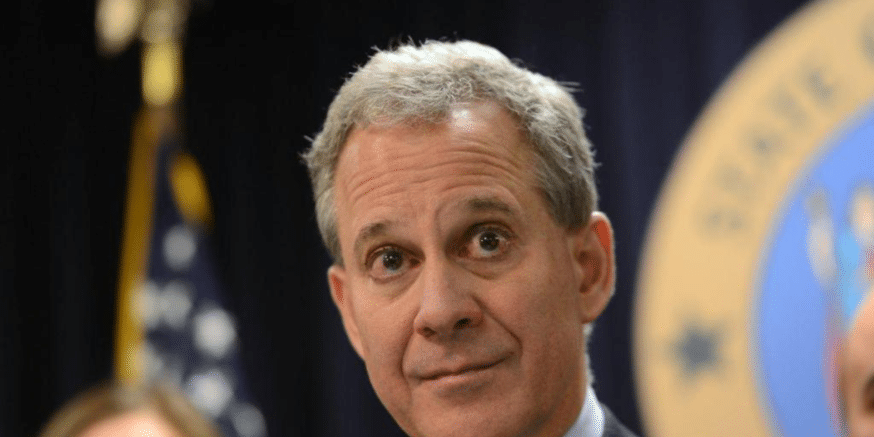

NY Attorney General Reaches Out to Exchanges

The New York State Attorney General’s office has sent letters and questionnaires to thirteen cryptocurrency exchanges. According to the official press release, the outreach is part of Attorney General Eric T. Schneiderman’s Virtual Markets Integrity Initiative, “a fact-finding inquiry into the policies and practices of platforms used by consumers to trade virtual or “crypto” currencies.”

Sent to the likes of Coinbase, Bittrex, and Binance, the questionnaire is meant to acquaint the Attorney General with existing exchange practices and operations. For example, it prods exchange executives for information on company ownership, fees, trading procedures/suspensions, and money laundering. The document also requests information on each exchange’s risk management mechanisms and its level of internal control to combat market manipulation and hacking attempts.

All of these questions were designed with consumers in mind, according to Schneiderman, to secure them the same protections and transparency investors in traditional markets have come to expect.

“With cryptocurrency on the rise, consumers in New York and across the country have a right to transparency and accountability when they invest their money. Yet too often, consumers don’t have the basic facts they need to assess the fairness, integrity, and security of these trading platforms,” the Attorney General stated in the release. “Our Virtual Markets Integrity Initiative sets out to change that, promoting the accountability and transparency in the virtual currency marketplace that investors and consumers deserve.”

The press release continues to expand on Schneiderman’s rationale, positing that “[often, exchanges] lack the basic market protections of traditional investing platforms.” This might leave cryptocurrency investors in the dark in the event of “[thefts] of vast sums of virtual currency from customer accounts, sudden and poorly explained trading outages, possible market manipulation, and difficulties when withdrawing funds from accounts.” Above all, the Attorney General’s office wants to ensure that exchanges are being completely transparent about their practices and policies, disclosing any information investors would need “to assess [a] platform’s operations and the adequacy of its policies and internal controls.”

Among those exchanges previously listed, the office also sent letters to Gemini, bitFlyer USA, Bitstamp USA, Bitfinex, Huobi, Kraken, Circle Internet Financial Limited (Poloniex), Tidex, Gate.io, and itBit. Tyler Winklevoss, Gemini’s CEO, welcomed the questionnaire and the initiative as a whole.

“Gemini applauds the Attorney General’s focus on this industry and the Virtual Markets Initiative, and we look forward to cooperating with and submitting our responses to the questionnaire that has been circulated,” he told CNBC in a statement.

The letter requests that exchanges return the questionnaire no later than May 1, 2018.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.